TL;DR

|

|---|

What is IR35?

IR35 is the common term for UK tax legislation designed to combat tax avoidance. It applies to contractors who provide their services through an intermediary, like a limited company, but whose working relationship with the client is more like that of an employee. In simple terms, it targets what HMRC (HM Revenue & Customs) calls “disguised employment.”

Put simply, IR35 is about fairness. If your contract falls “inside IR35,” you’ll be treated like an employee for tax purposes, and your income will be taxed accordingly. If it’s “outside IR35,” you’re recognised as a genuine contractor and have greater flexibility in how you manage your earnings.

This often raises the question: is PAYE inside or outside IR35? The answer is that PAYE is a method of tax collection, while IR35 decides whether PAYE applies to a contractor.

Who Does IR35 Apply To: Contractors, Intermediaries, or Off-Payroll Workers?

IR35, also called the off-payroll working rules, affects three main parties: contractors, their clients, and any agencies in between. For contractors, it usually applies when they work through their own limited company (often called a personal service company).

Since the 2017 and 2021 reforms, the responsibility for deciding whether a role falls inside or outside IR35 now sits with the client, not the contractor, at least for medium and large businesses. That decision directly impacts how a contractor’s earnings are paid and taxed.

What is PAYE?

PAYE stands for ‘Pay As You Earn’. It is the system HMRC uses to collect Income Tax and National Insurance contributions directly from employees’ earnings. If you are paid via PAYE, your employer deducts these taxes before you receive your salary.

For contractors, this usually means working under agency PAYE or through an umbrella company.

Who PAYE Applies To?

The PAYE system applies to most employees, full-time or part-time, with taxes handled automatically through payroll. It can also cover some temporary workers, like, for instance, if you’re on a day-rate contract via an agency, you’re treated as their employee and paid through their payroll.

When you are on a company’s direct payroll, you are automatically part of the PAYE system, and your employer handles all the necessary tax deductions for you.

What Are the Key Differences Between IR35 and PAYE?

The difference between IR35 and PAYE is simple:

- IR35 decides if you’re taxed as an employee or self-employed.

- PAYE is the mechanism for deducting tax and NI from employee wages.

Or put another way: compare IR35 to PAYE, and you’ll see that IR35 sets employment tax status, while PAYE executes the tax deductions.

1. Rights and Responsibilities

For employees under PAYE, the employer handles payroll, tax, and HMRC payments. For contractors, it depends on IR35:

- Outside IR35: Contractors manage their own company taxes.

- Inside IR35: The client or agency (fee-payer) runs payroll and deducts tax/NI.

Compliance duties also fall on:

- End Client: Deciding IR35 status.

- Fee-Payer: Deducting tax/NI if inside IR35.

- Contractor: Ensuring correct tax affairs.

This highlights what is the main difference between IR35 and PAYE for UK contractors: status vs. collection method.

2. IR35 Determines Status, PAYE Collects Tax

IR35 decides the status. PAYE applies if you’re inside IR35.

That’s why many contractors ask: What are the tax implications of working under IR35 versus PAYE? The implication is that both result in PAYE deductions, but under IR35, you don’t get the same employee benefits.

To understand how your PAYE tax code works and affects your take-home pay, read this detailed guide on how PAYE tax codes are determined.

3. Factors That Decide Employment Status

HMRC considers factors like client control, financial risk, and personal service when deciding status. These determine whether a role is truly self-employed or effectively employed, shaping both tax liability and employment rights.

4. Impact on Tax and National Insurance

Being inside IR35 means contractors are taxed like employees, with Income Tax and NI deducted at source. This removes the tax benefits of working through a limited company and often reduces take-home pay.

For example, a £500-a-day contract could leave you with significantly less income if deemed inside IR35, making IR35 status a critical factor in overall earnings.

Here’s a quick side-by-side comparison of PAYE vs IR35:

| Aspect | IR35 | PAYE |

|---|---|---|

| What it is | A test to determine if a contractor should be treated as an employee for tax purposes. | The system used to collect tax and National Insurance from employees’ wages. |

| Main Role | Decides if you should be taxed as an employee. | Collects the tax once status is decided. |

| Who decides | The client decides if you’re inside or outside IR35. | Employer/agency runs PAYE deductions. |

| Tax | Outside IR35: you handle your own tax. Inside IR35: tax taken like an employee. |

Employer deducts and sends to HMRC. |

| Rights | May or may not get benefits (depends on status). | Employees usually get benefits (holiday, sick pay, pension). |

| Pay Impact | Inside IR35 = less take-home pay. Outside IR35 = more flexibility. |

Take-home pay fixed after PAYE. |

How IR35 and PAYE Affect Contractors?

IR35 and PAYE directly shape a contractor’s earnings, inside IR35 means PAYE deductions apply, reducing take-home pay to levels closer to a regular employee.

1. Take-Home Pay: Inside IR35 vs Outside IR35 vs PAYE

For most contractors, the main concern is how IR35 impacts net income. Here’s a simple breakdown:

| Status | Tax Treatment | Take-Home Impact | Benefits/Extras |

|---|---|---|---|

| Outside IR35 | Salary + dividends (lower tax on dividends) | Highest pay, more flexibility | Can claim valid business expenses |

| Inside IR35 | Taxed like an employee under PAYE rules | Lower pay, no dividend advantage | Limited rights, no full employee benefits |

| PAYE Employee | Tax and NI deducted at source | Similar to inside IR35 | Full rights (holiday, sick pay, pension) |

2. Control, Expenses, and Flexibility

IR35 status doesn’t just affect pay; it also shapes how much freedom you have:

- Inside IR35: Less flexibility, fewer expenses to claim, and tighter working arrangements.

- Outside IR35: More control over your setup, plus the ability to claim legitimate business expenses.

3. Economic Impact of IR35 Reforms

Recent reforms have shifted responsibility onto employers. Medium and large businesses must now decide contractors’ IR35 status and, if inside IR35, run PAYE and make the correct deductions, adding more compliance pressure while reducing contractor flexibility.

How Do IR35 and PAYE Affect Employers?

The IR35 reforms place greater responsibility on employers; medium and large businesses must now determine each contractor’s status and run PAYE for inside-IR35 roles.

1. PAYE Obligations for Inside-IR35 Engagements

When a role is classed inside IR35, the obligations are:

- You take on full PAYE responsibilities.

- Deduct income tax, National Insurance, and other required amounts directly from pay.

- Provide payslips showing all deductions for transparency.

2. Engaging Contractors Outside IR35 via Limited Companies

For outside-IR35 roles, the arrangement is;

- Treated as a business-to-business relationship with the contractor’s limited company (directly or via an agency).

- The contractor manages their own tax and National Insurance.

To decide whether PAYE or a limited company is best for your business, read this detailed comparison guide.

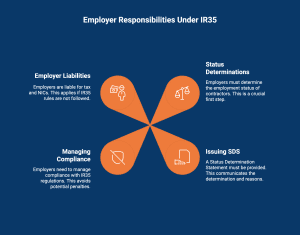

What Are Employer Responsibilities Under IR35?

Under the IR35 reforms, employers must assess each contractor’s status and apply PAYE where required. Getting it right keeps things compliant; getting it wrong can lead to costly penalties, making careful checks essential.

1. Making Status Determinations

Clients must assess IR35 status by reviewing contracts and actual working practices, control, substitution, and mutual obligation. HMRC’s CEST tool can help, but the client is ultimately responsible for making the determination.

2. Issuing Status Determination Statements (SDS)

An SDS confirms whether a contractor is inside or outside IR35 and explains why. It covers key factors like control and financial risk. Contractors should check their SDS carefully to ensure accuracy and compliance with HMRC.

3. Managing Compliance and Avoiding Penalties

Staying compliant is easier with proactive steps:

- Keep records of income and contracts.

- Review employment status regularly.

- Audit payroll for accurate tax and NI.

- Track benefits like holiday or sick pay.

To stay compliant with HMRC, read this detailed guide on everything you need to know about PAYE deadlines.

4. Deemed Employer Liabilities

If a contractor is inside IR35, the client becomes the deemed employer. They must:

- Deduct tax and National Insurance.

- Run payroll like for employees.

- Failure risks HMRC fines and backdated liabilities.

How Do PAYE and IR35 Work in Practice?

In practice, PAYE and IR35 differ most clearly in how workers are paid. The key distinction comes down to the payment process and who handles the tax deductions.

- Employees: Paid via payroll with PAYE tax and NI already deducted. IR35 doesn’t apply.

- Contractors Inside IR35: Deductions are still made under PAYE, but by the client or agency instead of their own company.

- Contractors Outside IR35: Invoice for services, receive gross payment, and handle their own company taxes.

Once a contract starts, its status is fixed; you can’t switch between PAYE and IR35 midway.

Should You Choose PAYE or IR35?

It’s not about choosing between PAYE and IR35, your contract terms decide your IR35 status, which in turn determines how you’re taxed.

For Employers

IR35 can seem like a headache for many employers, but getting it right really makes all the difference. Accurately assessing employment status ensures the right taxes are paid and helps avoid costly surprises down the line.

Part of this process means issuing Status Determination Statements (SDS) for each contractor and staying on top of any updates to Income Tax or National Insurance rules.

To learn how to register for PAYE as an employer, read this step-by-step guide to PAYE registration.

For Contractors

This isn’t a direct choice, as IR35 decides your status. But practically, contractors weigh: Should I choose a PAYE contract or an inside IR35 contract?

- PAYE offers security and benefits.

- Inside IR35 offers PAYE taxation but fewer benefits.

- Outside IR35 offers higher flexibility and earnings but with added responsibility.

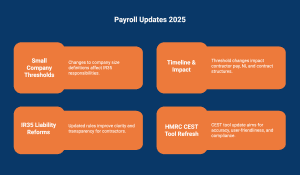

What Are the Key Legislative and Practical Updates for 2025?

IR35 and PAYE rules keep changing, so it’s important to stay updated. From April 2025, new reforms aim to make off-payroll rules clearer and fairer, with a focus on liability and transparency.

1. Updated Small Company Thresholds and IR35 Exemptions (from April 2025)

Currently, a company is “small” if it meets 2 of these 3 criteria:

- Turnover is under £10.2 million

- Balance sheet is under £5.1 million

- Fewer than 50 employees

Threshold changes in 2025 could change which companies qualify, shifting responsibilities and affecting how contractors are engaged.

2. Timeline and Impact of Threshold Changes

Threshold changes may impact take-home pay, National Insurance contributions, and how agencies and clients structure contracts. Staying updated helps all parties remain compliant and make smarter decisions.

3. April 2025 IR35 Liability and Transparency Reforms

From April 2025, IR35 rules will be updated to improve transparency. Contractors should find it easier to understand their status and how it affects tax and National Insurance.

4. HMRC’s 2025 CEST Tool Refresh

HMRC’s CEST (Check Employment Status for Tax) tool will be updated in 2025 to make employment status checks more accurate and user-friendly. This aims to improve compliance and reduce disputes.

To ensure compliance when hiring employees, read this detailed guide on the key payroll laws you need to know.

Why Choose Us? Strategic Payroll Services for UK Clients

At Direct Payroll Services, we provide expert payroll solutions designed to simplify and streamline your business operations across the UK. Trusted by companies of all sizes, our services ensure accuracy, compliance, and efficiency in every payroll cycle.

From managed payroll services and outsourcing to tailored support for accountants, care providers, CIS contractors, directors, and small businesses, we deliver flexible solutions that save you time and reduce costs. Get in touch today to discover how our payroll experts can transform your business.

Conclusion

IR35 decides if a contractor should be taxed like an employee, while PAYE is the system that collects that tax. With new reforms in 2025, both contractors and employers need to pay closer attention to rules around pay, responsibilities, and compliance.

For contractors, it affects how much you take home. For employers, it shapes how you hire and manage talent. Staying informed now means fewer surprises and more control over your finances later.

Frequently Asked Questions

How do I check if a contract is inside or outside IR35?

To check your IR35 status, you must review your contract and working practices against key tests like control and personal service. Your end client should provide a status determination. You can also use HMRC’s CEST tool to check employment status, but seeking professional advice for a comprehensive review is highly recommended.

Who determines IR35 status under current public/private sector rules?

For medium and large businesses in both the public sector and private sector, the end client is responsible for the IR35 status determination. The responsibility only remains with the contractor’s intermediary when the end client is classified as a small business in the private sector.

What are the financial consequences of being inside IR35, for me and the employer?

For a contractor, being inside IR35 reduces your net pay because the amount of tax deducted at source is higher. For the fee-paying employer, the main financial consequence is the added cost of paying Employer’s National Insurance contributions on top of the contractor’s rate.

How do I challenge or appeal an IR35 determination?

If you disagree with an IR35 determination, you should initiate the client-led dispute resolution process. You must present your case with evidence to the end client, who is legally required to review your appeal and respond within 45 days.

What are the risks of getting an IR35 status decision wrong?

The risks of an incorrect IR35 decision are significant, primarily for the party responsible for compliance. They can face investigations from HMRC, demands for back-dated tax and National Insurance, interest charges, and substantial financial penalties, especially if carelessness is proven.

Can someone be PAYE and also operate a limited company at the same time?

Yes, contractors can absolutely be on PAYE for one job while operating a limited company for other work. For example, you could have a part-time employment contract and take on separate, outside-IR35 projects through your company, ensuring compliance for each income stream.

What does being ‘inside IR35’ mean for my taxes and income?

Being ‘inside IR35’ means your income from that contract is taxed as if you were an employee. Your fees will be subject to PAYE deductions for income tax and National Insurance before you are paid, which will result in a lower net pay compared to an outside-IR35 contract.

How do you switch between PAYE and inside-IR35 mid-contract?

Switching between PAYE and inside IR35 mid-contract requires careful consideration of your employment status. Ensure compliance with the IR35 rules, update your contracts accordingly, and communicate changes to your clients or agency to maintain transparency and avoid potential penalties.

It is possible, under certain circumstances, to switch between PAYE and being inside IR35 during a contract?

Yes, it is possible, but it depends on your contract terms and the agreement with your client. Switching from PAYE to being inside IR35 (or vice versa) usually requires updating your contract and payroll arrangements.

What is the main difference between IR35 and PAYE for UK contractors?

IR35 decides if a contractor should be taxed like an employee. PAYE is the system that collects that tax. If you’re inside IR35, you’re effectively taxed through PAYE.

What are the tax implications of working under IR35 versus PAYE?

Inside IR35, you pay income tax and National Insurance like an employee. PAYE applies these deductions directly. Outside IR35, you can pay yourself via dividends and salary, which is often more tax-efficient.

Is it better to work through an umbrella company or as PAYE if my contract is inside IR35?

Both options mean PAYE tax, but umbrella companies may charge fees and offer fewer benefits. Direct PAYE with the client or agency is usually simpler and more transparent.

How do IR35 and PAYE impact limited company contractors differently?

Inside IR35, your limited company offers fewer tax benefits since income is taxed through PAYE. Outside IR35, you can still use dividends and keep business expenses, which can increase take-home pay.

What are the pros and cons of PAYE compared to operating as a limited company under IR35?

PAYE is simple with minimal admin but less tax-efficient. Running a limited company inside IR35 involves more admin and fewer financial advantages, though it can give flexibility for other outside IR35 contracts.

What should employers know when deciding between hiring contractors through PAYE or under IR35?

Employers are responsible for making accurate IR35 status decisions. If contractors are inside IR35, PAYE obligations such as tax and National Insurance must be handled correctly to avoid fines.

Should I choose a PAYE contract or an inside IR35 contract as a contractor?

It depends on priorities. PAYE offers simplicity and less admin. An inside IR35 contract through a limited company provides flexibility for future outside IR35 work, but fewer tax benefits.

Is IR35 the same as PAYE?

The answer is no, IR35 sets the rules, PAYE is the system that enforces them.