Key Highlights

- A payroll tax exemption means you do not need to deduct PAYE tax or National Insurance from certain employee payments and benefits.

- In the UK, common exemptions include mileage allowances, work-related training, and certain trivial benefits.

- Understanding these exemptions helps your small business manage costs and offer attractive perks to staff.

- HM Revenue & Customs (HMRC) sets specific rules for each type of exemption that must be followed carefully.

- A key payroll tax exemption exists for small businesses regarding the off-payroll working rules (IR35) for a specific tax year.

Navigating the world of payroll can feel complex, especially with all the rules and regulations. One area that can offer significant benefits for both you and your team is the payroll tax exemption.

In the UK, this means certain payments and perks you provide don’t require Pay As You Earn (PAYE) tax deductions. Understanding what qualifies for an exemption can help you stay compliant, manage your finances more effectively, and reward your employees in a tax-efficient way.

This blog explains how payroll tax exemptions work in the UK, who qualifies, and how to apply them correctly. It helps employers stay HMRC-compliant while reducing payroll costs and offering tax-efficient benefits to employees.

What is a Payroll Tax Exemption, and How Does It Work in the UK?

Payroll tax exemptions define when certain payments or benefits can be provided without triggering Income Tax or National Insurance. Understanding how these exemptions work helps UK employers stay compliant while structuring benefits efficiently, and allows employees to clearly see the true value of non-taxable perks.

Here’s how the payroll tax exemption affects each side:

- For Employers: A payroll tax-exempt benefit reduces administrative effort and payroll costs. Exempt payments do not need to be reported to HMRC or processed through PAYE, and no Income Tax or employer National Insurance contributions are due. This simplifies payroll management while offering cost-effective benefits to staff.

- For Employees: Payroll tax-exempt benefits are received in full, with no deductions for Income Tax or National Insurance. A £50 exempt benefit is worth the full £50, unlike a taxable cash bonus. These benefits add real value to pay packages and can improve morale and retention.

Used correctly, payroll tax exemptions create a compliant, tax-efficient arrangement that benefits both employers and employees alike.

What Types of Payroll Tax Exemptions Are Available in the UK?

HMRC recognises several specific types of payroll tax exemptions, each with its own rules and limits. The following examples cover the most common payments and benefits UK employers use, showing how they work in practice and when they can be applied tax-free.

1. Mileage Allowance Payments

Mileage payments can be payroll-exempt when employees use their own vehicle for work journeys. For example, reimbursing business travel up to HMRC’s approved mileage rates does not need to be processed through PAYE. Any payment above those limits becomes taxable, so basic mileage records should always be kept.

2. Trivial Benefits

Trivial benefits cover small, occasional non-cash gifts. For example, a £30 gift card or flowers to thank an employee can be tax-free, similar to childcare vouchers. Each benefit must cost £50 or less, cannot be cash, and must not be linked to performance or included in employment contracts.

3. Work-Related Training

Work-related training is payroll-exempt when it helps an employee perform their job. For example, paying for software training, compliance courses, or job-relevant qualifications is not taxable. Travel and accommodation linked to the training are also exempt, making staff development easier to support.

4. Pension Contributions

Employer pension contributions are payroll-exempt when paid into a registered pension scheme. For example, workplace pension payments do not attract Income Tax or National Insurance. This makes pensions a straightforward, long-term benefit that supports employees’ financial security without increasing payroll tax costs.

5. Mobile Phones

One mobile phone provided to an employee is usually payroll-exempt. For example, a company-owned smartphone with a monthly contract can be used for work and personal calls without tax charges. The exemption applies only if the phone remains owned by the employer.

6. Staff Canteen

Meals provided in a staff canteen are payroll-exempt when available to all employees. For example, offering free or subsidised lunches at work does not create a taxable benefit. This supports daily staff wellbeing and morale while keeping payroll reporting simple and compliant.

7. Annual Parties

Annual staff events are payroll-exempt up to £150 per person each tax year. For example, a Christmas party costing £120 per head is tax-free. If the limit is exceeded, the entire amount becomes taxable, so keeping event costs within the allowance is important.

8. Health Screenings

Certain health benefits are payroll-exempt when offered fairly. For example, one annual health screening or medical check-up per employee can be provided tax-free. Eye tests for screen users are also exempt, supporting employee wellbeing without adding extra payroll administration.

Used correctly, these exemptions help employers reduce payroll costs, stay compliant, and offer meaningful benefits without adding unnecessary tax or administrative burden.

Want to understand how pension salary sacrifice works and who benefits most? This guide explains how pension salary sacrifice can reduce tax and National Insurance while boosting retirement savings, along with key considerations for employees and employers.

What Is the Difference Between Exempt and Non-Exempt Payroll Items?

Exempt and non-exempt payroll items are treated differently for tax purposes. Knowing the difference helps employers apply PAYE correctly, stay compliant with HMRC rules, and ensure employees are not over- or under-taxed on payments and benefits they receive.

Below is a simple breakdown to show how they differ in practice:

| Area | Exempt Payroll Items | Non-Exempt Payroll Items |

|---|---|---|

| Tax treatment | Not subject to Income Tax or National Insurance | Subject to Income Tax and National Insurance |

| PAYE processing | Do not need to go through PAYE | Must be processed through PAYE |

| HMRC reporting | No P11D or payroll reporting required | Must be reported to HMRC |

| Common examples | Approved mileage, annual parties, and health screenings | Salary, bonuses, commission, overtime |

| Impact on employees | Received in full with no deductions | Paid after tax and NI deductions |

| Compliance risk | Errors can cause under-reporting if misused | Errors can cause under- or over-taxation |

Non-exempt items such as salary, bonuses, and commission are treated as earnings. For example, a cash bonus must be reported through payroll and taxed before payment. Exempt items, such as approved mileage or a qualifying staff party, sit outside PAYE and are not taxable.

Getting this distinction right is essential. Treating a non-exempt payment as exempt can lead to HMRC penalties, while taxing an exempt benefit unnecessarily reduces the value employees receive. Clear classification keeps payroll accurate, compliant, and fair for everyone involved.

Who Is Eligible for Payroll Tax Exemptions in the UK?

Payroll tax exemptions depend on the type of payment and, in some cases, the size of the business. While many exemptions apply to all employers, some rules differ for small and large organisations, particularly around off-payroll working (IR35). Understanding eligibility helps businesses apply the correct payroll treatment.

1. Small Businesses and Payroll Tax Exemptions

Small businesses in the private sector may be exempt from applying the off-payroll working (IR35) rules, particularly since the changes introduced in April 2021. For example, when engaging a contractor through their own limited company, the responsibility for assessing employment status stays with the contractor, not the client, reducing payroll tax obligations.

A business is classed as small if it meets two of these criteria for two consecutive years: turnover of £10.2 million or less, balance sheet total of £5.1 million or less, and an average of 50 or fewer employees. All businesses are treated as small in their first year.

2. Large Businesses and Payroll Tax Responsibilities

Large businesses do not qualify for the small company exemption and must apply the IR35 rules. For example, when hiring contractors, the client must determine employment status and deduct Income Tax and National Insurance where required. This increases payroll processing, reporting, and compliance responsibilities.

3. When Exemption Status Changes

A business can move from small to large as it grows. If it no longer meets the small company criteria for two consecutive years, IR35 responsibilities apply from the next tax year. Group structures and acquisitions also affect eligibility, as size tests apply across the whole group.

Knowing whether your business is classed as small or large ensures payroll tax exemptions are applied correctly and keeps your organisation compliant as it scales.

What Steps are Needed to Claim a Payroll Tax Exemption as an Employer?

Applying payroll tax exemptions is mainly about setting things up correctly rather than submitting a formal application to HMRC. Following a clear process helps employers apply exemptions properly, remain compliant, and avoid mistakes that could lead to under- or over-taxation.

Step 1: Identify the Payment or Benefit

Start by confirming whether the payment or benefit qualifies for exemption under HMRC rules. For example, approved mileage payments, trivial benefits under £50, or employer pension contributions may be exempt, while salary, bonuses, and commission are not.

Step 2: Check HMRC Conditions Carefully

Each exemption has specific conditions that must be met. For example, trivial benefits must not be cash or performance-related, and training must be work-related. Reviewing HMRC guidance ensures the benefit meets all exemption requirements.

Step 3: Confirm Employee or Business Eligibility

Some exemptions apply to all employers, while others depend on business size or structure. For example, IR35 exemptions apply only to small businesses. Confirm eligibility before excluding payments from PAYE or National Insurance.

Step 4: Set Up Payroll Correctly

Configure your payroll system so that exempt items are excluded from PAYE and National Insurance calculations. For example, exempt mileage or benefits should not be added as taxable earnings or trigger deductions.

Step 5: Keep Clear Records

Maintain clear records to support the exemption. For example, keep mileage logs, invoices, or training details. HMRC does not require an upfront submission, but records are essential if reviewed later.

Step 6: Review Regularly

Payroll exemptions can change as costs, rules, or business size change. Review exemptions regularly to ensure they still apply and update payroll treatment if thresholds are exceeded or conditions are no longer met.

Using a step-by-step approach helps ensure payroll tax exemptions are applied accurately, keeping payroll compliant and easy to manage.

What Are Common Payroll Tax Exemption Pitfalls and How Can You Avoid Them?

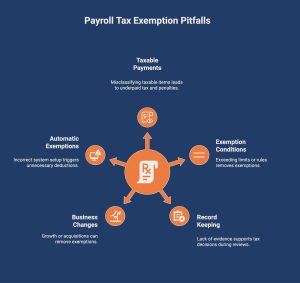

Payroll tax exemptions can reduce costs and simplify payroll, but mistakes are easy to make. Misunderstanding HMRC rules, applying exemptions incorrectly, or failing to review changes can lead to compliance risks, penalties, or employees being taxed unnecessarily. Knowing the common pitfalls helps employers avoid costly errors.

Here are the most common issues to watch out for:

- Treating taxable payments as exempt

Always confirm HMRC rules before excluding items from PAYE. Misclassifying salary, bonuses, or allowances can result in underpaid taxes and penalties. - Missing exemption conditions or limits

Many exemptions have strict thresholds or rules. For example, exceeding mileage rates or the £150 annual party limit removes the exemption entirely. - Poor record keeping

Exempt items still require evidence. Keep mileage logs, receipts, training details, and benefit costs to support your payroll decisions if HMRC reviews them. - Not reviewing business size or status changes

Growth, acquisitions, or group structures can remove exemptions such as the IR35 small business exemption. Regular reviews are essential. - Assuming exemptions apply automatically

Payroll systems must be set up correctly. Exempt benefits incorrectly added to payroll can trigger unnecessary tax and National Insurance deductions.

Avoiding these pitfalls ensures payroll tax exemptions deliver real value while keeping your payroll accurate, compliant, and stress-free.

Why Choose Direct Payroll Services for Payroll Tax Exemptions and Compliance?

Managing payroll tax exemptions requires precision, up-to-date HMRC knowledge, and consistent accuracy. Direct Payroll Services specialises in UK payroll for small and growing businesses, ensuring payroll tax exemptions are applied correctly without compliance risk. From exempt benefits and allowances to IR35 and off-payroll working rules, our experts handle the complexity for you.

We configure payroll systems accurately, maintain audit-ready records, and keep you compliant as rules or business size change. With Direct Payroll Services, you reduce administrative burden, avoid costly errors, and gain confidence that PAYE, National Insurance, and exemptions are handled properly, every pay run, every time.

Want stress-free, compliant payroll? Speak to Direct Payroll Services today and let our specialists manage your payroll with clarity and confidence.

Conclusion

Understanding payroll tax exemptions is crucial for both employers and employees. These exemptions can lead to significant savings and improved financial management when handled correctly. By familiarising yourself with the types of exemptions available, eligibility criteria, and the differences between exempt and non-exempt cases, you empower yourself to make informed decisions that can benefit your organisation or personal finances. Staying up-to-date with the latest regulations and guidance will also ensure compliance and optimise your payroll processes.

Frequently Asked Questions

Are there any exemptions from online payroll reporting requirements?

Most employers must report payroll digitally, but a small payroll exemption may apply in limited cases, such as religious objections or lack of digital access. Approval must be granted by HMRC, and evidence retained to support the exemption.

Are there tax-free benefits that do not need to be included in payroll?

Yes, certain benefits qualify as payroll tax-exempt allowances, including trivial benefits, some workplace pensions, and approved expenses. When conditions are met, they are excluded from PAYE payroll processing and year-end reporting, reducing administrative burden for employers nationwide.

What types of wages are considered exempt for payroll tax purposes?

Exempt wages for payroll tax can include certain termination payments, statutory redundancy elements, approved expenses reimbursements, and specific employee benefits. Treatment depends on thresholds and HMRC rules, so employers must review each payment type carefully before excluding it.

Where can I find official government guidance on payroll tax exemptions?

Official guidance on payroll tax exempt treatment is published by HMRC on the GOV.UK website. Employers can access up-to-date rules covering PAYE, expenses, benefits, and reporting obligations, ensuring compliance by following government-issued manuals and employer guidance notes directly.

What documentation is needed for payroll exemptions?

Understanding the definition of payroll exemptions helps determine the records required. Employers should retain policies, receipts, contracts, employee declarations, and HMRC approvals where applicable. Accurate documentation supports correct treatment, justifies exclusions during audits, and demonstrates compliance with PAYE obligations.

Are there payroll tax exemptions for IR35 and small businesses?

Yes, the off-payroll working small company exemption applies when a business meets the Companies Act size criteria. In these cases, IR35 status determination remains with the contractor’s limited company, reducing compliance duties and shifting risk away from clients.