Key Highlights

- A fixed salary is a guaranteed, regular payment that provides financial stability for employees.

- Variable compensation fluctuates, as it is directly linked to employee performance and achieving specific performance targets.

- Fixed pay helps with budgeting and offers security, while variable pay boosts motivation and earning potential.

- Businesses often combine both to create a balanced salary structure that rewards consistency and high achievement.

- Understanding the difference helps you build a compensation strategy that aligns with your company’s goals.

When you’re thinking about employee pay, the salary structure is one of the most important decisions you’ll make. It’s more than just a number; it affects how you attract talent, motivate your team, and plan your finances.

The two main components you’ll encounter are fixed compensation and variable compensation. Understanding how each works is crucial for designing a pay system that benefits both your employees and your business.

Let’s explore these concepts to help you decide what’s right for your organisation.

What Is Fixed Pay in a Salary Structure?

Fixed pay is the guaranteed portion of an employee’s earnings that does not change from pay period to pay period. It is agreed in advance, written into the employment contract, and paid regularly, providing stability and predictability for both employers and employees.

Here’s what fixed pay typically includes:

- Guaranteed base salary: The agreed salary is paid weekly or monthly, regardless of performance or business results. For example, an employee earning £40,000 per year receives the same base pay each period.

- Contracted allowances: Fixed allowances, such as housing or transport, are guaranteed and paid regularly as part of the contract.

- Consistent income structure: Fixed pay does not vary with bonuses, commissions, or incentives, making it the stable foundation of total compensation.

Fixed pay forms the core of most salary structures, giving employees financial security while helping employers maintain clear, predictable payroll costs.

What Are the Different Types of Fixed Pay?

Fixed pay includes all guaranteed earnings an employee receives regularly, regardless of performance or business results. These components form the stable foundation of a salary structure and are set out clearly in the employment contract.

1. Base Salary

Base salary is the core fixed amount paid weekly or monthly. It does not change with performance and provides a predictable income. For example, an employee on a £40,000 annual salary receives the same base pay each pay period.

2. Guaranteed Allowances

Some roles include fixed allowances that are paid regularly. For example, housing, transport, or location allowances may be contractually agreed and paid regardless of performance, making them part of fixed pay.

3. Fixed Shift Pay

Employees working set shifts may receive a fixed shift allowance. For example, night or weekend shifts paid at a guaranteed rate are fixed if the pattern and payment are consistent and not performance-based.

4. Contractual Overtime

When overtime hours are guaranteed under the employment contract, the related pay is treated as fixed. For example, roles with mandatory overtime built into working hours include this pay as part of fixed compensation.

5. Retainers and Fixed Role Supplements

Some employees receive a fixed retainer or role-based supplement for holding specific responsibilities. For example, a team lead allowance paid monthly remains fixed as long as the role is held, regardless of outcomes.

Understanding the different types of fixed pay helps employers build clear, predictable salary structures while giving employees the income stability needed for confident financial planning.

Confused about how holiday pay works with irregular hours? This article breaks down how holiday pay is calculated for employees with variable work patterns and what employers need to know to stay compliant.

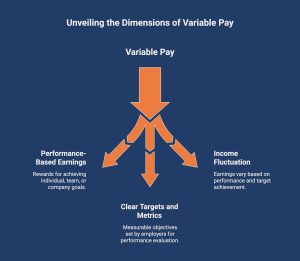

What Is Variable Pay and How Does It Work?

Variable pay is the part of an employee’s earnings that changes based on results rather than being guaranteed. It is linked to performance targets and rewards for contribution, helping employers encourage specific behaviours while giving employees the chance to earn more when goals are met.

Here’s how variable pay usually works in practice:

- Performance-based earnings: Variable pay depends on meeting individual, team, or company targets. For example, a salesperson earns commission for each sale, or a team receives a bonus for hitting quarterly goals.

- Clear targets and metrics: Employers set measurable objectives such as revenue, productivity, or project delivery. Payments are only made when these targets are achieved.

- Income can change over time: Unlike fixed pay, variable pay is not guaranteed. Earnings may be higher in strong performance periods and lower when targets are not met.

Variable pay is commonly used to motivate employees, reward results, and align pay with performance without increasing fixed payroll costs.

Managing seasonal staff? Discover top payroll solutions you need to handle fluctuating workforces, simplify seasonal pay runs, and ensure accurate reporting.

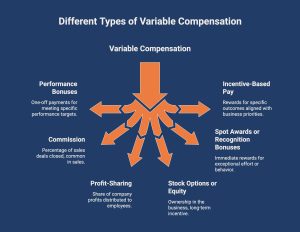

What Are the Different Types of Variable Compensation?

Variable compensation is one part of fixed and variable pay, where earnings change based on results rather than being guaranteed. Understanding what is fixed pay and variable pay helps employers design balanced reward systems that motivate performance while keeping payroll costs controlled.

Below are the most common types of variable compensation, with clear explanations and examples.

1. Performance Bonuses

Performance bonuses are one-off payments linked to results over a specific period. For example, an employee may receive a bonus for meeting annual targets or delivering a project successfully. These payments highlight the difference between fixed and variable pay, as bonuses are earned only when agreed-upon outcomes are achieved.

2. Commission

Commission is common in sales roles and is based on results, not time worked. For example, a salesperson earns a percentage of each deal closed. This is one of the clearest fixed and variable pay examples, where base salary provides stability and commission rewards higher performance directly.

3. Profit-Sharing

Profit-sharing allows employees to receive a share of company profits when the business performs well. For example, profits may be paid as a year-end bonus or pension contribution. This approach supports teamwork and clearly demonstrates fixed pay vs variable pay by linking rewards to company-wide success.

4. Stock Options or Equity

Stock options or equity give employees ownership in the business, usually as a long-term incentive. For example, shares may vest over time or be offered at a discounted rate. This form of pay encourages loyalty and growth-focused thinking, complementing fixed salary structures.

5. Spot Awards or Recognition Bonuses

Spot awards are immediate rewards for exceptional effort or behaviour. For example, an employee may receive a small bonus for solving a critical issue or helping a team meet a tight deadline. These payments are flexible and reinforce positive actions without changing base pay.

6. Incentive-Based Pay

Incentive-based pay rewards specific outcomes aligned with business priorities. For example, retention bonuses, project completion incentives, or referral rewards fall into this category. A common question here is whether overtime pay is fixed or variable; overtime is typically variable, as it depends on hours worked beyond standard pay.

Together, these approaches explain what is fixed and variable pay in practice. Using the right mix allows employers to balance stability with motivation, rewarding performance while maintaining predictable payroll structures.

Wondering if zero-hours contracts qualify for holiday pay? Learn how holiday entitlement works for zero-hours workers and what employers must consider under current employment rules.

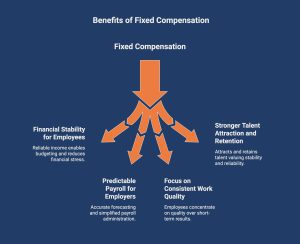

What Are the Benefits of Fixed Compensation?

Fixed compensation offers stability and clarity in pay structures, benefiting both employees and employers. By providing a guaranteed income, it creates financial security for staff while helping businesses manage payroll costs and expectations more effectively.

1. Financial Stability for Employees

Fixed compensation gives employees a reliable and predictable income each pay period. Knowing exactly how much they will earn makes it easier to budget for rent, mortgages, bills, and daily expenses. This financial certainty reduces stress, supports long-term planning, and contributes to a healthier work-life balance.

2. Predictable Payroll for Employers

For employers, fixed compensation creates a simple and predictable payroll structure. Labour costs are easier to forecast, budgeting becomes more accurate, and payroll administration is more straightforward. This predictability reduces financial uncertainty and helps businesses plan growth, hiring, and operational expenses with confidence.

3. Focus on Consistent Work Quality

Because income is not tied to performance targets, employees can focus on delivering consistent, high-quality work. Fixed pay reduces pressure to chase short-term results and encourages steady productivity, collaboration, and long-term contribution, improving overall organisational performance.

4. Stronger Talent Attraction and Retention

A dependable fixed pay structure appeals to candidates who value stability over variable earnings. It helps attract experienced professionals and retain employees long term, reducing turnover and building trust between employers and employees through clear and reliable compensation expectations.

Looking to boost payroll efficiency and reduce administrative burden? Read how managed payroll services help businesses streamline processes, ensure compliance, and save time while improving accuracy and reporting across your pay cycle.

What Are the Advantages of Variable Pay?

Variable pay rewards performance rather than time alone, making it a powerful tool for motivating employees and driving results. When used correctly, it encourages effort, aligns individual goals with business outcomes, and allows high performers to increase their earnings beyond a fixed salary.

1. Stronger Employee Motivation

Variable pay creates a clear link between effort and reward. When employees know that meeting targets can lead to bonuses or commissions, they are often more motivated to perform well. This encourages focus, accountability, and a results-driven mindset across teams and individual roles.

2. Higher Earning Potential for Employees

Unlike fixed pay, variable pay has no set limit. For example, commissions or performance bonuses allow employees to earn more when they consistently deliver strong results. This appeals to ambitious, goal-oriented individuals who want their income to reflect their effort and achievements.

3. Alignment with Business Goals

Variable pay aligns employee behaviour with company objectives. When bonuses are tied to sales, growth, or profitability, employees benefit directly from the organisation’s success. This shared focus helps drive performance in key areas while ensuring rewards are linked to meaningful business outcomes.

4. Recognition of Top Performers

Variable pay makes it easier to recognise and reward high performers fairly. Employees who go above and beyond receive tangible rewards, reinforcing positive behaviour and setting clear performance standards. This helps build a culture where achievement is recognised and excellence is encouraged.

How Do Fixed and Variable Salaries Differ?

Fixed and variable salaries differ in how predictable pay is and how strongly earnings are linked to performance. These differences shape employee security, motivation, and financial planning, while also influencing company culture and reward strategies. Understanding each contrast helps employers choose the right balance for their teams.

To make the differences clear at a glance, the table below compares fixed and variable salaries across key pay, performance, and risk factors.

| Aspect | Fixed Salary | Variable Salary |

|---|---|---|

| Pay predictability | Guaranteed and consistent | Changes based on performance |

| Income stability | High | Lower, can fluctuate |

| Budgeting ease | Easy and reliable | Requires flexibility |

| Performance link | Not directly tied to results | Directly tied to results |

| Financial risk | Low | Higher, with higher reward potential |

| Motivation driver | Stability and security | Incentives and rewards |

Below is a closer look at how these differences play out in practice.

1. Pay Stability and Predictability

Fixed salary provides a steady, guaranteed income paid at regular intervals. Employees can rely on this pay regardless of short-term performance.

Variable salary changes based on results, meaning total earnings may increase during strong performance periods or decrease when targets are not met.

2. Financial Planning and Budgeting

Predictable fixed pay makes budgeting simple and allows employees to plan expenses and savings with confidence.

Variable salary introduces income uncertainty, requiring more flexible budgeting and often a financial buffer to manage months when performance-based pay is lower.

3. Income Security and Performance Pressure

Fixed salary offers greater income security and reduces pressure to meet constant targets just to maintain earnings.

Variable salary increases performance pressure because income depends on achieving goals, which can motivate high performers but may also increase stress if expectations are high.

4. Motivation and Incentives

Fixed pay supports role fulfilment but may not strongly encourage employees to exceed expectations.

Variable salary is designed to motivate by rewarding results, creating a clear link between effort and financial reward that encourages higher performance and achievement.

5. Alignment with Business Objectives

With a fixed salary, employees are paid for doing their job, but pay is not directly tied to business outcomes.

Variable salary aligns individual effort with company goals by rewarding actions that contribute to growth, profitability, or key performance targets.

6. Financial Risk and Reward Potential

Fixed salary carries low financial risk, as income remains stable even during challenging periods.

Variable salary carries higher financial risk due to fluctuating earnings but offers greater reward potential for employees who consistently deliver strong results.

Together, these contrasts explain why many employers combine fixed and variable salary elements to create pay structures that balance security, motivation, and performance.

How Do You Find the Right Balance Between Fixed and Variable Compensation?

The right mix of fixed and variable pay depends on role type, business goals, and employee expectations. A balanced structure provides income stability while still rewarding performance, helping businesses motivate teams without increasing payroll risk.

Key principles to guide the balance:

- Start with a stable fixed base: Ensure fixed pay covers core living needs so employees feel financially secure and focused on their role.

- Use variable pay where performance is measurable: Apply incentives to roles with clear targets, such as sales, delivery, or growth-focused positions.

- Match pay mix to role seniority: Operational roles often need higher fixed pay, while senior or revenue-driven roles can support more variable components.

- Keep incentives achievable and transparent: Clear targets and fair thresholds prevent frustration and maintain trust in the pay structure.

- Review and adjust regularly: As the business grows or roles evolve, rebalance fixed and variable elements to stay aligned with outcomes.

Finding the right balance helps employers control costs, motivate performance, and offer pay structures that employees understand and value.

Why Choose Direct Payroll Services to Manage Fixed and Variable Pay Accurately?

Designing and managing fixed and variable pay structures can be complex, especially when bonuses, commissions, and performance-linked pay must be processed correctly through payroll. Direct Payroll Services helps businesses apply fixed and variable pay with accuracy, compliance, and clarity. We ensure that fixed salaries are processed consistently, variable pay, such as bonuses and sales commissions, is calculated correctly, and deductions align with HMRC rules.

Our specialists support clear reporting, predictable payroll costs, and compliant handling of performance-based earnings, reducing risk and administrative effort. Whether your team relies on stable salaries, incentive-driven pay, or a balanced mix, we keep payroll precise and stress-free.

Looking to simplify fixed and variable pay? Speak to Direct Payroll Services today for expert payroll support you can rely on.

Conclusion

Choosing between fixed and variable pay involves understanding the unique needs of your business and its employees. Fixed pay offers stability and predictability, making budgeting easier, while variable pay can drive motivation and align employees with organisational goals.

Each option comes with its own set of advantages and considerations that must be weighed carefully. Ultimately, the right choice will depend on your business model, the nature of your workforce, and your long-term objectives. By finding the right balance between fixed and variable compensation, you can create a more engaged and productive team.

Frequently Asked Questions

Is variable pay guaranteed, or does it depend on performance?

Variable pay is not guaranteed. It depends on individual performance, company performance, or predefined goals. Payments are triggered only when agreed targets are met, unlike fixed pay, which is paid regardless of outcomes or business results.

How does variable pay impact employee motivation and performance?

Variable pay links rewards to results, encouraging employees to focus on clear performance metrics. When targets are transparent and achievable, it can boost motivation, productivity, and accountability by directly connecting effort with financial outcomes.

Are there any advantages to having a higher fixed pay instead of variable pay?

Higher fixed pay provides income stability and predictability, which can reduce financial stress. It suits roles with limited performance measurement and supports retention where consistent output matters more than fluctuating incentives or short-term results.

What factors should HR consider when balancing fixed and variable pay?

HR should assess role responsibilities, market benchmarks, risk tolerance, goal clarity, and fairness. Balancing fixed and variable pay ensures competitiveness while aligning rewards with business priorities, employee motivation, and sustainable cost management.

What are some common examples of fixed and variable components in a salary?

Fixed components include basic salary and allowances. Variable components often include bonuses, incentives, and sales commission, typically linked to targets, revenue generation, or measurable outcomes defined in compensation policies.

Can you explain what fixed pay means in a salary structure?

Fixed pay is the guaranteed portion of compensation paid regularly, regardless of results. It forms the stable base of a salary structure and is used to meet essential income expectations and contractual employment obligations.

What is 12% variable pay?

12% variable pay means 12% of total compensation is performance-linked. This portion is paid only if targets are achieved, while the remaining 88% is fixed, providing a mix of stability and incentive-based earnings.

What is a fixed salary and variable salary in CTC?

In CTC, fixed salary is the assured annual pay, while variable salary depends on results. Variable elements reward performance, whereas fixed components ensure consistent income, benefits, and statutory contributions throughout the year.