Key Highlights

- On-demand pay, or Earned Wage Access (EWA), allows your employees to access their earned wages before the scheduled payday.

- This benefit helps reduce employee financial stress and their reliance on high-interest loans for unexpected expenses.

- For employers, offering on-demand pay can improve employee satisfaction, boost productivity, and lower staff turnover.

- It serves as a competitive advantage, helping you attract and retain top talent in a competitive job market.

- Implementation is typically managed through modern payroll software or a third-party provider that handles compliance and processing.

- While there are challenges like transaction fees and cash flow management, the benefits often outweigh the drawbacks.

Are you looking for ways to better support your team? In today’s world, employers are increasingly focusing on the holistic financial well-being of their staff.

Traditional payroll systems, with their rigid pay schedules, are being challenged by a more flexible alternative: on-demand pay. This innovative approach provides employees with early access to the wages they’ve already earned, offering a powerful tool for financial stability.

This blog explains what on-demand payroll is, how it works, and why it is gaining momentum in 2026. It covers benefits for employees and employers, key differences from traditional payroll, potential challenges, and implementation considerations.

What Is On-Demand Payroll and How Does It Work?

On-demand payroll is a type of payroll solution that allows employees to access a portion of their already earned wages before the scheduled payday. Also known as Earned Wage Access (EWA) or Pay on demand, it gives workers faster access to their money without relying on loans or credit.

At its core, on-demand pay is designed to be simple, fast, and employee-friendly. Here is how it typically works in practice:

- Access earned wages early: Employees can withdraw part of the pay they have already worked for, instead of waiting for the next payday.

- Receive funds the same day: Requests are made through a secure app or portal, with money often deposited instantly or within hours.

- Avoid high-interest borrowing: On-demand pay helps employees cover urgent expenses without turning to payday loans or credit cards.

- No disruption to payroll systems: Payments sync smoothly with existing payroll cycles, requiring no major operational changes.

- Gain greater financial control and peace of mind: Employees manage cash flow more effectively and feel supported during unexpected financial situations.

By offering clear, accessible wage flexibility, on-demand pay supports employee financial well-being while remaining simple and practical for employers to implement.

What are the Key Differences Between Payroll On Demand and Traditional Payroll Systems?

The primary distinction between a demand pay solution and traditional payroll systems lies in flexibility and timing. Here’s a simple breakdown of the key differences:

| Feature | Traditional Payroll Systems | Payroll On Demand |

|---|---|---|

| Wage Access | On a fixed, scheduled payday | At any point during the pay cycle |

| Payment Frequency | Fixed (weekly, fortnightly, or monthly) | Flexible access within the pay period |

| Flexibility | Rigid and predetermined | Highly flexible and employee-driven |

| Employee Control | None overpayment timing | Greater control over personal cash flow |

| Risk of Debt or Overdraft | Higher, due to delayed access to wages | Lower, as earned wages are available early |

| Primary Use | Regular, scheduled compensation | Covering unexpected costs and managing finances |

To understand how often you should pay employees and how pay frequency affects cash flow, compliance, and satisfaction, read this guide on pay frequency options and best practices.

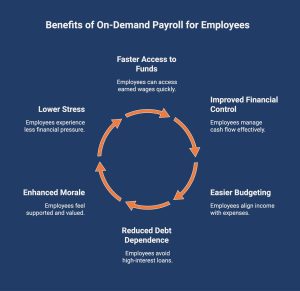

How Can Payroll On-Demand Pay Make Life Easier for Employees?

Payroll on-demand pay helps employees feel more secure by giving them faster access to money they have already earned, especially during unexpected or urgent situations. This added flexibility improves day-to-day financial stability and reduces stress around rigid pay cycles.

Here are the key ways on-demand pay supports employees and improves overall financial well-being:

1. Faster Access During Unexpected Situations

On-demand pay allows employees to access earned wages when sudden expenses arise, such as medical costs or urgent bills. This immediate access reduces panic, prevents missed payments, and offers peace of mind without waiting for the next payday.

2. Improved Financial Wellbeing and Cash Flow Control

By accessing wages already earned, employees gain greater control over personal cash flow. This flexibility helps manage expenses more effectively, smooth income gaps, and reduces the pressure of living paycheck to paycheck.

3. Easier Budgeting for Variable or Hourly Income

For employees with variable hours or fluctuating pay, on-demand payroll makes budgeting more manageable. Being able to access earned wages during the pay period helps align income with real-life expenses and improves financial planning.

4. Reduced Dependence on High-Interest Debt

On-demand pay reduces the need for payday loans or credit cards during emergencies. Employees use their own earnings instead of borrowing, avoiding high interest charges and long-term debt cycles.

5. Improved Employee Morale and Satisfaction

Feeling supported financially builds trust and loyalty. On-demand payroll shows that employers understand real-world challenges, improving morale, job satisfaction, and engagement across the workforce.

6. Lower Financial Stress and Better Work-Life Balance

Financial pressure affects mental health, focus, and performance. On-demand pay reduces stress by giving employees a sense of control and financial independence, helping them stay focused, balanced, and productive at work.

Consider offering payroll on-demand pay to support employees, strengthen trust, and improve well-being while boosting retention and engagement across your workforce.

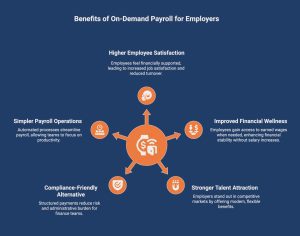

What are the Main Benefits of Offering On-Demand Payroll to Staff?

Payroll on-demand pay gives employers a practical advantage by improving retention, attracting stronger talent, and supporting smoother payroll operations without adding complexity.

Here’s how implementing on-demand pay creates measurable benefits for employers:

1. Higher Employee Satisfaction and Retention

When employees feel financially supported, job satisfaction increases, and turnover decreases. On-demand pay reduces money-related stress, builds trust, and demonstrates genuine care, encouraging employees to stay longer and remain engaged.

2. Better Financial Wellness Without Salary Increases

On-demand payroll improves financial wellness by giving employees access to earned wages when needed, without raising base salaries. This allows employers to support staff during financial pressure while maintaining cost control and sustainable payroll budgets.

3. Stronger Talent Attraction and Employer Brand

In competitive hiring markets, on-demand pay helps employers stand out. It positions the company as modern, flexible, and employee-focused, strengthening employer brand and overall company reputation with both candidates and existing staff.

4. Compliance-Friendly Alternative to Salary Advances

On-demand payroll offers a structured, compliant alternative to ad-hoc salary advances. Payments are limited to earned wages, processed transparently, and tracked through payroll systems, reducing risk and administrative burden for finance teams.

5. Simpler Payroll Operations and Higher Productivity

Modern on-demand payroll tools integrate smoothly with existing payroll systems. Automated processes reduce manual work, improve cash flow visibility, and allow teams to focus on productivity instead of payroll queries or financial distractions.

On demand payroll services allow employees to access earned wages early while helping employers streamline payroll operations and improve retention.

To understand how payroll outsourcing works and what payroll companies actually do for businesses, read this guide on how payroll companies work and what services they provide.

Are There Any Risks or Drawbacks Associated With On-Demand Payroll?

On-demand payroll services deliver clear benefits, but they also come with challenges that employers should plan for to ensure the program supports financial well-being rather than creating new issues.

Below are the most common challenges to consider before implementing on demand payroll:

1. Transaction Fees and Cost Awareness

Some on-demand pay services charge small fees per withdrawal. While lower than payday loans, repeated use can add up. Employers must clearly explain costs so employees use the benefit wisely and avoid unnecessary or frequent withdrawal habits.

2. Cash Flow and Payroll Planning

Unplanned wage withdrawals can raise concerns about cash flow predictability. Without the right systems, finance teams may struggle to plan payouts. Using a reliable provider helps forecast demand, automate controls, and maintain payroll stability over time consistently.

3. Risk of Overuse Without Budgeting Support

Easy access to wages can encourage frequent withdrawals if budgeting support is missing. Employees may lose sight of full pay cycles. Education, spending limits, and guidance help ensure that on-demand pay supports stability rather than creating new stress.

Employer on demand payroll gives organisations a flexible way to support employee financial wellbeing while maintaining control over payroll processes.

Need Reliable Payroll Support Without the Headache?

Direct Payroll Services helps businesses stay on top of payroll by managing everything accurately, securely, and on time. We work with small businesses, accountants, care providers, and contractors, taking the pressure off internal teams and removing payroll complexity.

Our services include managed payroll, payroll outsourcing, payroll bureau support, CIS payroll, directors’ payroll, and specialist care home and domiciliary care payroll. Each service is delivered with a strong focus on compliance, data security, and clear communication, so you always know your payroll is in safe hands.

If you want payroll handled smoothly and professionally, contact Direct Payroll Services to book an appointment today.

Conclusion

On-demand payroll is becoming a practical way for employers to support financial well-being without complicating operations. By offering on-demand payroll services, businesses can modernise pay access while staying compliant. A well-structured employer on-demand payroll model improves retention, engagement, and trust. The next step is to review your payroll setup and explore whether on-demand access fits your workforce’s needs.

Frequently Asked Questions

What do employees need to know about accessing pay through payroll on demand?

Employees should understand instant pay options, early wage access limits, fees, timing, and budgeting impacts on financial wellness during each pay period, how money reaches a bank account, and how flexibility supports regular payday mental health safely and effectively.

Are there any risks or challenges linked to payroll on demand for UK businesses?

UK employers face challenges balancing instant pay usage, early wage access policies, cashflow planning, and compliance, ensuring financial wellness across every pay period, funding timing to each bank account, and protecting regular payday mental health organisation-wide consistently responsibly.

Which sectors in the UK benefit most from payroll on demand solutions?

Sectors with hourly staff benefit most, including retail, care, and logistics, where instant pay and early wage access improve financial wellness, smooth income within a pay period, deliver earnings to a bank account, and stabilise regular payday mental health.

What impact does on-demand payroll have on employee financial well-being?

On-demand payroll improves resilience by offering instant pay and early wage access, strengthening financial wellness, easing expense shocks during a pay period, moving funds to a bank account faster, and supporting regular payday mental health long-term outcomes.

Which types of businesses benefit most from on-demand payroll solutions?

Businesses with variable schedules benefit most because instant pay and early wage access boost financial wellness, reduce pressure each pay period, help wages reach a bank account promptly, and reinforce regular payday mental health for teams consistently companywide.

What software or platforms support on-demand payroll for employers?

Employers use payroll platforms supporting instant pay and early wage access, improving financial wellness visibility per pay period, automating transfers into a bank account, maintaining controls, and safeguarding regular payday mental health for workforces at scale reliably and securely.

What is the on-demand salary?

An on-demand salary allows instant pay through early wage access, enhancing financial wellness by releasing earned wages during a pay period, sending money to a bank account, while preserving regular payday mental health structures for employees and employers.

Is On-Demand Payroll right for your business?

On-demand payroll suits organisations seeking instant pay and early wage access to support financial wellness, manage expectations each pay period, route earnings to a bank account, and strengthen regular payday mental health outcomes responsibly across modern teams.

Is earned wage access (On-Demand Pay) safe to use?

Earned wage access is safe when governed, as instant pay and early wage access encourage financial wellness, guide spending within a pay period, transfer earnings to a bank account, and protect regular payday mental health through clear policies.