PAYE registration is essential for employers to manage payroll and stay compliant with tax rules. PAYE (Pay As You Earn) allows HMRC to collect income tax and national insurance directly from wages.

This guide covers everything you need to know—who needs to register, how to do it, and what to do afterward. Plus, we’ll explain how to cancel your registration if needed.

By the end, you’ll be ready to handle PAYE with confidence and focus on growing your business

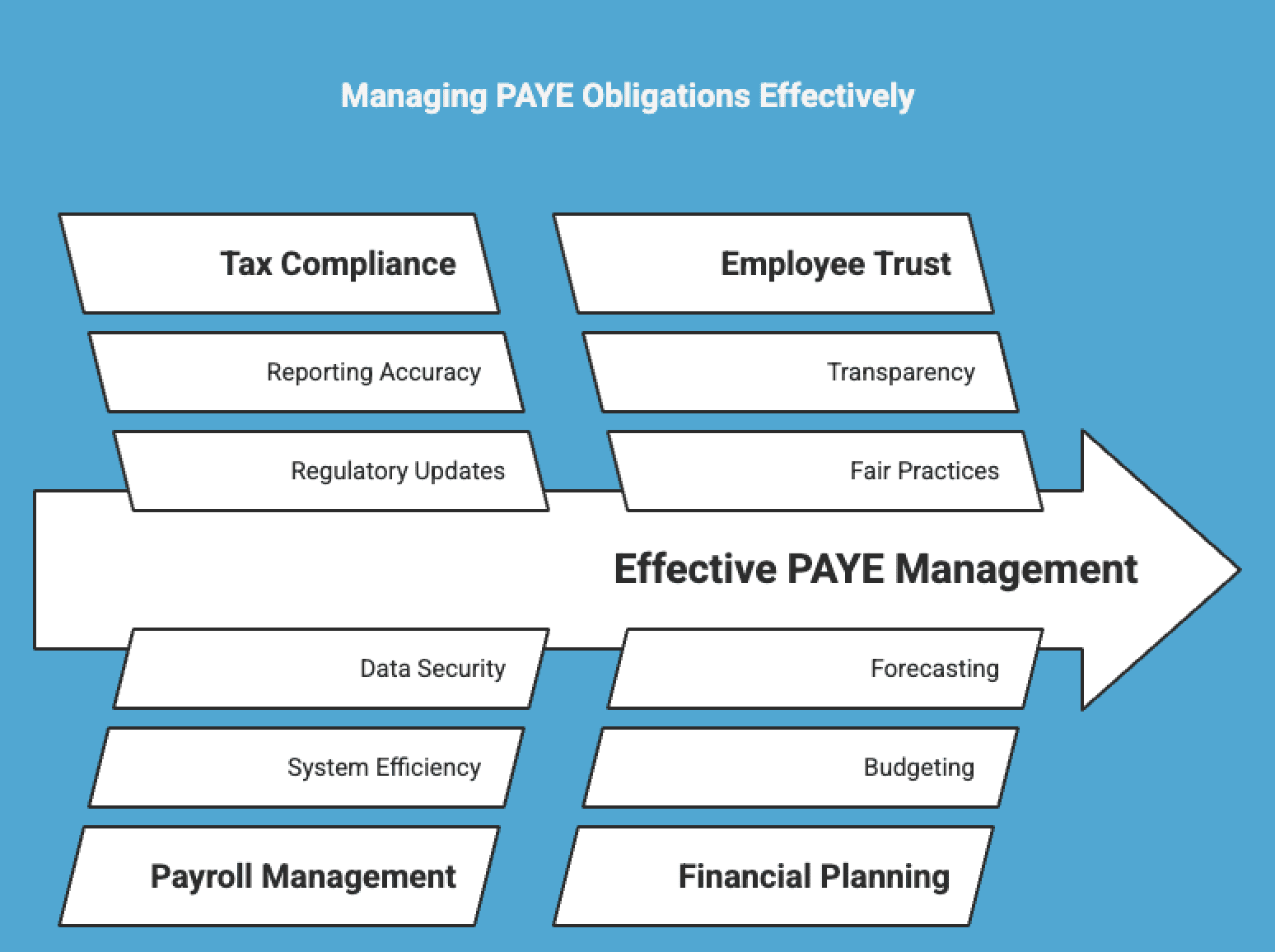

How PAYE Impacts Your Business and What You Need to Know?

Understanding PAYE (Pay As You Earn) is crucial for any employer, as it directly impacts your business’s payroll system and tax compliance. PAYE is a system through which HMRC collects income tax and National Insurance contributions from your employees’ wages before they receive them. Here’s how it impacts your business and what you need to know:

1. Tax Compliance

As an employer, you’re responsible for deducting the right amount of income tax and National Insurance contributions from your employees’ wages, including employee wages under the PAYE system. Failing to properly implement PAYE can result in penalties, interest on late payments, and damage to your business’s reputation. By correctly registering and operating PAYE, you ensure your business stays compliant with tax regulations.

2. Payroll Management

PAYE simplifies payroll management by automating tax deductions and National Insurance deductions, generating detailed payslips that outline these deductions. You’ll need to report these tax deductions to HMRC each time you pay your employees, which means staying on top of payroll and ensuring everything is filed on time. This requires accurate record-keeping and timely submissions.

3. Employee Trust

Employees expect their employer to handle tax matters efficiently. By properly managing PAYE, you show that your business is trustworthy and that you take responsibility for the tax contributions. This builds confidence with your team, leading to smoother operations and fewer payroll-related queries.

4. Financial Planning

PAYE affects your business’s cash flow since you’ll need to allocate funds for tax contributions before distributing wages. Knowing your PAYE obligations ahead of time will help with better financial planning and budgeting. This is particularly important for businesses with fluctuating payrolls or seasonal workforces.

5. What You Need to Do

- Register with HMRC if you haven’t already. This is essential to start the PAYE process.

- Set up a payroll system to accurately calculate and report deductions.

- Make regular submissions to HMRC and ensure you pay any taxes on time.

- Stay informed about changes to tax codes, National Insurance rates, and other regulations that could impact your payroll.

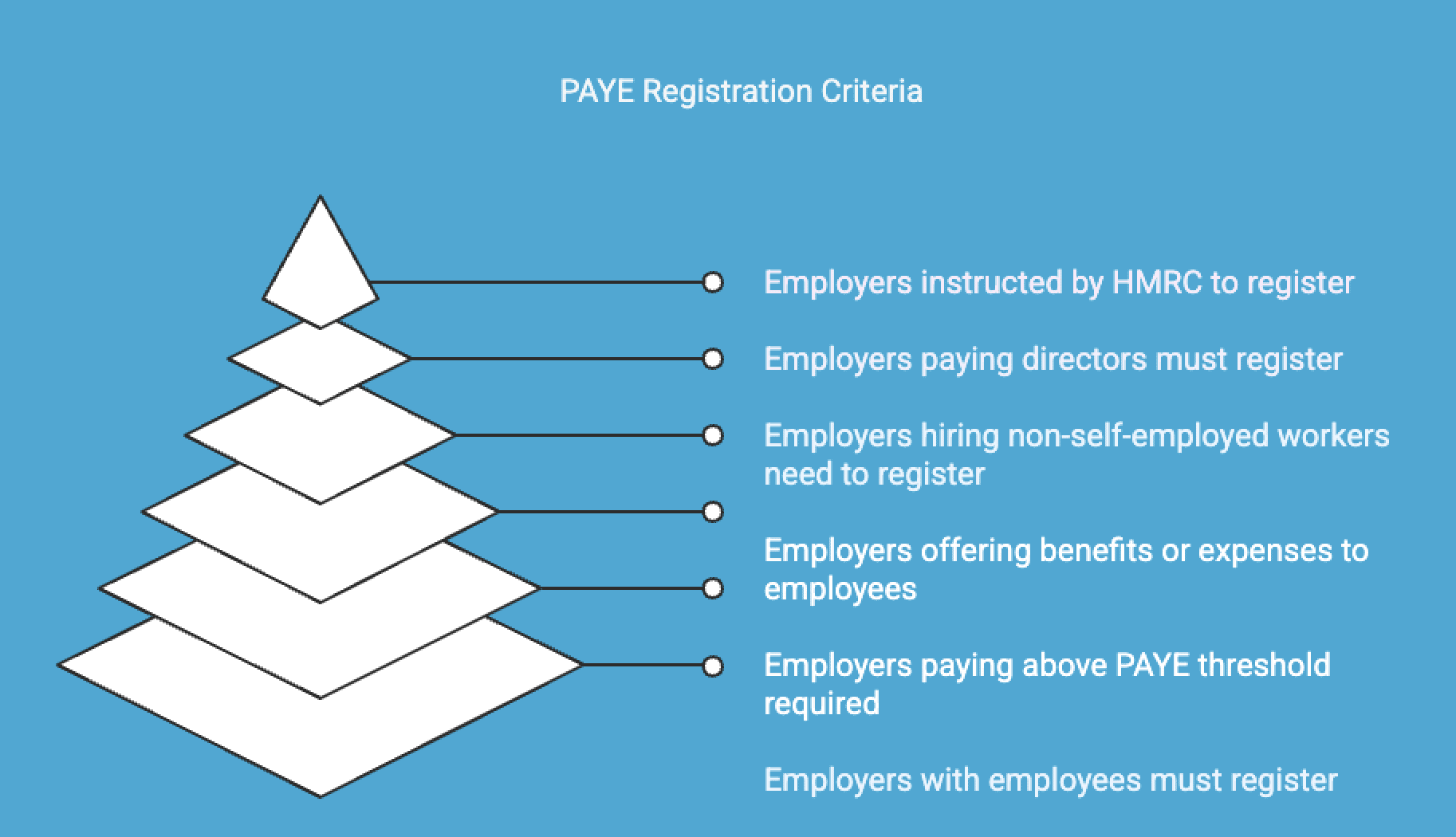

Who Needs to Register for PAYE?

Registering for PAYE is a requirement for certain businesses and employers, but not all businesses need to register immediately. Here’s a breakdown of who needs to register for PAYE:

1. You Have Employees

If your business employs people, whether full-time, part-time, or temporary, you generally need to register for PAYE. This applies even if you only hire one person or if the person is working for a short period.

2. You Pay Employees Above the PAYE Threshold

If you pay employees above a certain threshold, including their employee benefits, for the first time, you must register for PAYE. The threshold depends on the employee’s income and other factors like age and tax allowances. For example, as of the 2025 tax year, employees earning over £12,570 per year typically need to be taxed under PAYE.

3. You Provide Benefits or Expenses to Employees

If you provide taxable benefits (such as company cars or private health insurance) or reimburse employees for expenses (like travel costs), you must register for PAYE and report these benefits to HMRC.

4. You Hire Workers Who Aren’t Self-Employed

If you hire workers on a PAYE basis, rather than as independent contractors or self-employed individuals, you’re required to register. This includes both salaried employees and workers paid hourly or weekly.

5. You Hire Directors Who Are Paid

Even if you run a small company, if you have a director who is being paid a salary, you will need to register for PAYE, as HMRC expects PAYE deductions to be made on their salary and any employee expenses.

6. You’ve Been Told to Register by HMRC

If HMRC contacts you and advises you to register for PAYE, you must comply with their instructions. They may notify you based on the details of your business or if they believe you meet the criteria.

Situations Where PAYE Registration Isn’t Required (Yes, There Are Exceptions)

- If you hire only freelancers or self-employed contractors who are responsible for their own tax payments.

- If you pay your employees below the PAYE income threshold (typically below £123 a week).

- If your employees are under 16 years old or over the state pension age and earn below the threshold.

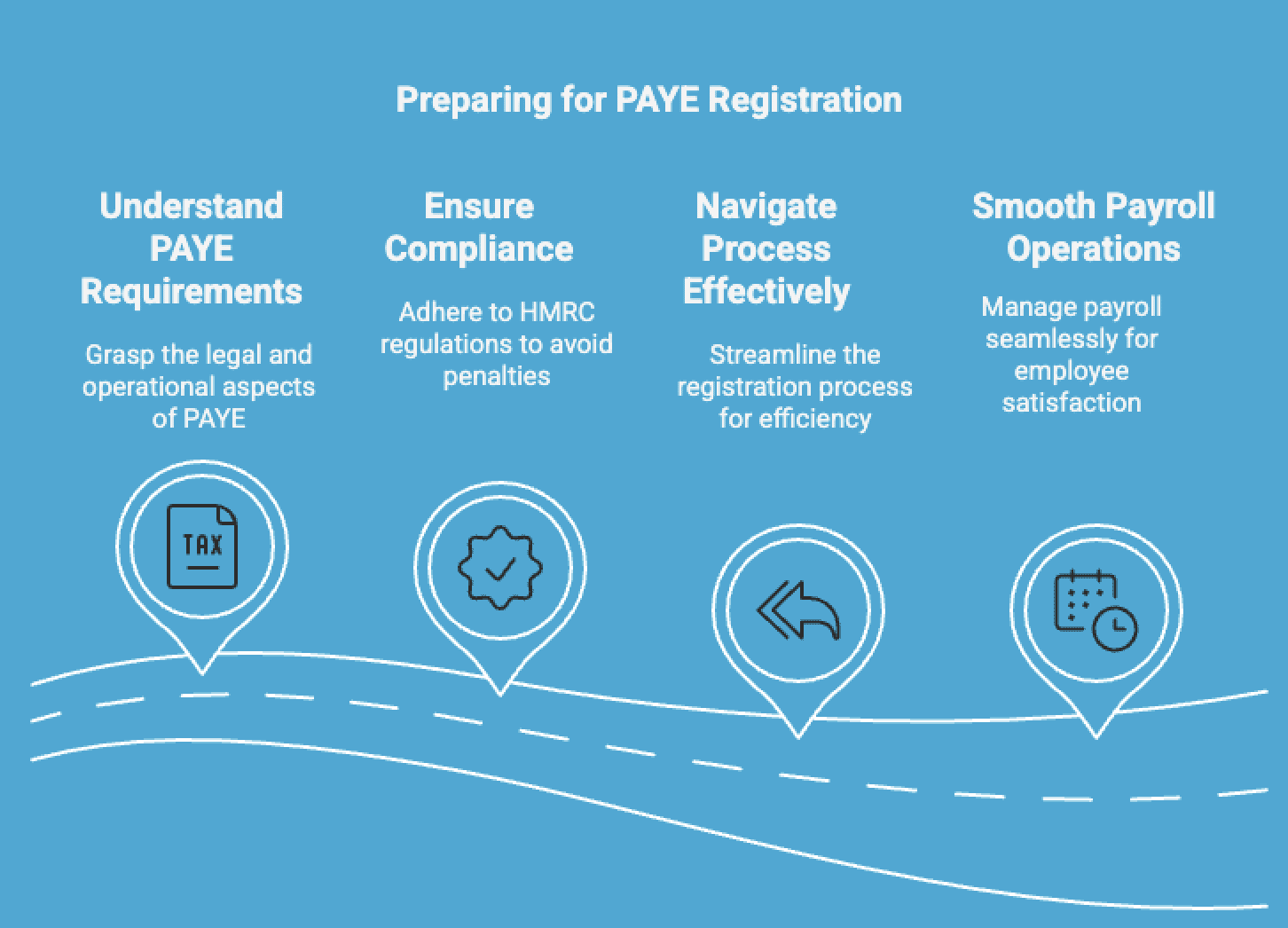

How To Prepare For PAYE Registration?

Preparing for PAYE registration involves several key steps to ensure that you’re ready to manage your payroll and stay compliant with HMRC. Here’s how you can get prepared:

1. Check Your Business Details

Before registering, gather important details about your business, such as:

- Your business name and address

- Your employer PAYE reference number (if applicable)

- Your National Insurance (NI) number, the contact details of any other company directors, and the number of employees you expect to employ.

- Company registration details (if you’re a limited company)

These will be required when you complete the registration process.

2. Determine Your PAYE Responsibilities

Understand the scope of PAYE registration by reviewing which employees you need to register for. Consider:

- Whether your employees earn above the threshold for PAYE

- If you’re providing any taxable benefits, expenses, or salary bonuses that need to be included in the PAYE system

- If you’re hiring directors who will be paid through PAYE

Knowing these details helps you ensure you’re only registering for the employees who require it.

3. Set Up a Payroll System

You’ll need a reliable payroll system to calculate and manage your PAYE deductions. Some options include:

- Payroll software: There are many online systems that automatically calculate tax, National Insurance, and other deductions for you (e.g., Sage, Xero, QuickBooks).

- Manual payroll: If you choose to do payroll manually, make sure you understand how to calculate income tax, National Insurance, and pension contributions. However, manual processing can be prone to errors, so using software is generally recommended.

- Payroll service providers: You can also outsource the payroll process to experts who will handle everything for you. Payroll service providers like Direct Payroll are your go-to partner for all your payroll service needs. Whether you’re a small business or a large organisation, we offer fully managed payroll solutions that save you time, reduce errors, and keep you fully compliant with HMRC regulations.

4. Determine Your Pay Frequency

Decide how often you’ll pay your employees (weekly, bi-weekly, monthly, etc.). This affects how frequently you need to submit payroll information to HMRC and pay tax and National Insurance contributions.

5. Familiarize Yourself with HMRC Reporting Requirements

PAYE registration comes with certain reporting obligations. Be prepared to submit:

- Real Time Information (RTI): RTI reporting requires you to send payroll details to HMRC each time you pay your employees. This must be done before or on the payday.

- Annual reports: You’ll also need to submit an end-of-year report summarizing everything you’ve paid your employees, including tax and National Insurance contributions.

6. Get Ready for Tax Codes and Allowances

Understand the tax codes and National Insurance bands that apply to your employees. These will change yearly and determine how much income tax to deduct from wages. You’ll receive these codes from HMRC, but having a basic understanding will help you manage the process.

7. Understand Additional Deductions

Besides income tax and National Insurance, your payroll system might need to account for other deductions, such as child maintenance payments:

- Pension contributions (if you’re enrolled in a workplace pension scheme)

- Student loan repayments

- Other voluntary deductions (e.g., union dues, charitable donations)

Be sure to gather any additional information needed for these deductions.

8. Have a Bank Account Ready

If you don’t already have one, set up a business bank account. You’ll need this to process employee payments and make HMRC payments for tax and National Insurance contributions.

9. Review Your Employee Records

Have up-to-date records for each employee, including:

- Full name, address, and date of birth

- National Insurance number

- Employment start date

- Tax code

These details are necessary for accurate payroll processing.

10. Consider Seeking Professional Help

If you’re unsure about the registration process or managing PAYE, whether you’re a start-up or an established business, consider seeking advice from an accountant or payroll specialist. They can guide you through the registration process, ensure everything is in order, and help you avoid mistakes that could lead to penalties associated with different tax rates.

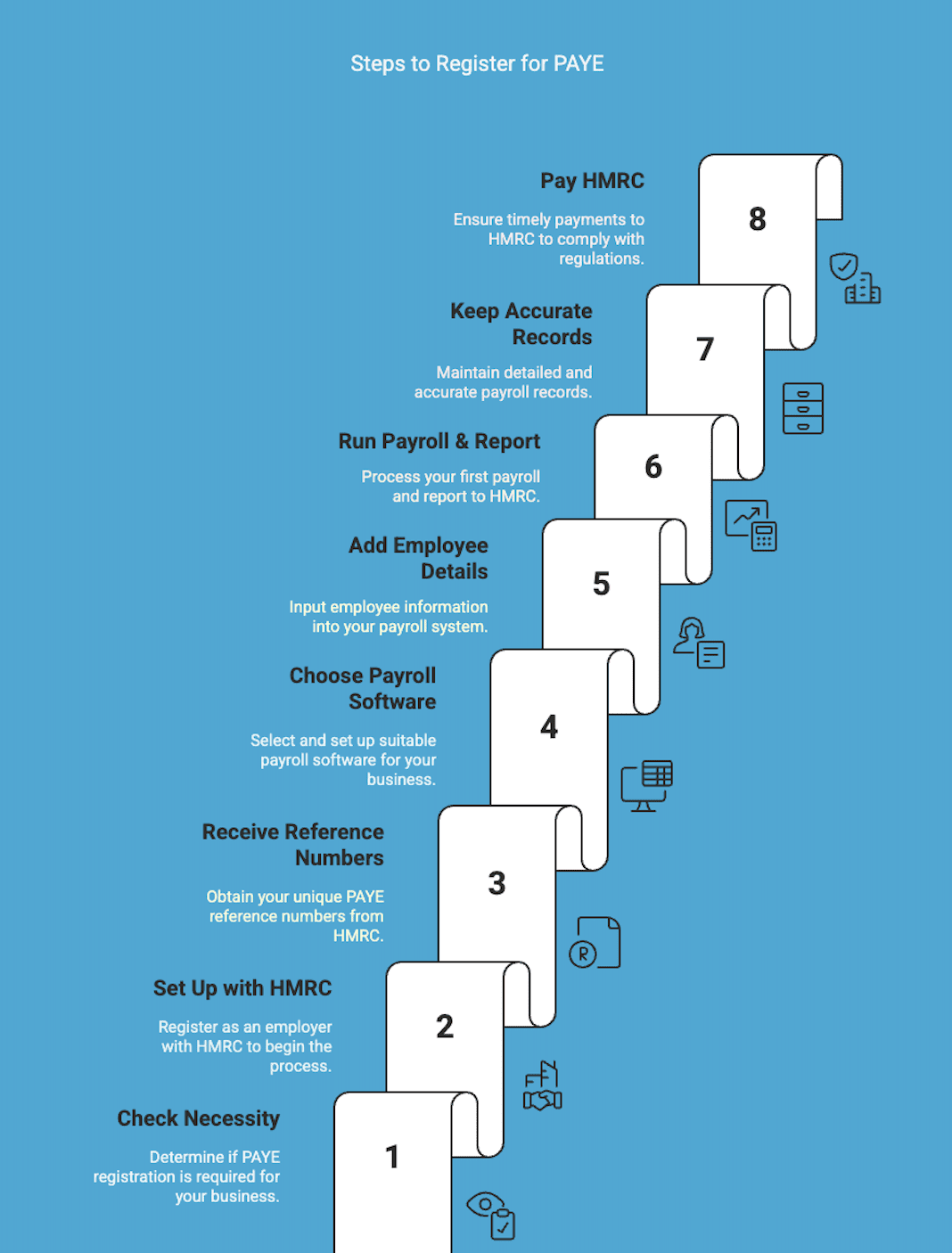

How to Register for PAYE? A Step-by-Step Guide!

Registering for PAYE is a crucial step for any UK employer planning to pay staff. It ensures you deduct and submit income tax and National Insurance contributions correctly to HMRC. If you’re hiring employees or directors who earn above the threshold or receive taxable benefits, you must register before your first payday. Here’s a step-by-step guide to help you through the PAYE registration process.

Step 1: Check If You Need to Register

Before registering, confirm whether PAYE applies to your situation involving construction work. If you’re paying an employee who earns above the tax threshold or providing taxable benefits or expenses, you need to register with HM Revenue and Customs (HMRC).

Step 2: Set Up as an Employer with HMRC

Visit GOV.UK Register as an Employer and fill out the registration form to set up PAYE online. You’ll need details such as your business name, type (sole trader, limited company, etc.), UK National Insurance number, and company registration number (if applicable). It can take up to 5 working days to receive your PAYE reference numbers.

Step 3: Receive Your PAYE Reference Numbers

Once registered, HMRC will send two important references by post:

- PAYE reference number

- Accounts Office reference

These are needed to make PAYE payments and file reports.

Step 4: Choose and Set Up Payroll Software

Select HMRC-approved payroll software that suits your business. This will calculate tax and National Insurance, create payslips, and file reports to HMRC in real time. For smaller employers, HMRC’s free Basic PAYE Tools is a good starting point.

Step 5: Add Employee Details to Your Payroll System

Input essential details for each employee, including name, address, date of birth, start date, salary, tax code, and National Insurance number.

Step 6: Run Your First Payroll and Report to HMRC

Submit a Full Payment Submission (FPS) to HMRC each time you pay employees. This report must be sent on or before each payday and should include pay and deductions for all staff.

Step 7: Keep Accurate Records

You’re legally required to maintain payroll records for at least 3 years. These should include payments, deductions, reports sent to HMRC, and any benefits or expenses.

Step 8: Pay HMRC

Make your PAYE payments to HMRC by the 22nd of the following month (or the 19th if paying by post). This includes tax, National Insurance, and any other deductions.

What Comes After Registration? Next Steps You Need To Know About

Once you have successfully registered for PAYE, your responsibilities as an employer under the PAYE system begin. In order to navigate this process correctly and efficiently, it’s important to understand what these responsibilities are and how they should be managed.

Managing PAYE Responsibilities

Upon successful registration, your responsibilities under the PAYE system hinge around the efficient management of payroll. Specifically,

- Run regular payrolls to calculate income tax, national insurance, and other deductions for your employees. Ensure these deductions are correct and kept up-to-date.

- Generate employee payslips that accurately outline all deductions and allowances.

- Submit Full Payment Submissions (FPS) to HMRC for each pay period, detailing salaries paid and deductions made.

- Update employee records routinely to reflect changes or particular circumstances. These could include benefits given, leave taken, changes in salary, and so on.

- Handle tax code notices sent by HMRC. These contain specific instructions on what tax code to use for each employee.

Bear in mind that managing PAYE responsibilities can be complex, particularly for new employers. Using a comprehensive payroll software can help streamline the process.

Common Issues and How to Resolve Them

While managing PAYE responsibilities, it’s common to run into some issues. Here are some potential problems you might face and how to tackle them:

- Delayed Paydays: If your registration isn’t processed in time for the first payday, don’t panic. You can still run payroll, store your full payment submission, and send a late full payment submission to HMRC.

- Incorrect Tax Codes: A Wrong tax code can result in inaccurate taxation for employees. Always ensure that the tax code used matches the latest notice from HMRC.

- Issues with Employee Records: Maintaining updated and accurate employee records is crucial. Discrepancies can lead to incorrect deductions and potential issues with HMRC.

- Missed Deadlines: If deadlines for submitting FPS or Employer Payment Summaries (EPS) are missed, it could lead to penalties. Be diligent about deadline tracking or consider using payroll software that can automate these submissions.

If you encounter difficulties that you can’t resolve, it’s advisable to seek professional advice from an accountant or contact HMRC directly.

Direct Payroll – Payroll Made Effortless

Tired of payroll headaches? Direct Payroll simplifies your entire process — from automated calculations and tax filings to seamless employee payments. Whether you’re a small business or a growing enterprise, our reliable, secure platform keeps your team paid accurately and on time, every time.

Why choose Direct Payroll?

- Fast, accurate payroll processing

- Full tax compliance, guaranteed

- Easy onboarding and dedicated support

- Scalable solutions for every stage of growth

Let Direct Payroll handle the numbers — so you can focus on growing your business.

Streamline your payroll today. Get an instant quote now!

Conclusion

PAYE is key to keeping your business compliant and your payroll running smoothly. While registering can feel complex, it’s a crucial step that supports essential services—and keeps you on the right side of the law.

Understanding how to register, manage ongoing PAYE duties, and close the scheme properly (like submitting a final payroll return) is vital. When in doubt, get expert help. Staying compliant is always better than facing penalties later.

Frequently Asked Questions

What is the deadline for registering for PAYE?

There’s no hard and fast rule, but generally, you should register with a future date in mind before the first payday of your employees. It can take up to 15 working days of registering to receive your PAYE reference.

Can I register for PAYE if I’m self-employed?

Yes, you can register for PAYE even if you’re self-employed. A common scenario is if you’re the only director of a limited company, you’ll need to register for PAYE.

How often do I need to report to HMRC?

As an employer, you need to send a Full Payment Submission (FPS) to HMRC every time you pay your employees.

What to do if I miss the PAYE registration deadline?

If you failed to register on time, immediately start the process of registration. You can still run payroll, store your full payment submission, and send a late full payment submission to HMRC.

Are there penalties for late PAYE Registration?

Technically, there aren’t any penalties specifically for late registration for PAYE. However, late registration might lead to missed payroll submissions or delayed tax payments, which can result in potential penalties and interest charges.