Real-Time Information (RTI) is more than just payroll jargon—it’s a legal requirement for every UK employer. Each time you pay an employee, you’re obligated to report that payment and any deductions to HMRC via a Full Payment Submission (FPS). This process ensures that tax, National Insurance contributions, and statutory payments are calculated accurately and in real time.

Failing to submit RTI correctly or on time can lead to penalties, disrupt payroll operations, and delay essential employee benefits such as statutory sick pay or maternity leave.

This guide is designed to give you a clear understanding of how RTI works. You’ll learn the key differences between Full Payment Submission (FPS) and Employer Payment Summary (EPS), how to avoid common submission errors, and how to manage scenarios such as new starters, leavers, and employee deaths. Let’s dive in.

What is RTI submission?

Real-Time Information (RTI) was introduced in April 2013, requiring employers to submit payment details to HM Revenue and Customs (HMRC) every time they pay their employees, rather than at the end of the year.

RTI submission is how employers in the UK report employee pay, tax, and National Insurance details to HMRC, every time they pay staff. It keeps everything up to date, so employees get the right tax codes, and benefits like statutory maternity pay or universal credit are calculated properly.

Why are Timely RTI Submissions Non-negotiable?

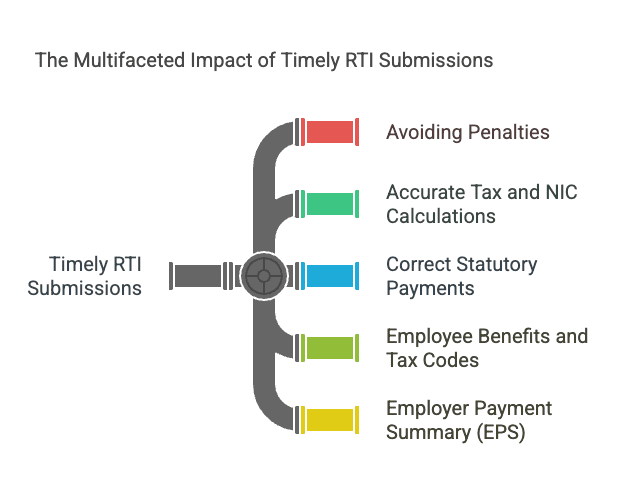

Submitting your RTI data on time and correctly isn’t just about avoiding fines—it’s about ensuring your payroll runs smoothly and your employees’ financial well-being is maintained. Here’s why it matters:

- Avoiding Penalties: Failing to submit RTI returns on or before the payment date can result in penalties. The amount depends on the number of employees in your PAYE scheme. For example, if you have 1 to 9 employees, the penalty is £100 per month.

- Accurate Tax and NIC Calculations: RTI submissions provide HMRC with up-to-date information on employee earnings and deductions, ensuring accurate tax and National Insurance contributions (NICs) calculations.

- Correct Statutory Payments: Timely RTI submissions are crucial for calculating statutory payments like Statutory Sick Pay (SSP) and Statutory Maternity Pay (SMP). Errors or delays can lead to incorrect payments to employees.

- Employee Benefits and Tax Codes: Accurate and timely RTI submissions help maintain correct tax codes for employees, reducing the risk of under or overpayment of taxes.

- Employer Payment Summary (EPS) for Deductions: If you’re part of the Construction Industry Scheme (CIS), submitting an EPS is necessary to notify HMRC of deductions

Read also: Payroll Risk Management Strategies To Protect Your Business.

What You Need to Comply with RTI?

To stay compliant with RTI requirements, you’ll need reliable payroll software that’s RTI-compatible. This software must be capable of sending real-time data to HMRC each time you pay your employees. It should include all required information—employee details (name, address, NI number), gross pay, tax and NIC deductions, student loan repayments, statutory payments (if any), and any new starter or leaver statuses.

You’ll also need:

- A Government Gateway account for online access to HMRC services

- An active PAYE scheme

- Employer PAYE reference and Accounts Office reference

- Employee information that’s accurate and up-to-date

Reminder: RTI submissions must be sent on or before each payday—don’t wait until the end of the month.

What is Full Payment Submission (FPS)?

A Full Payment Submission (FPS) is a mandatory report that UK employers must send to HMRC every time they pay their employees. It details exactly what each employee was paid and what deductions were made, including Income Tax and National Insurance Contributions. Even if an employee earns less than £120 a week or works only briefly, they still need to be reported under PAYE through an FPS.

Each FPS includes vital information such as employee names, dates of birth, gender, addresses, tax codes, and National Insurance numbers. It also covers gross pay, deductions, and net salary, alongside indicators for new starters or employees who’ve left during that period. If you’re claiming Employment Allowance or issuing statutory payments like maternity or bereavement pay, that’s included too.

Remember, it’s necessary to make an FPS before or on the day you pay your employees; non-compliance with this can potentially result in penalties from HMRC.

What is the Employer Payment Summary (EPS)?

An Employer Payment Summary (EPS) is more than just a backup to your regular payroll reporting—it’s a key part of keeping your PAYE scheme compliant and up to date. While an FPS is submitted every time you pay your staff, an EPS kicks in when there’s something different to report to HMRC.

You’ll need to file an EPS if no employee payments were made during a tax month—it tells HMRC not to expect an FPS or estimate liabilities. It’s also your route for reclaiming statutory payments like maternity, paternity, or bereavement pay, and for claiming Employment Allowance once per tax year. Limited companies use the EPS to report CIS deductions suffered, and larger employers report Apprenticeship Levy liabilities here too. Planning a break in payroll or shutting down your PAYE scheme? You guessed it—submit an EPS.

EPS must be sent by the 19th of the month following the tax period. Failing to submit an EPS when required can lead to HMRC estimating your PAYE liability, which may result in overpayments or underpayments. Additionally, HMRC may issue penalties for late or non-submission.

How to View RTI Submissions in Your HMRC Account?

Once you’ve submitted your RTI data—whether it’s a Full Payment Submission (FPS) or an Employer Payment Summary (EPS)—you can view it directly through your HMRC online account. To do this, simply log in to your Government Gateway account and click on the “PAYE for Employers” section. Under this, you’ll find a breakdown of all your RTI submissions, their statuses, and whether HMRC has received them successfully. This is crucial for keeping track of what’s been submitted, identifying errors early, and ensuring you’re staying compliant.

Tip: Check your submission reports regularly. It helps you spot missed or rejected filings quickly and take corrective action before penalties are triggered.

What Fines and Penalties Can You Expect Due to Delayed RTI Submissions?

HMRC takes RTI compliance seriously. If you fail to submit an FPS on time or miss an EPS where required, you could face:

- Late filing penalties: These vary depending on the size of your business, starting from £100 per month.

- Estimated charges: HMRC may estimate your PAYE liability based on past data, potentially leading to overpayment or underpayment.

- Inaccurate benefit payments: Mistakes in RTI can delay or affect statutory payments such as maternity, paternity, or sick pay for your employees.

- Interest and surcharges: If payments are late or based on incorrect submissions, you may be charged interest on top of the outstanding amounts.

The best way to avoid this? Submit accurate data, on time, every time—and double-check submission receipts in your HMRC account.

How Should You Handle RTI Submissions for Special Cases?

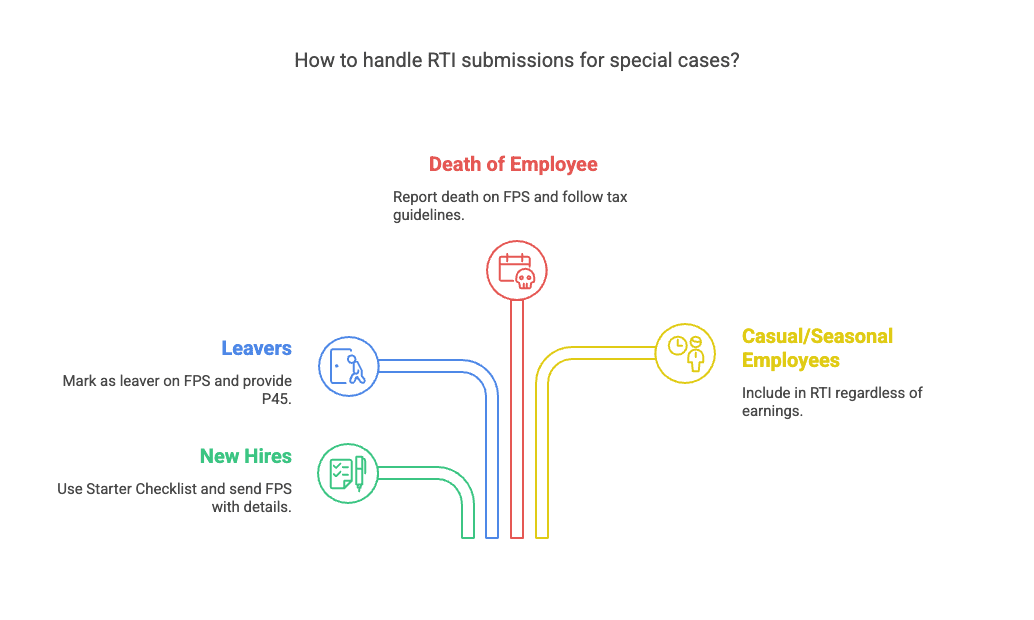

Often, employers come across specific situations, like the incorporation of casual, seasonal, and temporary employees, or addressing unfortunate incidents such as the death of an employee. Let’s delve deeper into how these scenarios could be managed adeptly in terms of RTI submission.

1. Dealing with New Hires and Leavers

Managing starters and leavers’ status forms an integral part of RTI submission. When dealing with:

- New hires: On hiring a new member, before payment, employers should employ the Starter Checklist to determine the applicable tax code for the employee. An FPS with starter details is to be sent to HMRC. If the new hire brings a P45 from a previous job, the form’s information helps determine the correct tax code.

- Leavers: When an employee leaves, mark them as a leaver while sending the FPS. Provide them a P45 form to facilitate smooth tax handling at their next job.

Remember:

- New starters must fill out the Starter Checklist, even if they provide a P45.

- Always mark leavers on FPS during their last payment

- Distribute P45 forms to leavers, which will assist in their future employment

Prudent management of these changes can ensure smooth transitions and accurate tax calculations, thus warranting an efficient payroll system.

2. Processing in the Case of Death of an Employee or Pension Recipient

Losing an employee or pension recipient is never easy, but it’s important to manage the payroll process correctly to stay compliant and ensure everything is handled for their estate.

1. Reporting the Death in RTI

In your next Full Payment Submission (FPS), enter the date of death in the ‘Date of leaving’ field. This alerts HMRC to update their records. A P45 should not be issued in this case.

2. Making Final Payments

- Use the existing tax code for any final payments.

- Do not deduct National Insurance contributions.

- Payments should be made to the employee’s estate.

3. Payments After the Death Has Been Reported

If you’re paying after submitting the FPS:

- Use tax code 0T on a ‘week 1’ or ‘month 1’ basis.

- Mark ‘Yes’ under the Payment After Leaving indicator.

- Choose ‘H – Correction to an earlier submission’ for the late payment reason.

- Update year-to-date figures accordingly.

4. For Pension Recipients

The process is nearly the same:

- Report the date of death in the ‘Date of leaving’ field.

- If it’s a new tax year and the death wasn’t reported yet, use tax code 0T on a ‘week 1/month 1’ basis.

- Mark ‘Yes’ for Payment After Leaving and select reason ‘H’ if reporting late.

- Always update the YTD totals.

3. RTI Submission for Casual, Seasonal, and Temporary Employees

A common misconception is that short-term or part-time workers can be excluded from RTI reporting—but that’s not the case. HMRC requires you to include all employees under your PAYE scheme, no matter how briefly they work or how little they earn.

If you’re employing:

- A student working during the holidays

- A temporary staff member for an event

- A part-time worker on irregular hours

You must still report their pay and deductions via an FPS on or before each payment. This ensures their tax records are updated in real time and that they’re eligible for benefits or tax rebates down the line. It also protects your business from compliance issues.

Even if someone earns below the Lower Earnings Limit (£123/week for 2024/25), they still need to be reported in RTI if they fall under PAYE.

Stay Compliant with RTI submissions with Direct Payroll Services

At Direct Payroll Services, we understand that Real-Time Information (RTI) submissions can be complex and time-consuming. That’s why we’re here to simplify the process for you. With over 250 businesses across the UK trusting us, we offer tailored payroll solutions that ensure your RTI submissions are accurate, timely, and fully compliant with HMRC regulations.

Why Choose Us?

- Expertise You Can Trust: Our team of payroll professionals is well-versed in RTI requirements, ensuring your submissions are always accurate and on time.

- Tailored Solutions: Whether you’re a small business, an accountant, or a care home, we provide customised payroll services that fit your specific needs.

- Comprehensive Services: From Full Payment Submissions (FPS) to Employer Payment Summaries (EPS), we handle all aspects of RTI submissions, so you can focus on growing your business.

- Peace of Mind: With our cloud-based software and secure systems, your payroll data is protected, and you’re always compliant with the latest HMRC regulations.

Let us handle the complexities of RTI, so you can focus on what matters most—running your business. Contact us today!

Conclusion: Why RTI Matters More Than You Think

RTI submissions aren’t just another payroll task—they’re the heartbeat of staying compliant, avoiding penalties, and keeping HMRC off your back. Whether it’s your regular FPS, an EPS when no one’s getting paid, or tying up loose ends at year-end with EYU, every piece plays a part in keeping things smooth and above board.

Mess up your RTI, and you’re looking at missed benefits for employees, wrong tax codes, or even fines. Get it right, though, and you’ll not only avoid headaches but also build trust with your team by showing them their pay is handled with care and accuracy.

So if payroll’s been a stress point or you’re still unsure when to file what, now’s the time to fix it. Invest in getting your RTI process on point, or better yet, bring in the experts and never miss a beat.

Frequently Asked Questions

What Are the Deadlines for RTI Submissions?

FPS must be submitted on or before the employee’s payday, while EPS usually needs to be sent by the 19th day of the month following the tax month. Failure to comply can result in penalties from HMRC.

How Can Errors in RTI Submissions Be Corrected?

Errors in payroll data from previous tax years can be corrected with an Earlier Year Update (EYU). However, from April 2021, EYU is no longer valid, and corrections in data should be made by sending a further year-to-date Full Payment Submission (FPS).

Are There Any Exemptions to RTI Submission Requirements?

There are very few exemptions to RTI submission requirements. However, small-scale employers who are unable to engage in electronic communication can employ paper channels to file their RTI. Always consult with an accounting professional when in doubt about any aspect of RTI submissions.