Payroll isn’t just about paying employees—it’s a legal obligation that directly affects your compliance, reputation, and team morale. For UK business owners, understanding payroll means navigating HMRC regulations, PAYE requirements, and real-time reporting. This guide walks you through the core components of running payroll legally and efficiently in the UK, helping you avoid costly mistakes and keep your workforce confident in the process.

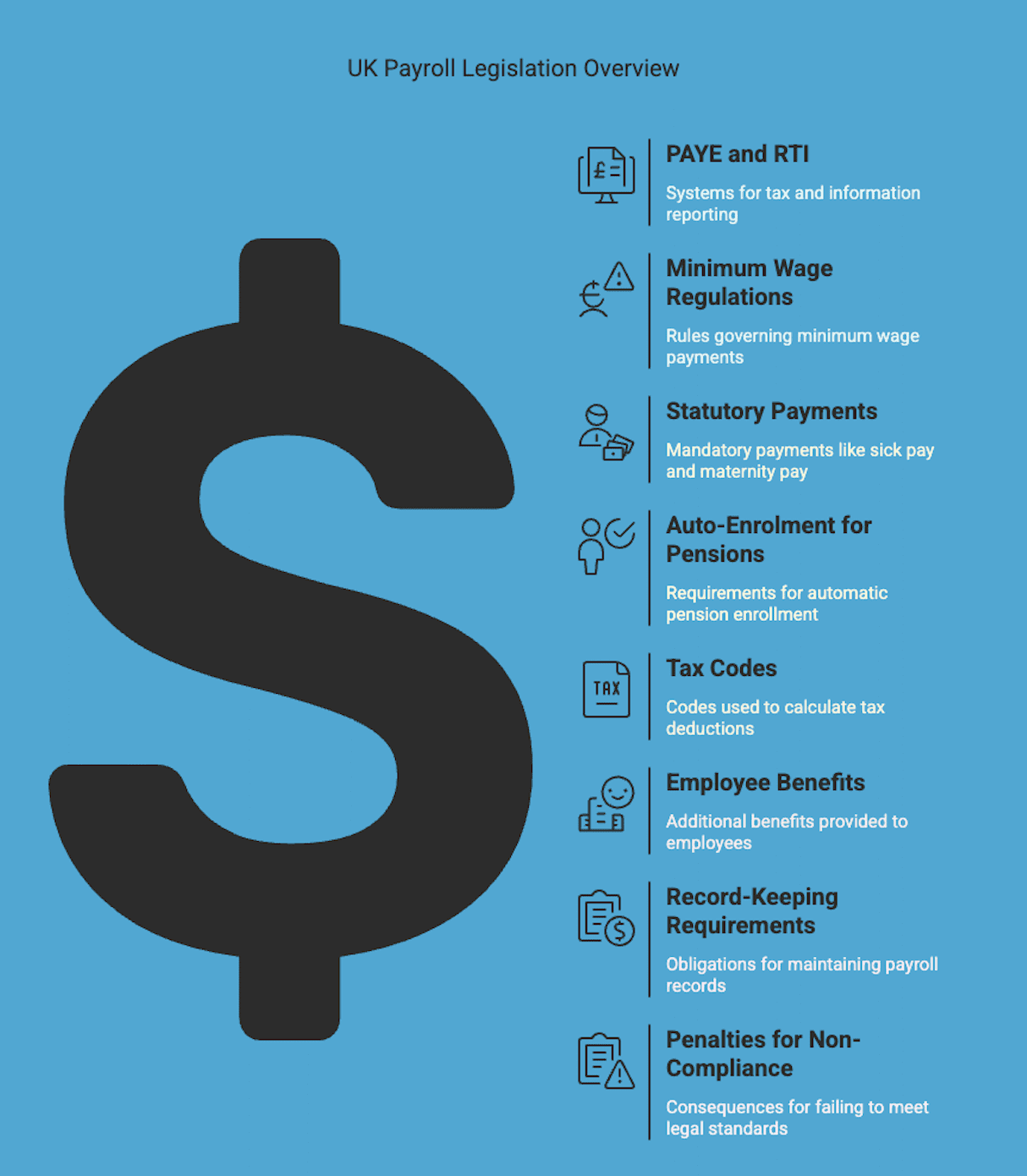

Key UK Payroll Laws Every Employer Must Understand

Navigating payroll legislation in the UK is essential for any business that employs staff. It ensures you stay compliant with legal obligations, avoid penalties, and build trust with your employees. Below is a breakdown of the key areas you need to understand.

1. Employer Responsibilities

As an employer, you must register with Her Majesty’s Revenue and Customs (HMRC) and operate PAYE (Pay As You Earn) as part of your payroll. You’re responsible for deducting income tax and National Insurance from your employees’ wages and submitting reports on time.

2. PAYE and Real Time Information (RTI)

PAYE is the system used to collect tax and National Insurance contributions. Under real-time information (RTI), employers must submit payroll data to HMRC every time they pay employees. This keeps records accurate and up to date.

3. National Minimum and Living Wage

You are legally required to pay your employees at least the National Minimum Wage or National Living Wage, depending on their age and employment status. The current rates change annually, so it’s important to stay updated.

4. Statutory Payments

Employers must understand statutory entitlements, including:

- Statutory Sick Pay (SSP)

- Statutory Maternity, Paternity, Adoption, and Shared Parental Pay

- Holiday pay obligations under the Working Time Regulations

5. Auto-Enrolment and Pensions

All eligible employees must be automatically enrolled in a workplace pension scheme. Employers must contribute a minimum amount and keep accurate records of contributions and opt-outs.

6. Tax Codes and Employee Benefits

Using the correct tax codes is crucial for accurate deductions. If you offer benefits like company cars or private healthcare, you must report these through the P11D system or payroll.

7. Keeping Payroll Records

You must keep payroll records for at least 3 years. These should include payslips, deductions, employee details, and tax code notices from HMRC.

8. Penalties for Non-Compliance

Failing to meet payroll obligations can lead to penalties, ranging from fines for late submissions to interest on unpaid liabilities. Compliance protects your business legally and financially.

What Are the Mandatory Payroll Compliance Requirements in the UK?

All UK employers must meet specific payroll compliance requirements to operate legally and avoid penalties. Here’s what’s mandatory:

1. Registering as an Employer with HMRC

Before paying staff, you must register with HMRC as an employer. This enables you to set up a PAYE scheme and begin reporting tax and National Insurance contributions. Once registered, you’ll be able to deduct income tax and National Insurance from employee wages. Failure to register on time can lead to penalties, so it’s crucial to complete this step promptly.

2. Operating PAYE (Pay As You Earn)

PAYE is used to deduct income tax and National Insurance from employees’ wages. Employers must calculate and submit these deductions to HMRC each pay period. This ensures that both tax and National Insurance contributions are paid accurately and on time, helping to avoid potential penalties for non-compliance.

3. Submitting Real Time Information (RTI)

Every time you pay employees, you must submit a Full Payment Submission (FPS) to HMRC, detailing the amounts paid and deductions made. This keeps HMRC records current.

4. Paying at Least the Minimum Wage

You must pay staff at or above the applicable National Minimum Wage or National Living Wage, based on their age and employment status. Rates change every April, so it’s important to stay updated on any adjustments to ensure compliance. Failing to meet the correct wage rates can result in fines or legal action..

5. Providing Statutory Payments

Employers must administer and pay statutory entitlements, including:

- Statutory Sick Pay (SSP)

- Statutory Maternity, Paternity, Adoption, and Shared Parental Pay

- Holiday pay under the Working Time Regulations

6. Auto-Enrolment into a Pension Scheme

All eligible employees must be automatically enrolled in a qualifying workplace pension scheme. You must also contribute a set minimum percentage and handle opt-outs and re-enrolment duties. Ensuring compliance with these requirements helps secure employees’ retirement savings while avoiding potential fines or legal complications.

7. Issuing Payslips

You’re legally required to provide itemized payslips to employees on or before payday. These must show gross pay, deductions, and net pay. Failing to provide clear payslips can lead to disputes and potential legal issues, so it’s crucial to maintain accurate records and ensure transparency.

8. Using the Correct Tax Codes

You must apply the correct tax codes as issued by HMRC to ensure accurate tax calculations and avoid over- or underpayment. Incorrect tax codes can lead to payroll errors, employee dissatisfaction, and potential penalties from HMRC. Regularly reviewing and updating tax codes is essential to maintaining compliance and preventing costly mistakes..

9. Keeping Payroll Records

Employers must retain payroll records for at least 3 years. These include pay details, deductions, employee information, and HMRC submissions. Keeping accurate records not only ensures compliance but also helps resolve disputes and supports audits if HMRC requests evidence.

10. Reporting Benefits and Expenses

If you provide non-cash benefits (like company cars or health insurance), you must report them via payroll or through a P11D submission. Failure to report these correctly can result in unexpected tax liabilities and penalties for both the employer and the employee.

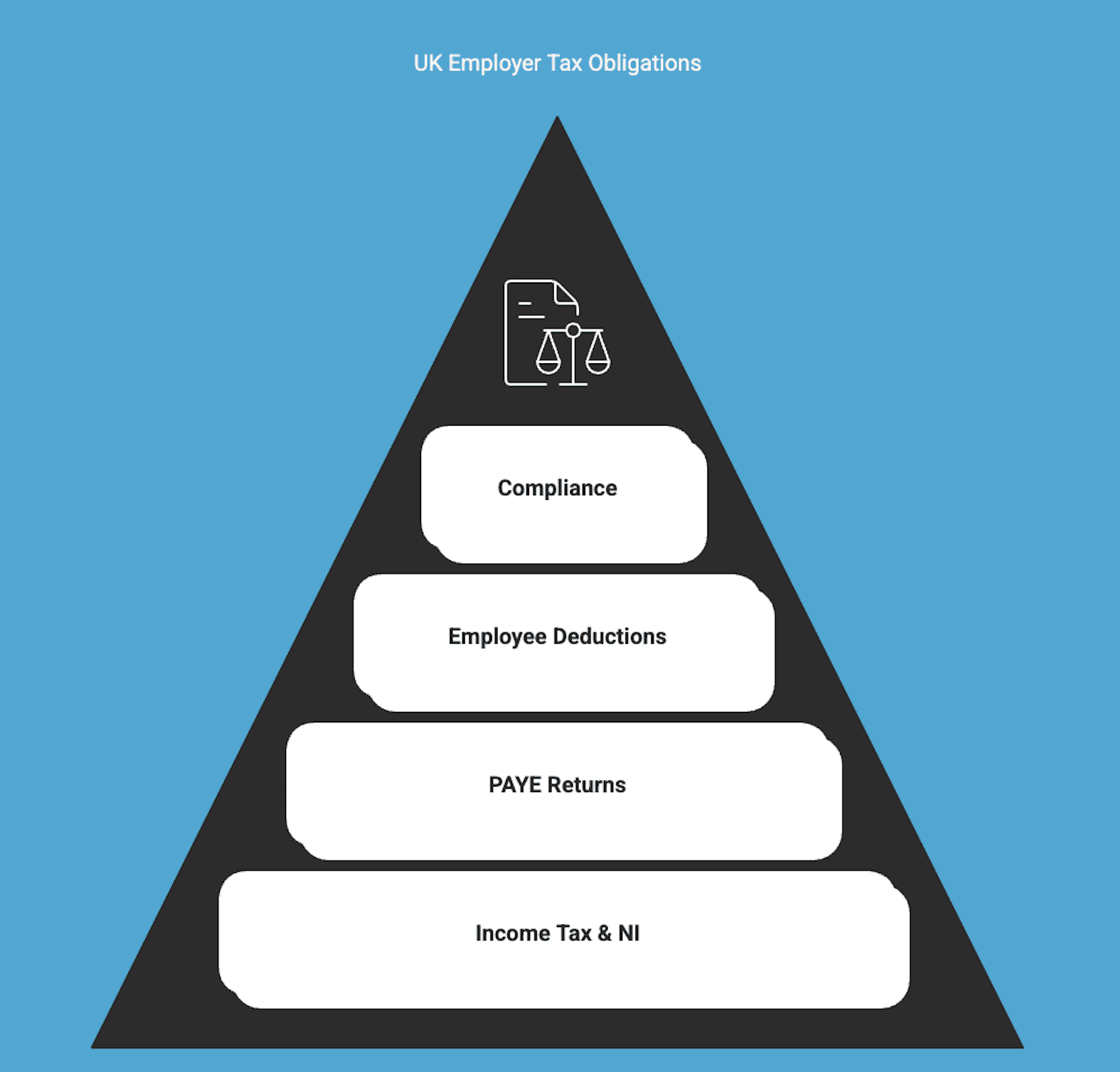

What Are the Tax Obligations for Employers in the UK?

UK employers have several tax-related duties tied to payroll. Failing to meet these obligations can lead to fines, interest charges, and damaged employee trust. Here are the key responsibilities:

1. Deducting Income Tax and National Insurance

Under the PAYE system, you must deduct income tax and National Insurance contributions (NICs) from employees’ wages. These deductions must be calculated based on the employee’s tax code and earnings.

2. Paying Employer National Insurance Contributions

In addition to deducting NICs from employees, employers are also required to pay Class 1 employer NICs on earnings above the threshold. These contributions are a direct cost to the business.

3. Submitting PAYE Returns to HMRC

Every time you run payroll, you must submit a Full Payment Submission (FPS) and an Employer Payment Summary (EPS) to HMRC. This report includes pay and deduction details for each employee and must be filed on or before payday.

4. Making Monthly or Quarterly Payments to HMRC

You must pay HMRC the amounts owed for tax and NICs by the 22nd of the following month (if paying electronically). Smaller employers may be eligible to pay quarterly.

5. Handling Student Loan and Other Deductions

If HMRC notifies you, you must deduct student loan repayments or other legally mandated deductions from employees’ wages and include them in your PAYE reports.

6. Issuing P60s and P45s

At the end of each tax year, you must give new employees a P60 summarizing their total pay and deductions. If an employee leaves, you must issue a P45 detailing their earnings and tax paid to date.

7. Reporting Taxable Benefits and Expenses

If your employees receive benefits like company cars or private healthcare, these must be reported to HMRC via payroll or a P11D form, and may result in additional tax or NIC liabilities.

8. Applying Correct Tax Codes

You must use tax codes issued by HMRC for each employee. These determine how much tax is deducted. Using the wrong code can result in incorrect deductions and compliance issues.

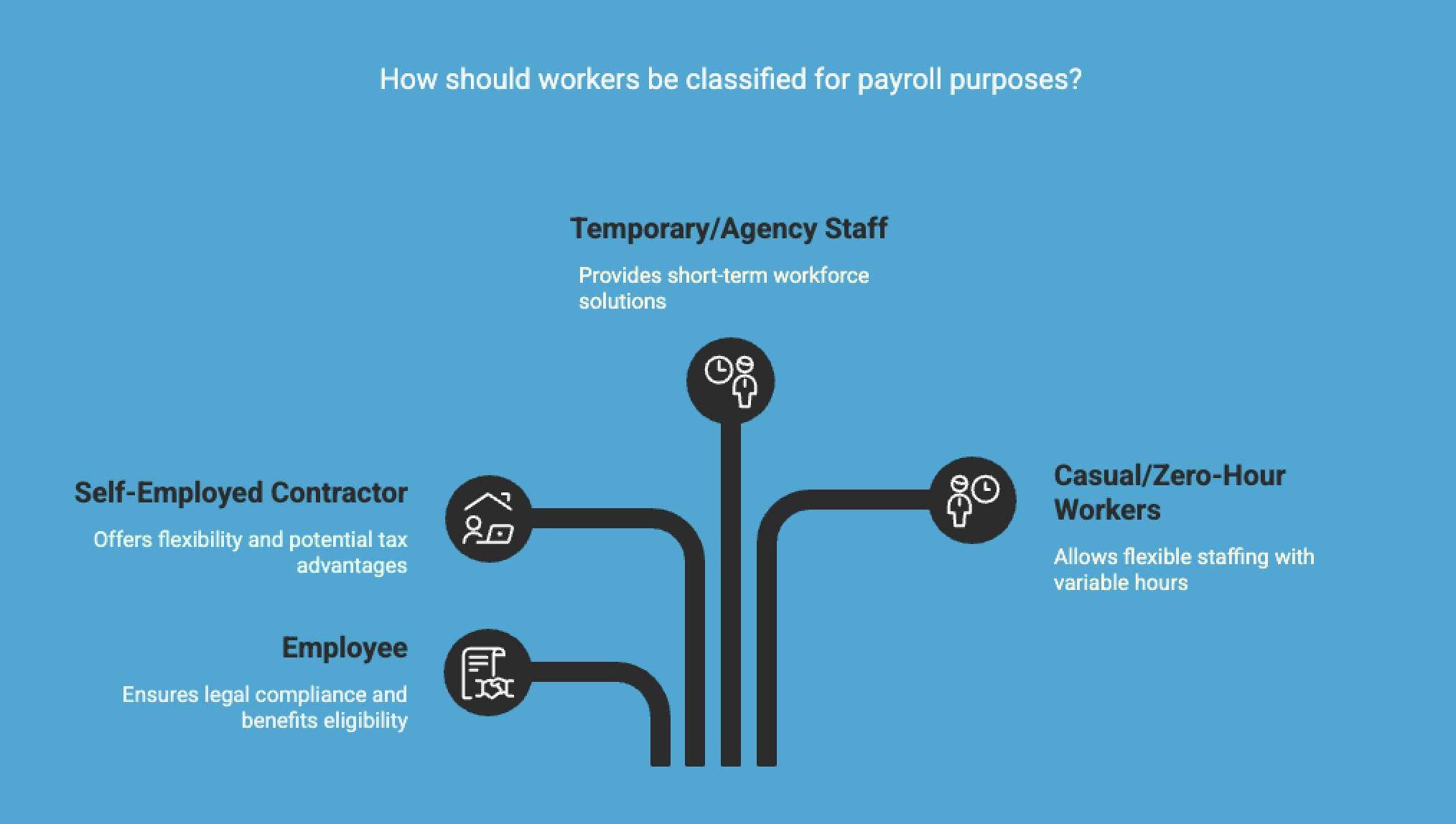

How Does Employee Classification Impact Payroll in the UK?

Classifying workers correctly is essential for payroll accuracy and legal compliance. Misclassification can lead to underpaid taxes, fines, and even employment tribunal claims. Here’s how different classifications affect your payroll obligations.

1. Employee vs. Self-Employed Contractor

- Employees: You must operate PAYE, deduct income tax and National Insurance, provide statutory benefits, and auto-enroll them in a pension scheme if eligible.

- Self-Employed Contractors: Typically, they manage their own tax and NI. You pay the agreed fee and don’t handle PAYE or benefits—unless HMRC deems them a “disguised employee” under IR35 rules.

2. Workers

Workers sit between employees and self-employed individuals. They’re entitled to some statutory rights (e.g. holiday pay and minimum wage) but may not qualify for full employee benefits. PAYE usually still applies, and you may need to enroll them in a pension scheme to ensure compliance with the National Minimum Wage (NMW).

3. Temporary and Agency Staff

If you hire temporary workers directly, you must handle PAYE and benefits. If they’re supplied by an agency, the agency usually handles payroll—unless otherwise agreed.

4. Casual and Zero-Hour Workers

Casual workers must still be paid via PAYE and are entitled to basic statutory pay rights. You’re responsible for tracking their hours and ensuring they receive the minimum wage, holiday pay, and any applicable statutory entitlements.

5. Impact of Misclassification

Incorrect classification can result in:

- Unpaid taxes and National Insurance

- Fines and interest from HMRC

- Claims for back pay, holiday pay, or unfair dismissal

- Reputational damage and legal risk

6. Best Practices for Classification

Here are some best practices for classification.

- Review contracts and working arrangements regularly

- Use HMRC’s Check Employment Status for Tax (CEST) tool for guidance

- Seek legal advice when in doubt, especially with freelancers or consultants

Why Choose Direct Payroll for Your Business?

Managing payroll shouldn’t be a time-consuming burden—it should be seamless, accurate, and compliant. At Direct Payroll, we take the pressure off your shoulders by delivering end-to-end payroll solutions tailored to UK businesses of all sizes.

Whether you’re a startup hiring your first employee or a growing enterprise managing multiple teams, we ensure every payslip is correct, every tax submission is on time, and every legal requirement, including pension contributions, is met. From PAYE setup and RTI submissions to pension auto-enrolment and P60 distribution, we handle it all—so you don’t have to.

What sets us apart?

- Full HMRC Compliance: We stay updated on payroll legislation so you never fall behind.

- Real-Time Processing: Timely reports, accurate deductions, and same-day processing keep your payroll on track.

- Tailored Solutions: Our services scale with your business—custom packages for startups, SMEs, and enterprises.

- Expert Support: Get one-on-one access to experienced payroll professionals who understand your business needs.

- Transparent Pricing: No hidden fees. Just honest, affordable payroll support you can count on.

Let Direct Payroll be the partner you trust to keep your business compliant and your people paid—efficiently, legally, and reliably. Get an instant quote now!

Conclusion

Understanding payroll laws and tax rates is very important for every business. It helps to stay legal and avoid legal troubles. You need to know about minimum wage rules and tax duties. This knowledge can protect your business from expensive fines. Payroll laws change often, so it’s key to keep up with the newest rules and good practices. When you focus on following the laws, you protect your business and create a good workplace for your employees. If you are unsure about payroll problems or need help dealing with them, reach out for a consultation. I can help you understand and use these rules effectively.

Frequently Asked Questions

What are the penalties for non-compliance with payroll laws?

Not following payroll laws, including overtime regulations, can lead to fines, legal problems, and audits. When companies don’t comply, it can affect wages, taxes, and employee benefits. Employers might harm their reputation if payroll errors rise and workers become unhappy, which could lead to legal disputes handled by HM Revenue review systems.

How frequently do payroll laws change in the UK?

Payroll laws usually change every April, when the new tax year begins, including various tax thresholds and allowances. It is important to stay updated on legal updates to avoid mistakes. Employers should keep an eye on HMRC platforms. They should also get help right away if there are changes that impact compliance across the United Kingdom regions.

What should businesses do to stay compliant with payroll laws?

To maintain payroll compliance, it’s important to use good payroll software that accounts for maternity pay. Comprehensive systems help ensure that you follow key rules, such as tax codes. Checking data protection regulations often helps stop fraud and other manipulation. Looking at legal guidelines helps create clear business goals in advance.

Are there specific payroll considerations for small businesses?

Small businesses deal with specific challenges when it comes to payroll. They need advice that directly meets their unique needs. This includes understanding their obligations under HR payroll guidelines. It is important to keep clear records of their legal responsibilities. By managing their staff internally, they can minimize the difficulty of working with outside accounting services.