Receiving a compliance check notice from HM Revenue can be unsettling, but it doesn’t always mean you’ve done something wrong. It’s HMRC’s way of ensuring individuals and businesses are paying the right amount of tax under the UK tax system.

This guide covers why compliance checks happen, what HMRC might review in your self assessment tax return or whole return, and how to respond with confidence, especially if you’re dealing with tax fraud, tax avoidance, or a potential criminal investigation.

Why might HMRC carry out a compliance check?

HMRC may launch a compliance check to ensure you’re paying the correct amount of tax and complying with UK tax laws. These checks aren’t always a sign of wrongdoing, but certain triggers can increase the chances of being selected, including:

- Mistakes or inconsistencies on your tax return, such as incorrect figures or missing information

- Unusual activity, like sudden changes in income or expenses compared to previous years or industry norms

- Suspected tax evasion or avoidance, especially if HMRC believes errors were deliberate

- Failure to respond to HMRC letters or provide requested documents

- Routine selection, where your case is picked at random as part of HMRC’s quality assurance process

Being prepared and knowing why checks happen can help you respond confidently and avoid unnecessary delays or penalties.

Worried About an HMRC Compliance Check? Here’s How the Process Works

Getting a letter about an HMRC compliance check can be stressful, especially if you’re running a small business and are unsure what’s coming next. But understanding the process can make it a lot less intimidating.

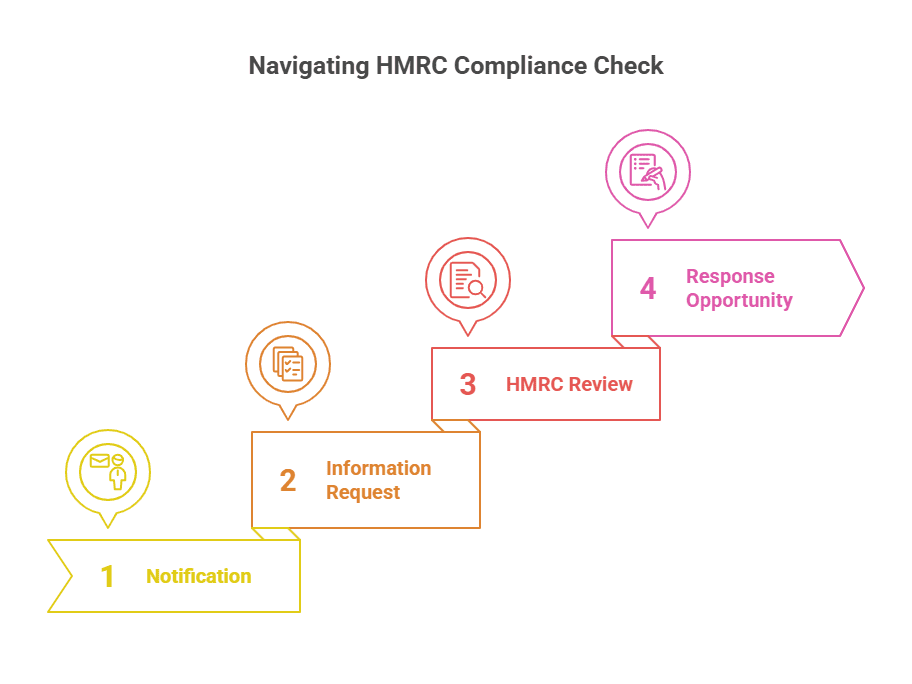

Here’s what typically happens during HMRC compliance checks:

1. You’ll Be Notified

HMRC will contact you by letter or phone to inform you that a compliance check has commenced. They’ll explain what part of your tax return or records they’re reviewing; this could include income tax, corporation tax, tax credits, or your self-assessment.

2. You’ll Be Asked for Information

You may be asked to provide documents such as bank statements, invoices, payroll records, or explanations for specific transactions. In some cases, a HMRC compliance officer may visit your home, business, or accountant’s office.

3. HMRC Reviews and Responds

After reviewing your info, HMRC may:

- Close the check with no changes

- Ask you to make corrections

- Issue a decision notice

- Apply HMRC compliance check penalties if they find payroll errors, especially for a deliberate error, or if you failed to take reasonable care

4. You’ll Be Given a Chance to Respond

You’ll have a chance to agree with or appeal HMRC’s decision. Within 30 days, you can request a review, appeal to a tribunal, or seek additional support.

For small business compliance, HMRC often provides guidance to help you correct honest mistakes. But ignoring the process or delaying your response can lead to more significant issues.

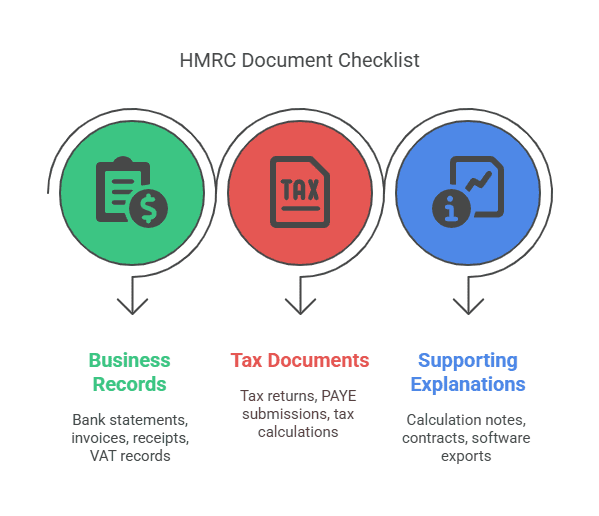

Papers You’ll Need for HMRC Checks

One of the most common concerns during an HMRC compliance check is not knowing what documents or information you’ll need to provide. Whether you’re a sole trader or running a small business, being unprepared can slow down the process, or worse, raise red flags.

HMRC typically requests documents that help verify whether you’ve paid the correct amount of tax. Here’s what you should have ready:

Personal or Business Records

- Bank statements (business and personal, if relevant)

- Sales invoices and receipts

- Purchase invoices and expense records

- VAT records (if registered)

- Payroll information (if you employ staff)

Tax-Specific Documents

- Self-Assessment or company tax return copies

- PAYE submissions (if applicable)

- Previous years’ tax calculations

- Evidence of tax credits or deductions claimed

- Any correspondence with HMRC

Supporting Explanations

- Notes on how figures were calculated

- Contracts or agreements (for income or expenses)

- Accounting software exports or spreadsheets

- Adviser or accountant summaries (if you’ve appointed one)

Being proactive with this checklist can save you time, reduce stress, and help you avoid unnecessary HMRC compliance check penalties. If you’re ever unsure, it’s okay to ask HMRC for clarification

Or get help from a qualified adviser.

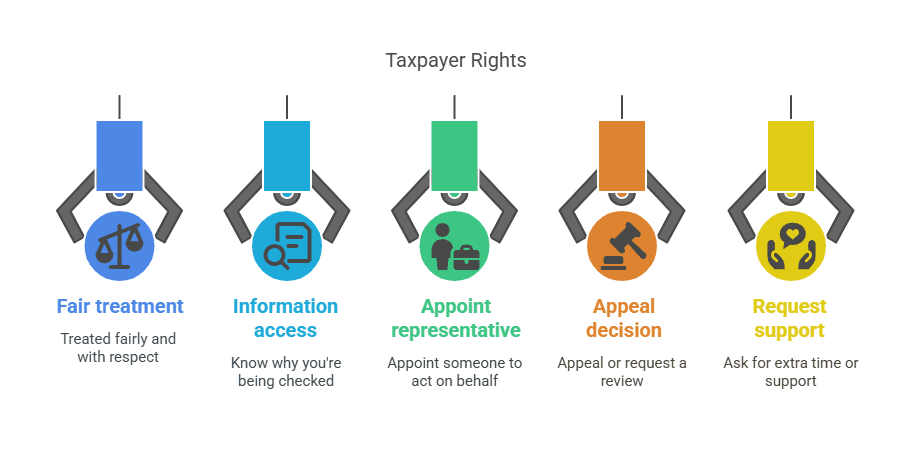

Feel in Control: Know Your Rights & Duties During an HMRC Check

When you’re facing an HMRC compliance check, it’s easy to feel overwhelmed, but you do have rights. Knowing your responsibilities helps you respond in the right way, without risking unnecessary HMRC penalties or delays.

Your Rights:

- To be treated fairly and with respect by HMRC officers

- To know why you’re being checked and what information is needed

- To appoint someone to act on your behalf (like your accountant)

- To appeal or request a review of HMRC’s decision

- To ask for extra time or support if you’re struggling

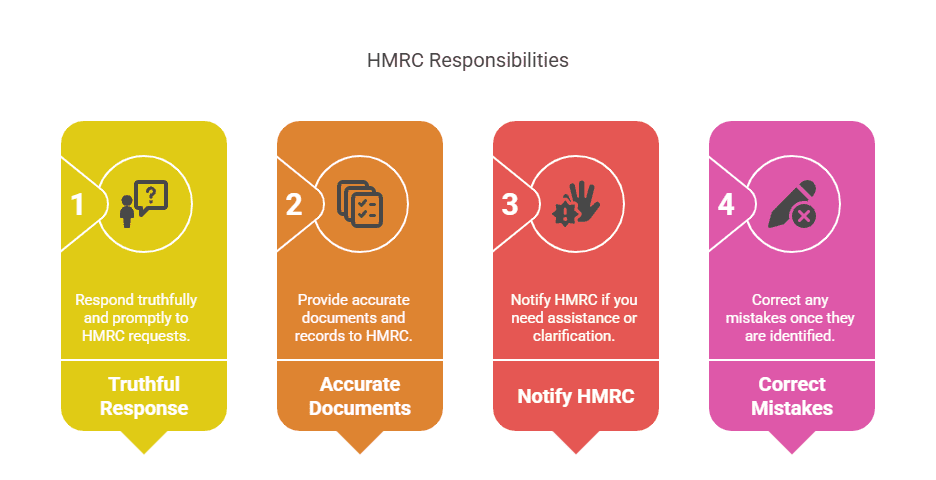

Your Responsibilities:

- To respond truthfully and promptly to HMRC requests

- To provide accurate documents and records

- To notify HMRC if you need more time or if something’s unclear

- To correct any mistakes once identified

Want to Avoid Penalties? Here’s How to Prepare for an HMRC Check

If you’ve been notified of an HMRC compliance check, don’t panic, but don’t wait either. Proper preparation can make all the difference between a quick resolution and a stressful, drawn-out process.

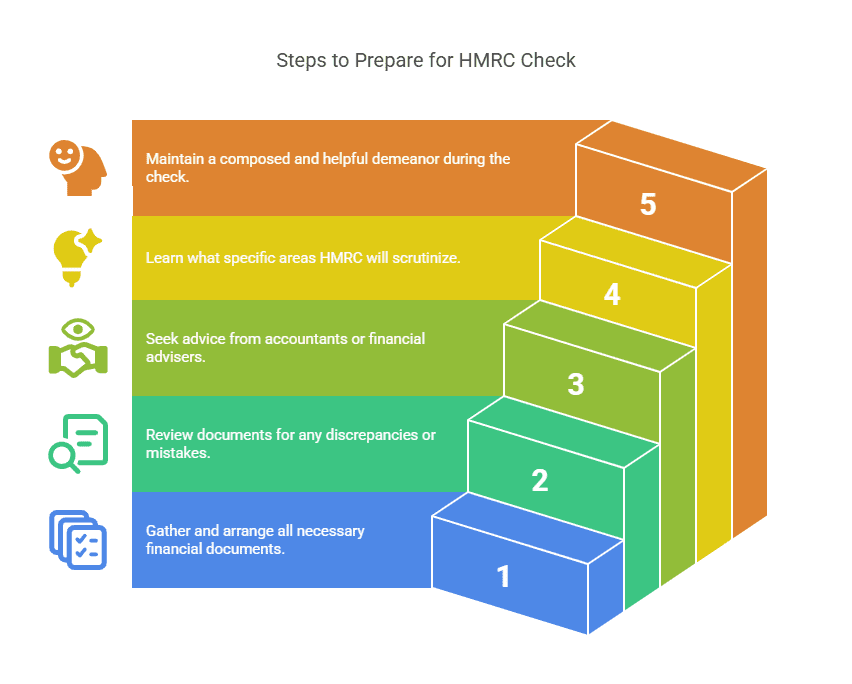

Here’s how to get ready and stay one step ahead:

1. Get Your Records in Order

Start by reviewing your tax returns, bank statements, receipts, and any supporting documents. HMRC will require clear evidence that your tax affairs are accurate and up to date.

Check these records:

- Income and expense logs

- PAYE and payroll records

- VAT returns

- Any adjustments made in previous years

2. Double-Check for Mistakes

Look for errors like missed income, duplicate expenses, or incorrect tax codes. If you spot a genuine mistake, be proactive; HMRC compliance check penalties may be reduced if you correct errors voluntarily.

3. Involve Your Accountant or Adviser

If you work with an accountant, inform them immediately. You can also give temporary authorisation to HMRC to speak with them on your behalf. A tax adviser can help explain complex entries and handle requests from HMRC directly.

4. Understand What HMRC is Looking For

The letter or call from HMRC will explain the focus of the check, whether it’s income tax, corporation tax, or something specific like tax credits or benefits-in-kind. Knowing this helps you gather the right information fast.

5. Stay Calm and Cooperative

During a compliance check, HMRC wants to see that you’re being honest and cooperative. That goes a long way. If you’re unsure about anything, ask for clarification or extra time, they’re more likely to work with you if you communicate openly.

Want to Avoid Fines? Here’s What Happens If You Don’t Comply with HMRC

No one likes the idea of penalties, but if you ignore or mishandle an HMRC compliance check, fines and interest can quickly add up. Whether it’s a genuine mistake or a deliberate error, knowing the consequences helps you act early and stay protected.

Here’s what to expect if you don’t meet HMRC compliance check requirements:

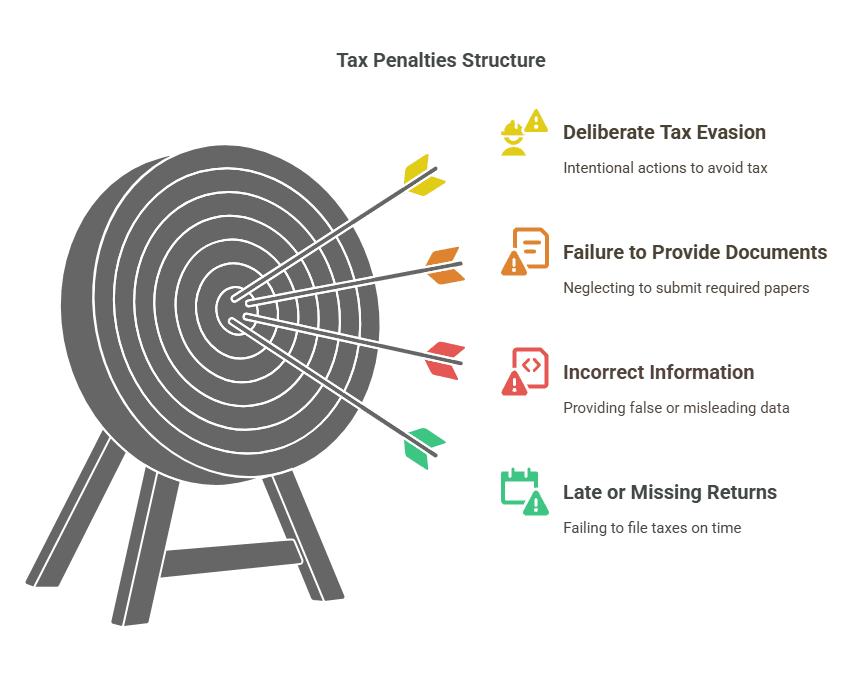

Types of Penalties You Could Face

HMRC examines how the error occurred and how promptly you respond. Penalties can apply to:

- Late or missing tax returns

- Incorrect information on returns

- Failure to provide requested documents

- Deliberate tax evasion or avoidance

The more serious the issue, and the less cooperative you are, the higher the fine.

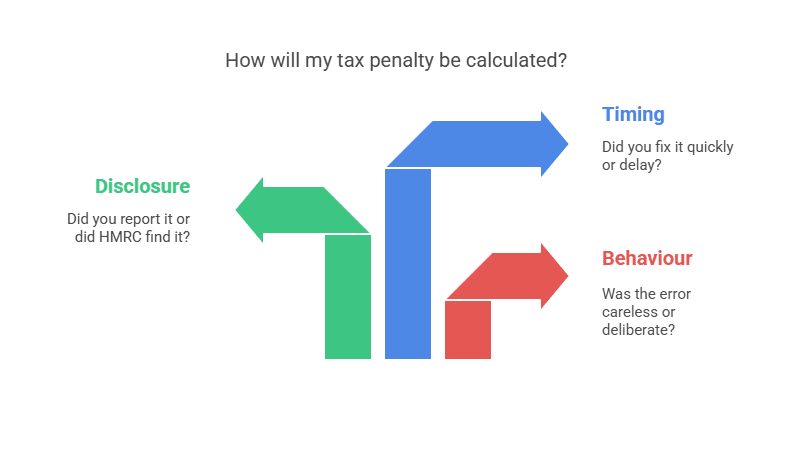

How Penalties Are Calculated?

Penalties depend on three main things:

- Behaviour – Was the error careless or deliberate?

- Disclosure – Did you report it to HMRC yourself, or did they find it?

- Timing – Did you fix it quickly or delay your response?

For example, if you made a mistake but corrected it voluntarily, your HMRC compliance check penalty may be reduced or waived. But if you ignore HMRC or try to hide something, penalties can reach up to 100% of the unpaid tax.

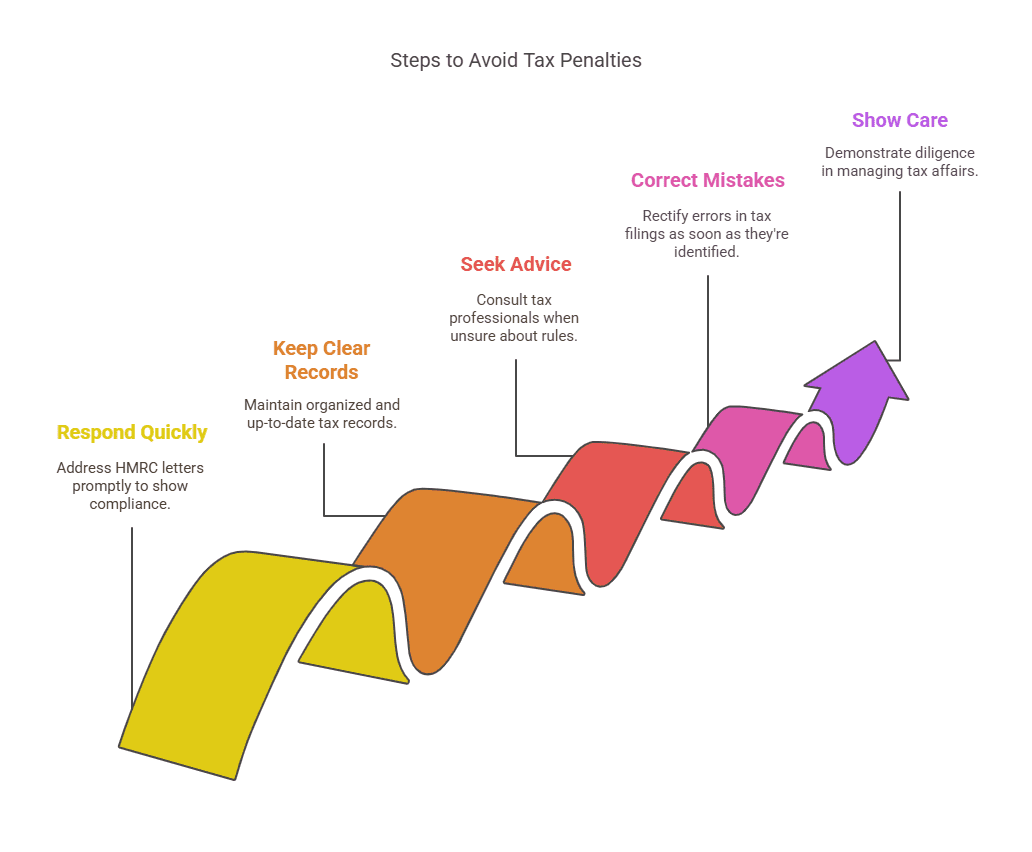

How to Reduce or Avoid Penalties?

- Respond quickly to all HMRC letters or requests

- Keep clear, up-to-date records

- Seek advice if unsure about tax rules

- Correct mistakes as soon as they’re found

- Show you’ve taken reasonable care in your tax affairs

For small business compliance, HMRC often provides guidance rather than punishment, but only if you’re open and cooperative. Being proactive is the best way to avoid unexpected tax bills or legal issues later.

Need Help Navigating HMRC Compliance?

If the thought of dealing with an HMRC compliance check feels overwhelming, you don’t have to face it alone. At Direct Payroll Services, we specialise in making payroll and tax compliance simple, accurate, and stress-free.

Our team works closely with small businesses to ensure every submission, record, and payment is fully HMRC-compliant. From handling PAYE and RTI to preparing for audits and correspondence, we take care of the details so you can stay focused on growing your business.

Whether you’re preparing for your first compliance check or want to avoid costly penalties down the line, we’re here to provide expert support with clarity and confidence.

Let’s make payroll one less thing to worry about, reach out today and get the peace of mind your business deserves.

Conclusion

An HMRC compliance check may feel daunting, but it doesn’t have to derail your peace of mind or your business. With the right preparation, clear records, and professional guidance, you can navigate the process with confidence. Whether it involves income tax, corporation tax, or your self-assessment, staying organised and proactive is the key to avoiding penalties and resolving any issues quickly.

Frequently Asked Questions

What should I do if I receive a compliance check notice?

Read the notice carefully, gather the requested documents, and consider getting professional advice. If needed, you can ask HMRC for more time or support by explaining your circumstances.

How long does an HMRC compliance check typically last?

It depends on the complexity. Some checks finish in weeks, others may take months—especially if detailed reviews, audits, or tribunal extensions are involved.

Can I appeal the results of an HMRC compliance check?

Yes. You can request a review, use alternative dispute resolution, or appeal to a tax tribunal. Legal or professional advice is recommended throughout the process.

Will HMRC visit my business during a check?

They might. HMRC can conduct in-person visits, speak with your accountant, or request to see records at your adviser’s office, especially for detailed investigations.

What happens if HMRC finds an error?

If it’s minor or careless, you may need to pay additional tax. Deliberate errors or fraud could lead to penalties, investigations, or even legal action.

Can I delay a compliance check if I’m unwell or away?

Yes, if you have a reasonable excuse like illness or bereavement, HMRC may allow extra time. Always notify them as early as possible.

What if I haven’t kept perfect records?

You must still respond to HMRC. Explain the situation honestly and provide as much supporting evidence as you can. Professional advice is strongly advised.