If you’re still issuing printed payslips, you’re likely spending more time and resources than necessary. Paper slips can go missing, delay employee access to pay information, and add to your admin workload.

That is why e-payslips offer a practical alternative. They streamline the payroll process, reduce errors, lower costs, and ensure employees can access their payslips securely—anytime, anywhere. They’re also ideal for modern, remote, or multi-site teams who need quick, paperless access to essential information.

However, if you are worried about its complexities, let us tell you that transitioning to digital payslips doesn’t have to be complicated. In this guide, we’ll walk you through how e-payslips work, the benefits they offer, how to implement them effectively, and how to stay compliant with UK payroll regulations, without disrupting your operations.

What is an Electronic Payslip?

Electronic payslips serve as the digital version of traditional paper payslips. They are sent digitally within regulated timelines, either weekly or monthly, depending on the organisation’s payroll protocol. The key differentiator lies in how these payslips are produced, disseminated, and stored – all of which happen electronically.

Unlike their paper-based counterpart, electronic payslips help businesses to curtail costs, enhance their eco-friendly measures, and streamline operational efficiency. Moreover, electronic payslips minimise potential data loss or misplacement, providing a safe and reliable alternative for businesses and employees alike.

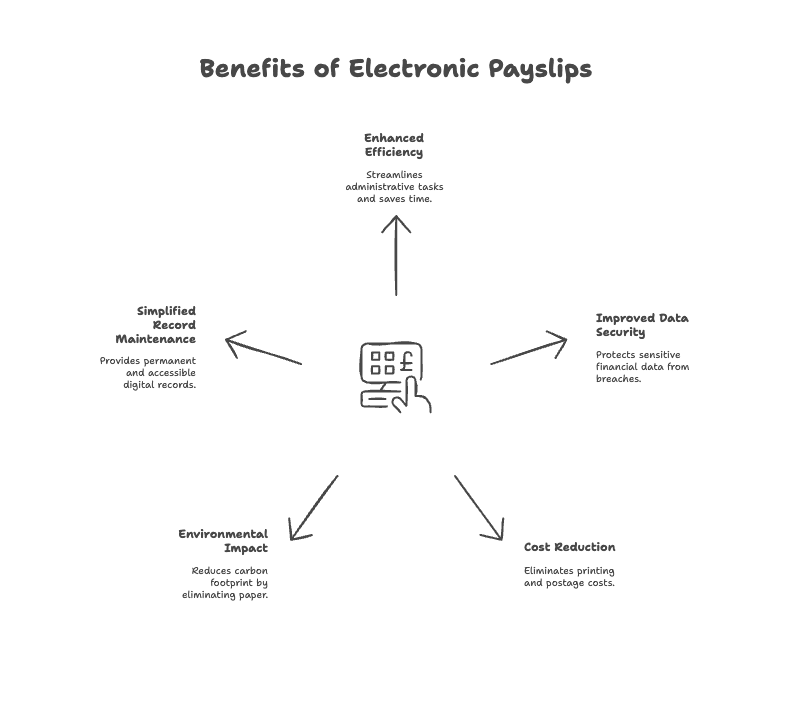

5 Ways Electronic Payslips Improve Payroll Efficiency

Switching to electronic payslips gives businesses a double shot of efficiency and savings.

Paperless distribution significantly reduces resources, both in time and monetary aspects, which otherwise go into printing, sorting, and distributing paper payslips.

That’s only part of the picture; electronic payslips also minimise administrative queries post-distribution, further increasing operational efficiency. Let’s take a closer look into additional advantages.

1. Enhancing Efficiency and Accessibility

From an efficiency viewpoint, electronic payslips significantly curb manual handling that is associated with traditional paper slips. With e-Payslips, administrative tasks such as sorting and distribution become streamlined and time-efficient. Additionally, annotating pay data becomes substantially simpler, thanks to the digital format.

Electronic payslips offer accessibility even beyond regular office hours or geographical limitations. This benefit plays a significant role for organisations spreading across large territories or those practising remote working arrangements.

2. Improving Data Security

Historically, paper payslips suffered from security flaws – loss, misplacement or unintentional distribution to the wrong person were common challenges. Besides causing inconvenience, such incidences often lead to data breaches with serious implications, bearing in mind the confidential employee information payslips carry.

On the other hand, electronic payslips stored and viewed through secured channels create a safe repository for financial data. Leveraging encrypted systems and two-factor authentication offers an additional security measure to protect against unauthorised access.

Consequently, businesses can strike off data theft concerns from their list while switching to electronic payslips.

3. Reducing Costs with Positive Environmental Impact

Long-term cost savings is another compelling reason to adopt electronic payslips. Ditching the printing and postage costs along with the reduced administrative hours piles up to considerable savings. Also, eliminating uncertainty surrounding variable postage charges allows businesses to secure their budget more efficiently.

Taking the green path becomes an achievable goal with the elimination of paper. While the effect may not be groundbreaking for smaller businesses, bigger organisations indeed witness a significant dip in their carbon footprint.

Going digital with payslips is one substantial step toward creating a more sustainable business environment. Above all, it also ticks the box for employees keen on an employer’s commitment to environmental conservation.

4. Ease of Combining with Other Payroll Information

Electronic payslips make it easy to deliver more than just salary details. You can attach important company updates, policy changes, or holiday schedules directly to each payslip, ensuring employees don’t miss key information. They also allow seamless integration with other payroll-related documents like P60s, P45s, reward summaries, and timesheets. This reduces the need for separate communications and makes payroll management more efficient and organised.

5. Simplifying Record Maintenance

With digital payslips, record-keeping becomes effortless. Unlike paper copies, which can be lost or damaged, e-payslips are stored securely and are always accessible to both the employer and employee. They create a consistent audit trail, making it easier to resolve discrepancies, respond to employee queries, or provide evidence during audits. Plus, storing records electronically helps businesses stay compliant with HMRC’s data retention requirements.

How to Implement Electronic Payslips for Maximum Efficiency?

The switch to electronic payslips is undoubtedly advantageous, but the implementation process requires astute attention. Employing a strategic approach helps businesses achieve a smooth transition. The only drawback? Considerations range from technological requirements and employee training to handling their potential concerns.

Let’s delve into a guide to steer through this transition and address common questions linked to the change.

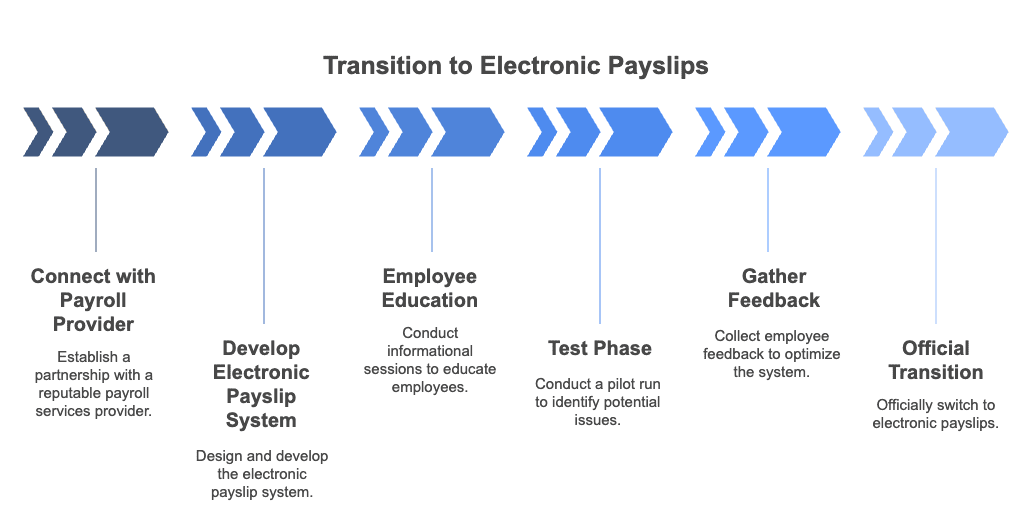

1. Step-by-Step Transition Guide to Electronic Payslips

Switching to electronic payslips doesn’t have to be overwhelming. With a structured plan, the process can be smooth and hassle-free. Here’s a practical roadmap to guide your transition:

- Connect with a Reputable Payroll Services Provider: Start by researching and partnering with a trusted provider who offers e-payslip functionality. Understand their service features, integration options with your current payroll software, and pricing models.

- Plan Your E-Payslip System: Decide how the digital payslips will look and function. Consider branding, layout, user accessibility, and how other payroll documents (like P60s or timesheets) will be integrated into the system.

- Educate Your Employees: Host short training sessions, create FAQs, and share step-by-step guides to help employees understand what’s changing, why it matters, and how to access their payslips securely.

- Launch a Test Phase: Roll out the system to a small group of employees first. Use this phase to identify technical glitches, usability issues, or gaps in the communication process before going company-wide.

- Gather Constructive Feedback: Encourage honest feedback from pilot users. This can help uncover small but impactful improvements and boost employee confidence before the full rollout.

- Go Live with Full Implementation: Once all systems are tested and refined, launch the e-payslip system across the organisation. Provide ongoing support—especially in the first few months—to address any user concerns promptly.

How to Handle Employee Concerns with Confidence?

While many employees will appreciate the convenience of electronic payslips, some may feel hesitant, especially those less comfortable with digital tools. Addressing these concerns thoughtfully is key to gaining company-wide acceptance. Here’s how to make that process easier:

- Communicate Clearly and Early: Explain the purpose of the transition and how it benefits both employees and the company, such as faster access, better security, and reduced paperwork.

- Emphasise Data Security: Reassure staff that their payslip data will be protected using secure, encrypted systems. Mention any compliance with GDPR or other UK data protection standards.

- Offer Hands-On Support: Provide one-on-one assistance or short walkthroughs for anyone who struggles with accessing or using the new system. Make sure support is ongoing, not just during rollout.

- Respect Personal Preferences: Let employees know they can still download and print their digital payslips if they prefer physical copies. Offering this flexibility can ease resistance while maintaining the digital workflow.

By addressing concerns upfront and providing strong support, you can ensure a smooth transition and achieve higher adoption across your team.

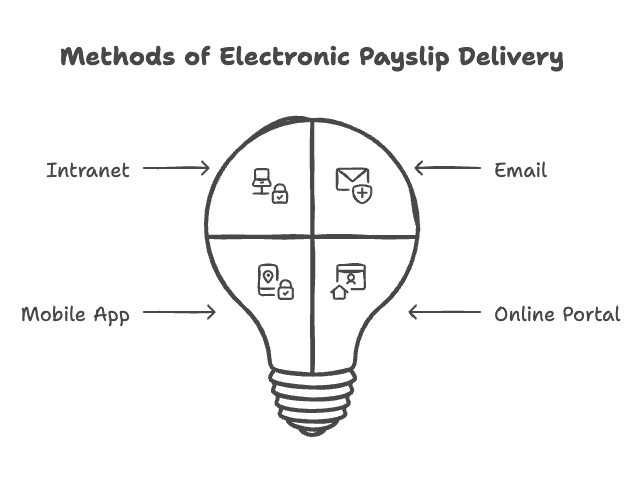

How are Electronic Payslips Delivered?

Unlike traditional paper payslips, which require in-person collection or home delivery, electronic payslips can be distributed through various digital channels. How you choose to distribute these payslips typically depends on your organisation’s unique circumstances. In this section, we will be discussing some of the most common avenues used to deliver electronic payslips

1. Intranet

If your company already runs on an intranet or internal network, you’re in luck—it’s one of the easiest ways to roll out electronic payslips. Employees can log in securely, view their payslips anytime, and even print them if they need a hard copy for personal records or loan applications.

It’s safe, centralised, and super convenient. Plus, there’s no need for emails or third-party platforms—everything stays in-house and under control.

2. Email

Email delivery of payslips is another common method adopted. However, considering the sensitive nature of the information, email isn’t usually regarded as the most secure option. Thus, it is advisable to employ encryption mechanisms when using email for payslip distribution, or leverage alternative methods with a higher degree of security.

3. Mobile App

Many payroll services offer mobile apps that allow employees to view their payslips securely. This efficient, safe, and accessible method ranks highly among the digital delivery options:

- Accessibility with any smart device

- Secure login features with a unique username and password

- Quick and easy access to pay details

- Environmentally-friendly way to receive payslips – no paper waste

4. Online Portal

The last significant delivery option includes electronic payslips via an online portal. An array of benefits surrounds this channel, with easy setup and secure access, outshining the rest. Ensuring data security and GDPR compliance is pivotal here. In many cases, outsourcing payroll operations guarantees secure and efficient distribution of electronic payslips.

To explore how outsourcing is evolving and why more businesses are adopting this model, check out our blog on 12 Key Payroll Outsourcing Trends for Businesses in 2025.

Make the Switch to Secure, Stress-Free E-Payslips Today with Direct Payroll Services.

Switching to electronic payslips doesn’t have to be complicated—and with Direct Payroll Services, it isn’t. Our digital payslip solutions are secure, compliant, and designed to seamlessly fit into your existing payroll system. Whether you’re running a care home, managing a small business, or supporting clients as an accountant, we tailor the setup to your needs—no one-size-fits-all approach here.

What sets us apart? We combine expert payroll knowledge with smart cloud-based tools to give your employees secure, 24/7 access to their payslips—anytime, anywhere. No printing, no postage, no headaches.

- HMRC-compliant

- GDPR-secure

- Employee-friendly

- Designed around you

Let us help you simplify payroll, save time, and cut unnecessary costs—without sacrificing accuracy or transparency. Contact us today to get a quote!

Conclusion

Traditional paper payslips have seen their day. As technological advancements continue to remodel business practices, the shift to digital formats is becoming an expected norm rather than an optional innovation. In the realm of payroll management, electronic payslips provide a progressive solution capitalising on digitalisation, improving efficiency, enhancing data security, reducing costs, and minimising environmental impacts.

Transitioning to electronic payslips is not just about replacing paper with a screen; it’s about leveraging technology to streamline payroll processes and engage employees. Remember, the success of implementing electronic payslips rests on choosing a reliable partner, educating and assisting your employees, and continuously refining the system based on feedback. As businesses set foot on the route to digital transformation, the adoption of electronic payslips is a crucial milestone to accomplish.

Frequently Asked Questions

Are electronic payslips compliant with regulations?

Absolutely. Regulatory bodies such as HMRC in the UK recognise and accept electronic payslips, provided they are clear and contain all necessary payroll details. Therefore, electronic payslips are not only convenient but also legally acceptable.

What if some employees prefer paper payslips?

While your business transitions to electronic payslips, accommodating employee preferences for paper payslips as an option can smooth the adoption process. Although it might reduce cost savings initially, the long-term benefits remain significant.

How to encourage the adoption of electronic payslips among employees?

Clear communication on the benefits, ease of use, and robust privacy measures, along with comprehensive training sessions for navigating the system, ensures better adaptation rates. Continuous support to address arising concerns can also foster positive transition experiences.