Key Highlights

- Statutory Adoption Pay (SAP) provides paid leave to eligible employees who adopt a child or become parents through surrogacy arrangements.

- Eligibility for SAP depends on employment status, length of service, average earnings, and meeting HMRC notice requirements.

- SAP is paid for up to 39 weeks, with higher payments in the first six weeks followed by a standard rate.

- Employers are responsible for assessing eligibility, processing SAP through payroll, and reporting payments to HMRC.

- Most employers can reclaim up to 92% of SAP from HMRC, or 103% under Small Employers’ Relief.

- SAP rules vary for agency workers, fixed-term contracts, fostering, surrogacy, and self-employed individuals, requiring careful assessment.

Adopting a child is a life-changing moment, and with it comes a mix of joy, responsibility, and practical challenges. One of those challenges is understanding the financial support available, especially for employees taking time off, including the adoption allowance and child benefit.

That’s where Statutory Adoption Pay (SAP) steps in. While it’s a crucial benefit for employees, it’s just as important for employers to fully understand how SAP works since it helps ensure compliance and proper support for staff.

In this blog, we’ll break down what SAP is, who’s eligible, how it’s calculated, and what employers need to do to manage it effectively, including key timelines, forms, and common mistakes to avoid.

What is Statutory Adoption Pay UK?

Statutory Adoption Pay (SAP) is a government-funded financial support scheme that provides eligible employees with paid leave when they adopt a child or become parents through a surrogacy arrangement. It is designed to replace part of their income during the adoption leave period, helping them manage the financial demands of welcoming a new child into their family. Similar to Statutory Maternity Pay (SMP), the employee’s employment rights are also protected during SAP.

One of the key features of SAP is that employees can receive payment regardless of whether they intend to return to work after their adoption leave. This makes SAP a vital source of stability and support during a major life transition, offering adoptive parents financial reassurance at a crucial time.

How SAP Supports Adoptive Parents?

Becoming an adoptive parent can be an emotional and transformative experience. Statutory Adoption Pay (SAP) offers essential financial support during this time by providing:

- Income Replacement During Leave: SAP helps replace a portion of the employee’s income while they are on adoption leave, giving them the financial freedom to focus on their new family member.

- Structured Payment Plan: For the first 6 weeks, employees receive 90% of their average gross weekly earnings, which is then replaced in the next 33 weeks by the lower of £184.03 per week or 90% of their average gross weekly earnings.

- Flexibility for the Employee: Employees are entitled to SAP even if they don’t plan to return to work after adoption leave, offering peace of mind regardless of future employment decisions.

- Support for Work-Life Balance: SAP ensures adoptive parents can dedicate time to bonding and caregiving without carrying the full financial burden.

- Employer Responsibility and Compliance: By facilitating SAP, employers not only meet legal obligations but also demonstrate support for employee welfare and family life.

Why SAP Matters for Employers?

From an employer’s perspective, understanding and correctly administering Statutory Adoption Pay (SAP) is crucial, not just for payroll compliance but for fostering a supportive and legally sound workplace. Here’s how:

- Legal Obligation and Compliance: Administering SAP accurately ensures employers meet statutory requirements, reducing the risk of legal issues or penalties due to non-compliance.

- Boosting Employee Morale and Retention: Providing support during major life events like adoption demonstrates empathy and corporate responsibility, which can improve employee loyalty and contribute to long-term retention.

- Efficient Payroll Management: Employers well-versed in SAP rules can accurately process payroll adjustments during adoption leave, handle tax, National Insurance, and pension contributions correctly, and avoid costly payroll errors.

- Reclaiming SAP Costs from HMRC: Most employers can reclaim 92% of SAP payments from HMRC, and even up to 103% if they qualify for Small Employers’ Relief. Knowing how to do this helps manage company finances more effectively.

- Accurate Recordkeeping and Reporting: Keeping detailed records and ensuring correct HMRC reporting reinforces transparency and protects the employer in case of audits or disputes.

- Reputation as a Responsible Employer: Supporting employees’ rights and personal circumstances strengthens your brand as a respectful and employee-friendly organisation.

Who Is Eligible for Statutory Adoption Pay and How Do Employers Assess It?

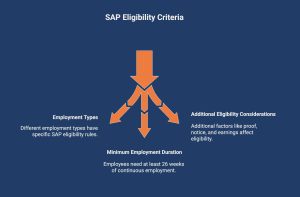

Figuring out who qualifies for Statutory Adoption Pay (SAP) can be tricky. While the rules are clear, things like average earnings and the flat rate can affect eligibility. As an employer, knowing how these factors work helps you stay compliant and better support your team. Here’s what you need to look out for:

1. Employment Types and Their Specific Rules

For different employment types, such as full-time, part-time, fixed-term contract, or agency workers, specific rules apply concerning the SAP eligibility. Let’s take a look at how different types of employment impact your eligibility for SAP.

| Types of Employment | Eligibility for SAP |

|---|---|

| Full-Time Employees | Full-time employees who meet the basic eligibility criteria qualify for SAP, such as:

|

| Part-time Employees | Similar to full-time employees, part-timers who meet the qualifying criteria similar to full-time workers can receive SAP. |

| Fixed-Term Contract | Even if an employee’s contract ends while they are on adoption leave, they can continue to get SAP, provided they fulfill the other requirements. |

| Agency Workers | Agency workers also qualify for the SAP if they’ve been working for the same employer continuously for 26 weeks. |

It’s important to note that none of these workers are excluded from potentially qualifying for SAP, as long as they satisfy the necessary eligibility requirements. Employers must be mindful of these nuances to ensure fair treatment and avoid potential legal complications.

2. Minimum Employment Duration Required

Among the core eligibility criteria for SAP is the requirement of a minimum continuous employment duration with the same employer.

This duration should be at least 26 weeks up until the week in which the employee is informed that they have been matched with a child for adoption. Even breaks such as holidays, sick leave, or maternity leave do not interrupt this continuity, paving the way for employees to become eligible for SAP.

Fulfilment of this criterion is critical, and the onus lies on both employees and employers to keep track of the same.

3. Additional Eligibility Considerations

Aside from the core criteria, there are additional considerations that contribute to an employee’s SAP eligibility.

- Provide valid proof of adoption or surrogacy as required by the employer during the process.

- Submit the correct notice within the required timeframe set by statutory guidelines and employer policy.

- Meet the lower earnings limit for National Insurance contributions based on average weekly pay thresholds.

- Inform the employer about any new employment undertaken during the Statutory Adoption Pay period promptly.

If these factors are not put in place or if the employee fails to notify of any new employment during their SAP period, SAP can be refused.

How is Statutory Adoption Pay Calculated?

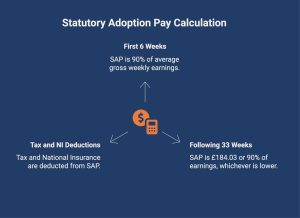

SAP calculation takes into account the gross average weekly earnings of the adopting parent and statutory rates.

1. First 6 Weeks of Adoption Pay

The initial 6 weeks of SAP, also referred to as weeks SAP, focus on providing substantial support to adoptive parents when the arrival of the adopted child happens or is imminent. During this time, the SAP is paid at a rate of 90% of the employee’s average gross weekly earnings.

The calculation considers the employee’s earnings during the eight weeks leading up to the 15th week before the child is placed with the parents.

For example, an employee earns £500 per week (gross pay). So, 90% of £500 is £450/week, and for the first 6 weeks:

£450 x 6 weeks = £2,700 total SAP

2. Following 33 Weeks

After the intense initial 6-week period, the SAP extends for a subsequent 33 weeks. During this time, the SAP isn’t as high as it was in the first 6 weeks. Instead, the benefits are paid at £184.03 per week or 90% of their average gross weekly earnings—whichever is lower.

This sustainable system ensures that the SAP does not put an undue burden on the employers while continuing to offer meaningful support to the employees.

It provides a substantial degree of financial stability to the adoptive parent, promoting a suitable balance between family life and work obligations.

3. Deduction: Tax and National Insurance

SAP, like any other pay, is subject to certain deductions by the employer. These typically include tax and National Insurance.

As of the current tax year, the Class 1 employee National Insurance rate is 8% on weekly earnings above the Primary Threshold (£242 per week). However, if the employee earns less than £242 per week, no NI contributions are deducted from SAP.

For example, if an employee receives £450 SAP per week, the NI contribution is:

- £450 − £242 = £208 (taxable portion)

- 8% of £208 = £16.64 NI per week

So, from a weekly SAP of £450, the NI deducted would be £16.64, leaving the employee with £433.36 (before income tax deductions).

| Type of Deduction | Description |

|---|---|

| Tax | SAP is taxable income; hence, the tax is subtracted as per the individual’s applicable income tax rate. |

| National Insurance | Social security contributions, known as National Insurance, are also deducted from SAP. |

These deductions maintain the same compliance as regular salary payments, ensuring that both the employee and employer abide by the HMRC guidelines. It’s crucial to note that even though these deductions may reduce the net amount received, they contribute to the employee’s future financial security.

How to Apply for Statutory Adoption Pay?

Applying for SAP entails giving notice to the employer of the intent to claim SAP and the expected date of adoption placement. This must be done at least 28 days before SAP is supposed to begin unless a shorter notice period is unavoidable.

Step 1: Required Employee Documentation (including overseas adoption)

The documentation process plays a pivotal role in the SAP application.

Employees should furnish documentary evidence from the adoption agency that validates the details of the adoption. The most common form of evidence is the ‘matching certificate,’ which essentially verifies the match of the prospective parent(s) with a child for adoption.

Couples adopting together need to complete Form SC6 to provide additional information regarding their circumstances. If you’re a parental order parent, you need to provide a written statement in the form of a statutory declaration stating that the court will grant the order for parental rights.

By ensuring all relevant documents are timely submitted, employees secure their rightful SAP entitlement.

Step 2: Notice Period

An employee looking to take adoption leave must provide the correct notice period to their employer. Generally, this involves notifying the employer at least 28 days before the intended start for parents of the child (the last 26 weeks), and statutory adoption leave for intended parents.

It’s crucial to include a copy of the matching certificate, as this confirms the adoption placement. Understanding the notice requirements can safeguard your employment rights and ensure a smooth transition into adoption.

Seek legal advice if you’re uncertain about your entitlement or any specific stipulations related to your situation.

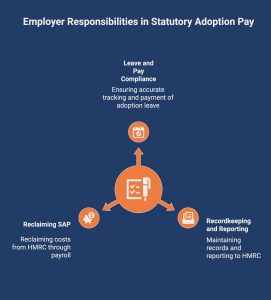

What Are Your Responsibilities as an Employer When Managing Statutory Adoption Pay?

Managing Statutory Adoption Pay isn’t just about payments; it’s about staying compliant and supporting your team. From calculating the amount of statutory adoption Pay to reporting to HMRC, here’s what every UK employer needs to get right.

1. Managing Leave and Pay Compliance

Managing leave and pay compliance forms a sizeable portion of the employer’s responsibilities while administering SAP.

- Employers need to accurately track and manage the adoption leave periods for their employees.

- They must also consistently comply with the rules for paying SAP, including the calculation, timing, rate changes, and cessation of payments.

- Meticulous attention to details such as employment duration and weekly gross earnings is necessary for precise SAP computation.

Incorrect compliance could lead to potential disputes, penalties, or legal action, stressing the importance of correct SAP management.

2. Recordkeeping and HMRC Reporting

Employers also need to retain records related to SAP. These include records of:

- Adoption leave dates

- SAP payments and any SAP-related employee evidence.

They should maintain this data for at least three years after the end of the tax year to which it relates, as per HMRC regulations. Employers should report these details to HMRC via Full Payment Submissions as part of their routine payroll processes. Ensuring transparency and diligence in record-keeping and reporting goes a long way in maintaining a compliant organisational setup.

3. Reclaiming SAP from HMRC

One of the privileges that employers enjoy is the ability to reclaim some or all of SAP costs from HMRC. There are particular rates, conditions, and procedures that dictate this reimbursement process. Follow these steps to reclaim SAP from HMRC:

- Calculate the correct amount of SAP to reclaim. It could be 92% or 103% if you qualify for Small Employers’ Relief.

- Maintain accurate records of all SAP payment details.

- Submit relevant SAP information via payroll report to HMRC.

- Confirm the final reclaimed amount with HMRC.

- Finally, receive the reclaimed amount, which can be used to offset the overall SAP costs initially incurred by the employer.

What Are the Common Challenges Employers Face with Statutory Adoption Pay (SAP) and How to Solve Them?

Even with clear statutory guidelines in place, managing Statutory Adoption Pay (SAP) isn’t always straightforward. Employers may face several common pitfalls that can disrupt compliance, especially if they become insolvent, and affect employee satisfaction. Below are two key challenges along with practical solutions:

1. Errors in Eligibility Assessment or Pay Calculation

Mistakes in assessing SAP eligibility or calculating payments can result in underpayments, overpayments, and HMRC corrections, damaging employee trust and increasing admin workload.

Solution: Regularly review eligibility checks, confirm qualifying earnings and service periods, and apply the correct statutory rates. Using compliant payroll software or payroll specialists helps reduce calculation errors.

2. Disputes or Misunderstandings About SAP Entitlement

Employees may dispute SAP decisions if they believe payments are incorrect or unfairly denied, leading to complaints or formal disputes.

Solution: Communicate decisions clearly, provide written explanations, correct errors promptly, and involve HMRC’s Statutory Payments Disputes Team if internal resolution fails.

3. Missing or Incomplete Documentation

Lack of proper adoption paperwork or late notifications can delay SAP processing and create compliance risks.

Solution: Request required documentation early, track deadlines carefully, and maintain organised payroll records to support SAP decisions.

4. Incorrect Payroll Setup or Reporting

SAP errors often occur when payroll systems are not configured correctly, causing incorrect deductions or HMRC reporting issues.

Solution: Ensure payroll software is updated for statutory payments and review payslips and FPS submissions for accuracy each pay period.

5. Keeping Up With Changing Regulations

SAP rates, thresholds, and guidance can change annually, increasing the risk of non-compliance.

Solution: Monitor HMRC updates regularly or work with a specialist payroll provider to ensure ongoing compliance without added administrative strain.

If the issue cannot be resolved internally, contacting HMRC’s Statutory Payment Disputes Team can provide an impartial review and help ensure compliance.

Pro-tip: You may also consider outsourcing your payroll services to ensure there are no roadblocks in the process.

Does Statutory Adoption Pay Apply to Self-Employed Individuals?

If you’re self-employed and planning to adopt, understanding what financial support you’re entitled to is essential. Many people assume Statutory Adoption Pay applies to all workers, but SAP follows strict employment-based rules that affect eligibility.

Here’s how entitlement works in practice:

- Employee-Only Eligibility: SAP is only available to employees who meet HMRC’s earnings and continuous employment criteria.

- Exclusion of Self-Employed Individuals: Self-employed individuals are not eligible for SAP, as there is no employer to calculate or pay it.

- PAYE Payroll Requirement: SAP must be administered, processed, and reclaimed through an employer’s PAYE payroll system.

- Alternative Support Options: Self-employed adopters may instead qualify for adoption allowance or financial support from their local authority.

Knowing these distinctions helps self-employed adopters plan finances accurately and avoid unexpected gaps in income.

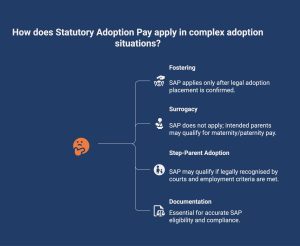

How Does Statutory Adoption Pay Apply in Fostering, Surrogacy, and Step-Parent Adoptions?

Statutory Adoption Pay can become more complicated when adoption does not follow a standard placement route. Situations involving fostering, surrogacy, or step-parent adoptions often raise questions about eligibility, timing, and documentation, making it essential for employers and employees to understand how SAP applies.

Below is a clear breakdown of how SAP is treated in complex adoption situations, helping employers and employees understand eligibility, documentation, and timing requirements:

- Non-Standard Adoption Routes: Statutory Adoption Pay becomes more complex when adoption does not follow a standard agency placement, as fostering, surrogacy, and step-parent adoptions involve different legal processes and timelines.

- Fostering and Foster-to-Adopt Arrangements: SAP only applies when a child is formally placed for adoption through an approved agency; fostering arrangements do not qualify until legal adoption placement is confirmed under UK law.

- Surrogacy Arrangements: SAP does not apply to surrogacy, as there is no adoption placement involved; intended parents may instead qualify for statutory maternity or paternity pay after a parental order.

- Step-Parent Adoptions: Step-parent adoptions may qualify for SAP if legally recognised by the courts, provided employment status, earnings, and service length criteria are met.

- Documentation and Legal Confirmation: Careful review of placement dates, court orders, and adoption agency confirmations is essential to ensure accurate SAP eligibility and compliance.

Understanding these nuances helps employers apply SAP accurately and allows employees to plan their leave and finances with clarity and confidence.

Why Choose Direct Payroll Services for Hassle-free Statutory Adoption Pay?

Managing Statutory Adoption Pay can be complex, time-consuming, and risky if handled incorrectly. Direct Payroll Services removes that burden by delivering fully compliant, accurate SAP processing you can trust.

Supporting over 250 UK businesses, we manage eligibility checks, calculations, payments, and HMRC reclaims with precision. Our sector-experienced payroll specialists understand statutory pay rules across care, accounting, construction, and small businesses, ensuring nothing is missed.

With secure cloud-based payroll systems and flexible bureau or outsourced options, we make statutory adoption pay simple, timely, and stress-free. Most importantly, we help you support employees during life-changing moments while staying compliant.

Take the stress out of Statutory Adoption Pay. Contact Direct Payroll Services today for expert payroll support.

Conclusion

Adoption is a deeply personal and transformative journey, and one that often comes with emotional and financial pressures. Statutory Adoption Pay offers vital support by helping ease some of those financial worries, and you might also consider Universal Credit, which provides additional assistance, giving adoptive parents the freedom to focus on their growing family.

For employers, understanding and managing SAP isn’t just about ticking legal boxes. It’s an opportunity to show genuine care, build trust, and create a workplace culture that values people and their lives beyond work. When employees feel supported during major life events, they’re more likely to stay engaged, loyal, and motivated.

Frequently Asked Questions

What is the maximum duration for receiving SAP?

The maximum duration for Statutory Adoption Pay is 39 weeks. This includes six weeks paid at 90% of average weekly earnings, followed by 33 weeks paid at the standard statutory rate set annually by HMRC guidelines.

How to calculate statutory adoption pay?

Statutory Adoption Pay is calculated in two stages. The first six weeks are paid at 90% of average weekly earnings, then the remaining weeks are paid at the statutory weekly rate or 90%, whichever is lower.

How does one appeal a denial of SAP?

An employee can appeal a denial of Statutory Adoption Pay by contacting HMRC’s Statutory Payments Disputes Team. They should provide written reasons, supporting evidence, and employer correspondence to allow HMRC to review eligibility and issue a formal decision.

What is the minimum salary to adopt?

To qualify for Statutory Adoption Pay, an employee must earn at least the Lower Earnings Limit for National Insurance during the relevant period. For the 2025/26 tax year, this threshold is £123 per week as defined by HMRC.

What are the two dates that apply to adoption pay and leave?

Two key dates apply to adoption pay and leave: the child’s placement date, or expected placement date, and the date the employee chooses to start adoption leave and pay, provided the required notice is given to the employer formally.

Does statutory adoption pay apply to self-employed individuals?

Statutory Adoption Pay does not apply to self-employed individuals, as it is an employment right. Self-employed adopters may access alternative support, but employers only assess SAP for employees who meet service, earnings, and proof of adoption requirements.

Can statutory adoption pay be combined with other parental benefits?

Statutory Adoption Pay can be combined with other parental benefits in specific cases. Eligible employees may opt into shared parental leave, while partners can separately claim their entitled weeks of statutory paternity leave if qualifying conditions are satisfied.

What is the difference between statutory adoption pay and adoption allowance?

Statutory Adoption Pay is paid by employers through payroll during the weeks of statutory adoption leave. Adoption allowance is a separate local authority benefit, means-tested in some cases, and not linked to employment contracts or payroll systems administration.

How much is statutory adoption pay?

Statutory Adoption Pay is paid for up to 39 weeks, starting with six weeks at 90% of average earnings, followed by a flat statutory rate. Payment amounts depend on statutory adoption pay eligibility assessed by the employer annually.

Is statutory adoption pay taxable?

Yes, Statutory Adoption Pay is taxable income. Employers deduct income tax and National Insurance through payroll, just like normal wages. To qualify for statutory adoption pay, employees must meet HMRC rules before payments and deductions are applied correctly.