TL;DR

|

|---|

Planning for retirement isn’t just about saving money; it’s about doing it in the most tax-efficient way possible. One option that’s become increasingly popular is pension salary sacrifice, where you swap part of your salary for extra pension contributions from your employer.

This simple arrangement can lower your taxable income, reduce National Insurance contributions, and boost your retirement savings at the same time. In this guide, we’ll break down how salary sacrifice works, the benefits it offers, and the key rules to keep in mind so you can decide if it’s the right move for you, or simply put, is pension salary sacrifice worth it?

How Does Salary Sacrifice Pension Work?

Pension salary sacrifice allows employees to give up a portion of their salary in exchange for increased pension contributions. Let’s understand how this works with the help of an example:

Take Sarah, for instance. She earns £40,000 a year and decides to give up £3,000 of her salary through pension salary sacrifice.

This reduces her taxable pay to £37,000, lowering the tax and National Insurance she owes. The result? Her take-home pay only drops by about £2,000, but her pension pot grows by the full £3,000.

On top of that, her employer saves on National Insurance and may even add part of that saving to her pension, boosting her retirement fund further.

Legal Framework and HMRC Guidelines

When setting up a pension salary sacrifice, it’s important to follow HMRC’s rules to keep things simple and compliant. Employers must run the scheme in line with minimum wage laws and protect employees from losing out.

A clear written agreement is needed to set out how the salary exchange works. It’s also important to stick to the guidelines on tax and employee benefits, as mistakes can cause payroll issues or incorrect National Insurance calculations.

Read this detailed guide on HMRC payroll and what UK employers need to know.

How is Pension Salary Sacrifice Different from Regular Pension Contributions?

Before diving into the details, it’s better to compare salary sacrifice pension contributions vs regular contributions side by side to see how they differ.

| Aspect | Salary Sacrifice Contributions | Regular Contributions |

|---|---|---|

| When contributions are taken | Taken from gross pay before tax and National Insurance deductions. | Taken from net pay after tax and National Insurance have already been applied. |

| Impact on taxable income | Lowers your taxable income, reducing the amount of tax and NI you pay. | No impact on taxable income; you miss out on the immediate tax break. |

| Employer involvement | Employers often add extra contributions and also save on NI costs. | Employer contributions are separate and do not change due to regular contributions. |

| Employee benefit | Increases pension savings faster and provides immediate tax efficiency. | Still grows your pension but without the upfront tax and NI savings. |

| Overall aim | Boost long-term retirement savings while maximising tax advantages. | Build retirement savings, but less efficient compared to salary sacrifice. |

What Are Some Real-World Tax Saving Examples?

The benefits of salary sacrifice are easier to see with numbers during the tax year. For example, if someone earns £30,000 a year and puts £5,000 into their pension, their taxable income drops to £25,000.

This means they pay less income tax and lower National Insurance. Employers also save on their NI contributions.

Together, these savings boost the pension pot and show why salary sacrifice can be such a valuable option for both employees and employers.

To decode your payslip, read this detailed guide on the complete list of tax codes and what they mean.

What Are The Benefits of Salary Sacrifice Pension?

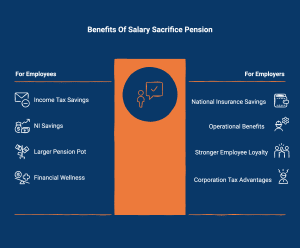

Pension salary sacrifice offers significant benefits for both employees and employers. By reducing taxable income and National Insurance liabilities, it increases retirement savings while also supporting business objectives.

Benefits for Employees

Here are the benefits of pension salary sacrifice for employees:

- Income Tax Savings – Contributions come out of gross pay before tax, reducing taxable income and lowering your tax bill.

- National Insurance Savings – With a lower gross salary, employees pay less NI, increasing take-home pay while still boosting pension savings.

- Bigger Pension Pot – More money flows directly into the pension, growing retirement savings faster.

- Financial Wellness – Employees can enjoy immediate financial benefits while securing long-term retirement stability.

Benefits for Employers

Here are the benefits of pension salary sacrifice for employers:

- National Insurance Savings – Employers contribute less NI because it’s calculated on the reduced salary, lowering payroll costs.

- Operational Benefits – Happier employees and reduced payroll burdens can contribute to better productivity and smoother HR management.

- Stronger Employee Loyalty – Offering pension salary sacrifice shows commitment to staff financial well-being, which improves satisfaction and retention.

- Corporation Tax Advantages – Reduced NI and increased pension contributions can also lower overall taxable income, creating corporation tax efficiencies.

For a clear breakdown of your statutory sick pay rights in the UK, check out this detailed guide.

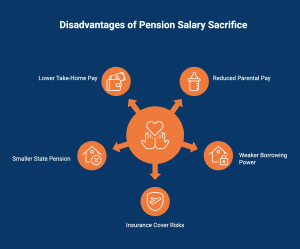

What are the Disadvantages of Pension Salary Sacrifice?

Pension salary sacrifice can reduce state benefits, statutory pay, borrowing power, and insurance cover, so it’s vital to weigh the trade-offs before proceeding.

1. Impact on State Benefits and Take-Home Pay

Salary sacrifice lowers gross pay, reducing take-home income and potentially affecting eligibility for state benefits tied to earnings. Employees should balance pension savings with the risk of reduced financial support and overall income.

2. Statutory Maternity/Paternity Pay Effects

Reduced gross salary may lower statutory maternity or paternity pay, as entitlement is based on average earnings. Employees should consider how this might affect financial security during parental leave.

3. Mortgage and Credit Applications

A lower reported salary can reduce borrowing capacity for mortgages or loans. Lenders may view reduced income cautiously, affecting approval or loan size. Professional advice helps balance retirement savings with borrowing needs.

4. Possible Risks and Limitations

Salary sacrifice offers benefits but reduces entitlement to state benefits, parental pay, and borrowing capacity. Employees should weigh risks carefully and seek financial advice before joining a scheme.

5. Life Insurance and Income Protection

Insurers often calculate cover from gross salary. Salary sacrifice may reduce life insurance or income protection benefits, or increase premiums. Employees should review policies before committing.

6. State Pension Implications

Lower National Insurance contributions from salary sacrifice can reduce qualifying years for the state pension, potentially shrinking retirement income. Checking long-term effects is essential.

How Much Salary Should I Sacrifice for My Pension?

The right amount to sacrifice will vary for everyone, it depends on your income, retirement goals, and your employer’s scheme rules. Think about your current savings, the lifestyle you want in retirement, and the tax relief available.

Calculating the Right Amount

Deciding how much of your salary to put into a pension sacrifice scheme means balancing your income with your financial goals. Think about what you can afford to give up without straining your take-home pay.

A salary sacrifice calculator can show how contributions affect tax savings and your pension pot. For extra clarity, a financial adviser can explain how different amounts also impact employer National Insurance and your long-term retirement benefits.

Percentage vs Fixed Amount Contributions

When joining a salary sacrifice scheme, you can choose between paying a percentage of your salary or a fixed amount.

A percentage means your pension grows as your income rises, while a fixed amount is easier to budget and stays the same each month.

Both options have pros and cons, so it’s important to consider your take-home pay, tax position, and long-term goals.

Impact on Different Salary Levels

The impact of pension salary sacrifice depends on how much you earn, particularly regarding an employee’s salary. For lower earners, especially those close to the minimum wage, giving up part of their salary could reduce take-home pay and affect benefits or financial stability.

Higher earners, on the other hand, usually gain more from the tax savings, as a lower taxable income means paying less income tax and National Insurance. Knowing how the scheme works at your income level is key to making the right financial choice.

Maximum Contribution Limits

Pension salary sacrifice is subject to contribution limits. Most people can contribute up to £40,000 a year with tax relief, but higher earners (over £240,000) may have this limit reduced.

You can also use carry-forward rules to add unused allowance from the past three years. Keeping track of contributions helps you grow your pension efficiently while staying within HMRC rules and avoiding penalties.

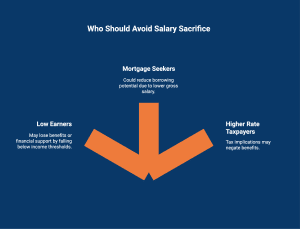

Who Should Avoid Salary Sacrifice?

Before choosing pension salary sacrifice, consider how it may affect your benefits, take-home pay, borrowing, and insurance.

1. Low Earners Near Minimum Wage

For individuals earning close to the national minimum wage, engaging in a pension salary sacrifice scheme may not be advantageous.

Sacrificing a portion of their salary could result in a significant reduction in take-home pay, impacting their ability to meet daily expenses.

These low earners likely experience limited capacity for additional contributions to their pension pot without compromising their financial stability. Also, this arrangement could negatively affect entitlements to state benefits as well.

2. Those Seeking Mortgages Soon

Reducing your salary through a salary sacrifice arrangement can impact mortgage applications significantly.

Lenders assess your financial profile based on your taxable income, which will be lower due to pension contributions. This could lead to challenges in meeting the income criteria necessary for approval.

It’s crucial for individuals planning to apply for a mortgage soon to consult a financial adviser.

3. Higher Rate Taxpayers Considerations

Contributing to a pension salary sacrifice scheme can be particularly beneficial for higher rate taxpayers.

By reducing taxable income, individuals engage in strategic tax planning, effectively lowering their income tax liability.

This arrangement not only enhances the pension pot through increased contributions but also curtails the national insurance contributions owed.

However, it’s essential to consider how salary sacrifice may impact future earnings and benefits, such as statutory maternity pay or various state benefits, to ensure long-term financial stability.

How Do I Set Up Pension Salary Sacrifice at Work?

To set up a pension salary sacrifice at work, discuss the option with your employer or HR department. Please make sure you understand the terms and implications from your pension provider, then formally agree on the amount to be sacrificed from your pre-tax salary for pension contributions.

Steps to Implement Salary Sacrifice

Implementing a salary sacrifice scheme involves several key steps.

- Explain to employees how salary sacrifice works and how it affects pay and tax.

- Put the agreement in writing so both sides know the terms.

- Update payroll to match the new salary.

- Keep checking the scheme to follow HMRC rules.

- Remind staff and employers of the benefits.

Changing or Opting Out of Your Agreement

Opting out of a salary sacrifice agreement is a simple process, usually detailed in your contractual agreement.

Employees can change their contribution levels or withdraw entirely, ensuring that future deductions reflect their current financial circumstances.

It’s advisable to consult your payroll provider or financial adviser for guidance, as some arrangements may affect tax savings or national insurance contributions.

Remember, this decision might impact your long-term pension savings, so consider the consequences before making changes..

Need Smarter Payroll Solutions? Discover Direct Payroll Services

Direct Payroll Services is the premier provider of payroll solutions in London and the surrounding areas. We support businesses of all sizes, from local firms to accountants and care homes, and can even act as a dedicated payroll bureau when needed.

Our in-house CIS payroll services make contractor payments simple and compliant, while our tailored solutions ensure your payroll works around your business, not the other way around. With expert guidance, compliance support, and stress-free payroll management, we make sure your people get paid on time, every time.

Contact Direct Payroll Services today and discover a smarter, simpler way to handle payroll!

Frequently Asked Questions

Are all employers required to offer pension salary sacrifice?

Not all employers are required to offer pension salary sacrifice; participation is voluntary and at the employer’s discretion under current UK legislation.

How to calculate salary sacrifice pension contributions?

To calculate salary sacrifice pension contributions, reduce the employee’s gross salary by the agreed sacrifice amount, then pay this directly into their pension. For example, if £300 is sacrificed from a £3,000 salary, gross pay becomes £2,700, and £300 goes into the pension.

Are all workplaces required to offer pension salary sacrifice?

No, employers are not required to offer a salary sacrifice scheme. While they must provide a workplace pension scheme under auto-enrolment laws, offering salary sacrifice is an optional enhancement. It is an attractive employee benefit but not a legal obligation for an employer pension.

Can I have a salary sacrifice pension if I’m self-employed?

No, you cannot have a salary sacrifice pension if you are self-employed. This type of pension arrangement is exclusively for employees, as it requires an employer to alter the employment contract and make employer pension contributions on the employee’s behalf.

Is there a limit to a salary sacrifice pension?

Yes, there is a limit to salary sacrifice pensions. The total pension contributions, including any employer contributions and salary sacrifice amounts, cannot exceed the annual allowance set by HMRC, which is currently £40,000 for most individuals. Exceeding this may incur tax penalties.

What happens to salary sacrifice if I change jobs?

When changing jobs, your pension salary sacrifice arrangement typically ends. You may need to renegotiate terms with your new employer or reinstate contributions. It’s crucial to assess how this impacts your retirement savings and ensure continuous contributions for optimal benefits.

What is salary sacrifice pension and how does it work?

Salary sacrifice pension and how automatic enrolment works is simple: you agree to give up part of your salary, and your employer pays it into your pension. This reduces taxable income, saves on NI, and grows your pension pot faster.

Are there any disadvantages or risks to salary sacrifice pension schemes?

Yes. Disadvantages of salary sacrifice pension schemes include reduced take-home pay, lower eligibility for state benefits, smaller statutory pay, possible administrative burden, and possible impact on borrowing or insurance cover due to a lower reported salary.

What common mistakes should people avoid with salary sacrifice pension schemes?

Common mistakes with salary sacrifice pension schemes include sacrificing too much salary, ignoring how it affects mortgages or benefits, not checking employer contributions, and failing to review long-term impacts on pensions and insurance.

What happens if HMRC may remove pension salary sacrifice tax relief?

If HMRC may remove pension salary sacrifice tax relief, it could reduce the overall benefit of the scheme according to HM Revenue and Customs. Employees would lose some tax advantages, making it less effective for boosting pension savings.

Does salary sacrifice affect pension?

Yes. Salary sacrifice affects pension by increasing contributions and boosting savings through tax and NI relief. But it may also reduce benefits, statutory pay, or borrowing capacity due to a lower reported salary.

What is smart pension salary sacrifice?

Smart pension salary sacrifice is when you give up part of your salary in exchange for extra employer pension contributions. It helps reduce tax, save on National Insurance, and grow your pension faster.

Is pension salary sacrifice worth it?

Is pension salary sacrifice worth it depends on your situation. It usually boosts retirement savings and take-home pay, but it can reduce state benefits, statutory pay, and affect mortgage applications.

What are the pros and cons of salary sacrifice pension?

The pros and cons of salary sacrifice pension include tax and NI savings, bigger pension contributions, and possible employer top-ups. Downsides are lower reported salary, which may affect borrowing, benefits, or insurance cover.

What is salary sacrifice pension vs relief at source?

Salary sacrifice pension vs relief at source comes down to timing. Salary sacrifice reduces taxable income upfront, while relief at source adds basic rate tax relief later. Each impacts tax and take-home pay differently.

What are salary sacrifice pension employer contributions?

Salary sacrifice pension employer contributions are the payments your employer makes into your pension when you give up part of your salary, including employee contributions that are also part of the funding. Employers may also add their National Insurance savings to increase your pot further.

What does company changing pension to salary sacrifice mean?

Company changing pension to salary sacrifice means your employer switches to a scheme where part of your salary is exchanged for pension contributions, effectively resulting in a lower salary.

What if my employer doesn’t offer salary sacrifice?

If your employer doesn’t offer pension salary sacrifice, you can use alternatives like personal pensions or Individual Savings Account (ISAs), or ask HR if they plan to introduce it.

How does salary sacrifice into pension work?

Salary sacrifice into pension works by reducing your gross salary and redirecting the sacrificed amount straight into your pension. This lowers tax and NI bills while boosting your long-term retirement savings.