You’ve got enough on your mind: baby names, nursery prep, and night feeds, but figuring out parental pay shouldn’t be another headache. Whether you’re an expectant parent planning ahead or already knee-deep in nappies, understanding how much you’ll be paid (and when) during leave can feel like decoding legal jargon.

Between statutory rights, employer policies, and ever-changing government rules, it’s easy to feel overwhelmed or miss out on money you’re actually entitled to.

This blog cuts through the confusion, providing clear answers. We’ll break down who qualifies for parental pay, how much you can expect to receive, key timelines, and how to claim it. It’s useful for you whether you’re taking maternity, paternity, shared, or adoption leave.

Let’s make sure your time at home is focused on bonding, not budgeting blunders.

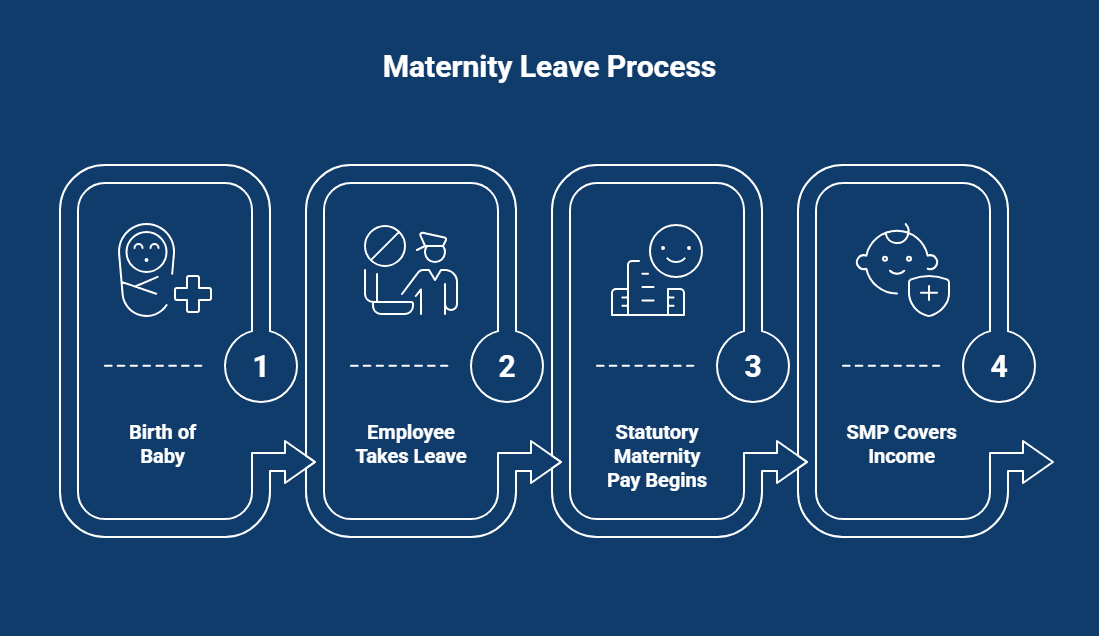

What’s the Process for Maternity Leave and Pay?

Maternity leave gives employees up to 52 weeks off when they’re expecting a baby. This time is for recovery after birth and bonding with the new baby. Statutory maternity leave is split into two parts:

- Ordinary Maternity Leave (26 weeks): The first 26 weeks of leave, which you can take as standard.

- Extended Leave (26 weeks): The next 26 weeks, which are optional but can be taken for a total of up to 52 weeks.

By payroll law, all employees are entitled to take at least two weeks off immediately after the birth of their baby. During this time, statutory maternity pay (SMP) will help cover part of the income for up to 39 weeks.

How Much Is Statutory Maternity Pay?

To be eligible for statutory maternity pay, employees must meet specific conditions. Here’s how it works:

- Qualifying Week: Employees must have worked for the same employer for at least 26 weeks by the 15th week before the baby’s due date. This is known as the “qualifying week.” If you don’t meet this requirement, you may not qualify for SMP, but you could be eligible for maternity allowance instead.

-

- First 6 weeks: You’ll receive 90% of your average weekly earnings.

- Next 33 weeks: You’ll receive a flat rate of £187.18 per week (as of the 2025/ 2026 tax year).

Pay Breakdown:

Conditions for Statutory Maternity Pay

For maternity pay to be valid, employees must meet the following conditions:

- Employment Length: You must have been working with the same employer for at least 26 weeks by the 15th week before your baby is due.

- Earnings Requirement: You must be earning at least £125 per week (as of 2025/2026). The employer will check your earnings over the eight weeks before the qualifying week to ensure this.

- National Insurance: You must also meet the National Insurance requirements. Your employer will check this to ensure your contributions are up to date.

Employees need to submit the correct paperwork on time. They need to provide their employer with a MAT B1 certificate and give 28 days’ notice about when they want maternity pay to begin. The employer must pay the statutory maternity pay during the entire time it is owed. After that, they can get some or all of the money back from HMRC.

How Does the Paternity Leave and Pay Work?

Paternity leave is a way for fathers or civil partners to be with their families after a baby is born or adopted. People can get statutory paternity leave, which is often one or two weeks in a row. You must take this leave within eight weeks after the baby comes.

Starting April 2024, this leave can be split into two separate one-week breaks. This means you can use the weeks anytime during your child’s first year, which gives you more flexibility.

How Much Is Statutory Paternity Pay?

Statutory paternity pay is determined by the following:

Pay Breakdown:

- 90% of your average weekly earnings, or

- £187.18 per week, whichever is lower.

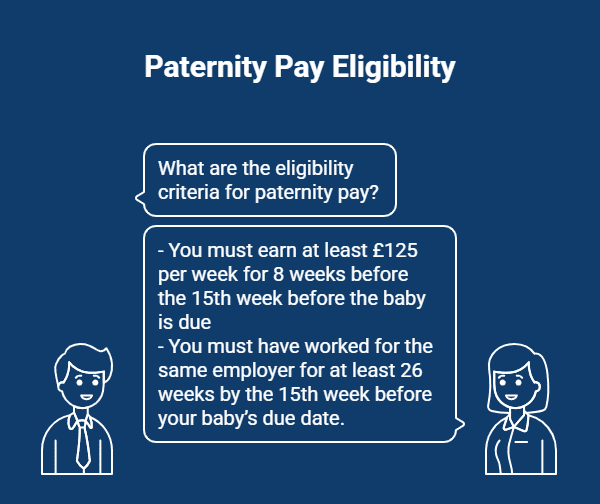

Conditions for Statutory Paternity Pay

For paternity pay to be valid, employees must meet the following conditions:

- Earnings: You must earn at least £125 per week (as of 2025/ 2026) during the eight weeks before the 15th week before the baby is due. This ensures that you meet the government’s criteria for receiving statutory pay.

- Employment: You must have worked for the same employer for at least 26 weeks by the 15th week before your baby’s due date.

- National Insurance: National Insurance contributions will be deducted from your statutory paternity pay, similar to other wages. Your employer will handle this.

You must also tell your boss you plan to claim paternity pay. You need to provide proof that you are taking care of the child so that your rights, money, and national insurance are protected during paternity leave.

Adoption Leave and Pay: What You Need to Know

Adoption leave allows employees to spend time bonding with and caring for a child they are adopting. Eligible employees can take up to 52 weeks of statutory adoption leave, divided into two parts:

- 26 weeks of ordinary adoption leave

- 26 weeks of additional adoption leave

This leave is available to employees who adopt children under 18.

Statutory adoption pay works like maternity pay. You’ll receive:

- 90% of your average weekly earnings for the first 6 weeks

- £187.18 or 90% of earnings (whichever is lower) for the remaining period

To qualify for adoption pay, you must meet specific criteria and provide relevant documentation, including details from the adoption agency, placement dates, and a notice of intent.

Eligibility Criteria for Adoption Benefits

To qualify for statutory adoption leave and pay, you must:

- Be employed for at least 26 weeks before the adoption matching date.

- Earn at least £125 per week during the 8 weeks before the adoption date.

Only the main adopter is eligible for adoption pay. The second partner can claim paternity benefits instead.

Process for Claiming Adoption Leave and Pay

- Notify Your Employer: Provide written notice at least 28 days before you want your adoption pay to start.

- Provide Proof: Show adoption paperwork that includes the adoption agency’s name, placement date, and matching letter.

What Are the Surrogacy Rules?

Employees who are growing their families through surrogacy are entitled to many of the same rights as other parents. This includes:

- Full Maternity Leave: Birth parents using surrogacy are entitled to 52 weeks of statutory maternity leave.

- Antenatal Care Appointments: Employees are entitled to attend two unpaid antenatal appointments with the surrogate.

- ACAS Guidelines: Employers can refer to the ACAS guidelines for full details on surrogacy rights and entitlements.

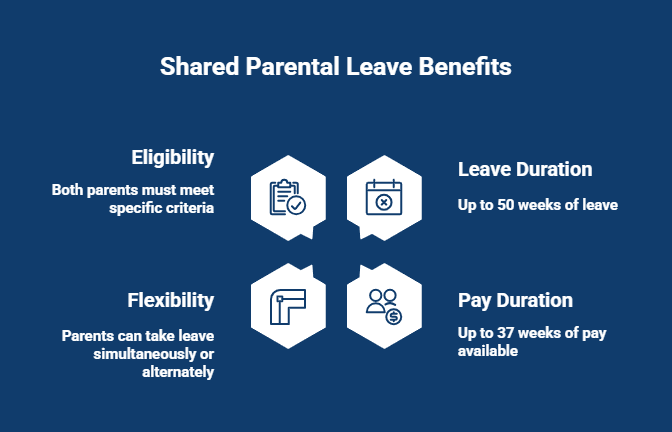

Shared Parental Leave: A Smarter Way to Split Time Off

Shared parental leave (SPL) gives new parents more control over how they share time off in the first year after childbirth or adoption. It’s designed for flexibility, allowing both parents to be present when it matters most. Here’s what you need to know:

Key Features of Shared Parental Leave & Pay

- Up to 50 Weeks of Leave: Parents can split up to 50 weeks of leave between them if one parent shortens their maternity or adoption leave.

- Up to 37 Weeks of Pay: Shared parental leave pay is available for up to 37 weeks, to be shared in any proportion between both parents.

- Flexibility Built In: Parents can take leave simultaneously or take turns. It’s entirely up to what works best for your family setup.

- Eligibility Matters: Both parents must meet particular employment and earnings criteria to qualify.

How to Apply for Shared Parental Leave

- 8 Weeks’ Notice Required: You must give your employer at least 8 weeks’ written notice before your leave starts.

- Include Key Details: Your notice must include the expected week of childbirth (or placement) and how much leave and pay each parent will use.

- Shared Responsibility: Both parents must submit notice and meet qualifying conditions for leave to be split.

Financial Considerations You Shouldn’t Miss

- Lower Pay Than SMP: Shared parental pay may be lower than statutory maternity pay, potentially reducing household income.

- Employer Top-Ups: Some employers offer enhanced pay; check your contract or staff handbook to know what you’re entitled to.

- NI Contributions Still Matter: Even during unpaid leave, National Insurance contributions can affect future benefits and pension plans accordingly.

- Budget Ahead: If there’s a risk of income gaps, consider building a financial buffer before starting your leave.

Also Read: Know Your Statutory Sick Pay Rights: How It Works in the UK

Parental Bereavement Leave and Pay: Your Rights During a Loss

Losing a child is a challenging experience, and parental bereavement leave and pay are designed to help grieving parents during this heartbreaking time. If you’re eligible, you can take up to two weeks of paid leave to mourn the loss of your child.

Key Features of Parental Bereavement Leave and Pay

- Eligibility: Available to parents who have lost a child under 18.

- Leave Duration: Up to two weeks of leave.

- Pay: Statutory payments based on your average weekly earnings.

- Support Available: If you need guidance, the ACAS helpline is available to provide advice and support.

How Does the Neonatal Care Leave and Pay Work?

Neonatal care leave allows parents to take time off work when their baby requires extra medical attention. This leave ensures you can be with your baby and still receive some income. Statutory payments may apply, but eligibility depends on your average weekly earnings and work history before the qualifying week.

Key Points to Remember:

- Leave: Take time off to care for your baby in the neonatal care unit.

- Pay: Statutory payments based on your earnings.

- Eligibility: Requirements include earnings and prior work periods.

Recovery of Payments: Ensuring Your Parental Pay

Recovery of payments ensures you get the money you’re owed during parental leave, including holiday pay. Statutory payments like maternity and paternity pay can be reimbursed through a claim sent by your employer to HMRC, taking into account the amount of time you are eligible for these payments.

Key Points to Note:

- Claim Process: Employers submit claims to HMRC for the recovery of statutory pay.

- National Insurance: Employers must accurately report National Insurance contributions.

- Eligibility: Following the eligibility rules reduces errors in payment recovery.

- Communication: Stay in touch with payroll to protect your rights and ensure proper payments.

How to Keep Records for Parental Pay?

Keeping accurate records is essential for managing parental pay UK. Track the start and end dates of maternity or paternity leave, and save any agreements related to shared parental leave.

What Else to Know:

- Track Leave Dates: Record the start and end dates of your leave.

- Save Payment Proof: Keep a record of statutory pay received.

- Follow Rules: Ensure national insurance contributions and statutory payments are correct.

- Stay Protected: Accurate records help protect your employment rights and facilitate more effortless follow-ups.

How to Avail Further Help for Parental Pay?

Navigating your parental rights can be challenging, but help is available. The ACAS helpline provides lots of information and sound advice on employment rights, including maternity pay, paternity leave, and shared parental leave.

If you need money, you can look into the Sure Start Maternity Grant and find free legal advice.

Talking to local groups can help you understand who is eligible for different statutory payments, so you know your rights during these important periods of work.

Payroll That Keeps Up with Parenthood and Growth

Juggling parental leave, statutory pay, and compliance is hard enough. Your payroll system shouldn’t make it harder. That’s where Direct Payroll Services steps in, handling everything from maternity pay to shared leave with accuracy, automation, and zero stress.

Forget spreadsheets and last-minute errors. With Direct Payroll Services, you get:

- Automated processing that saves hours

- Built-in compliance with UK regulations

- 24/7 employee access to payslips and tax docs

- Seamless sync with your HR and accounting tools

Whether you’re managing a lean startup or scaling a fast-growing team, Direct Payroll keeps your operations smooth, so you can focus on your people, not payroll chaos.

Get an instant quote today and take one more thing off your plate. Contact us now!

Conclusion: Empower Yourself with Knowledge

Understanding your parental leave and pay options isn’t just about money; it’s about peace of mind during one of life’s most significant moments. Knowing your employment rights, from statutory maternity and paternity pay to shared parental leave and bereavement support, helps you make informed choices for you and your family.

Don’t miss out on financial support, such as maternity allowance or statutory payments: know what you’re entitled to.

If you’re ever in doubt, don’t hesitate to seek free legal advice. Empower yourself with the right knowledge so you can focus on what matters most during these life-changing times.

Frequently Asked Questions

What is the difference between SMP and SPP?

Statutory Maternity Pay (SMP) provides financial support for mothers on maternity leave, enabling them to care for their newborn baby. Similarly, SPP (Statutory Parental Pay) helps parents on shared parental leave, allowing both parents to share caregiving duties and manage family life while receiving financial assistance so they can focus on what matters most.

How can you check if you are eligible for enhanced maternity or family pay?

To see if you can get enhanced maternity or family pay, you should look at your work contract. You can also talk to your HR team. They are familiar with company rules and can inform you about any unique eligibility criteria for this type of pay. These company rules may differ from the standard rules established by law. It’s a good idea to keep all your paperwork close by.

How long do I need to have been in my job to qualify for parental leave?

To get parental leave, you usually must work for your employer for at least 26 weeks by the end of the qualifying week, meeting the continuity of employment test. This rule is in place so that people who work can take time off and receive the corresponding pay.

What if my employer tries to prevent me from taking parental leave or treats me poorly for requesting it?

If your employer tries to keep you from taking parental leave or punishes you for asking, write down every time this happens. It’s a good idea to seek advice. You may have a reason to file a complaint or even initiate a legal case regarding this issue at work. It is essential to understand your rights and access support when needed.