Key Highlights

- Payroll outsourcing allows accountants to save significant time and reduce operating costs.

- A dedicated payroll accountant handles everything from payslip generation to tax compliance for your payroll clients.

- Using specialised payroll software helps minimise errors and ensures accuracy in calculations.

- Outsourcing the need to process payroll frees up your team to focus on core accounting services.

- Key services include managing statutory deductions and pension contributions, ensuring full compliance.

- The payroll process involves multiple steps, which an outsourced provider can manage efficiently.

Managing payroll can be a complex and time-consuming task, especially for accountancy firms juggling multiple clients. As businesses of all sizes seek ways to become more efficient, payroll outsourcing for accountants has emerged as a powerful solution.

By handing over payroll management to a specialist, you can free up valuable resources, reduce costs, and minimise the risk of errors.

This guide explores how outsourcing your payroll can transform your practice, saving you both time and money while enhancing your service offering.

What Is Payroll Outsourcing and Why Should Accountants Choose It?

Payroll outsourcing is when a business or accounting firm hands over payroll responsibilities to a specialist provider, making payroll accounting far simpler and more manageable. Instead of running payroll in-house, companies rely on experts to ensure accuracy, compliance, and timely payments.

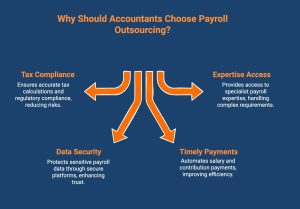

In practice, payroll outsourcing supports the day-to-day work of an accountant and payroll function by replacing manual processes with expert-led services. Here’s what it typically includes:

- End-to-end payroll processing: Managing wage calculations, deductions, and net pay using reliable payroll systems for accountants.

- Tax calculations and regulatory compliance: Handling Income Tax, National Insurance, statutory payments, and government filings in line with current regulations.

- Secure management of payroll data: Protecting sensitive employee and client information through compliant, secure payroll platforms.

- Automated salary and contribution payments: Ensuring employees, tax authorities, and benefit providers are paid accurately and on time.

- Access to specialist payroll expertise: Working with experienced accountants payroll companies that understand complex payroll requirements.

By outsourcing payroll, businesses and accounting firms simplify payroll management, reduce risk, improve efficiency, and allow accountants to focus on advisory work rather than administrative payroll tasks.

What are the Key Differences Between Payroll Outsourcing and Traditional In-House Payroll?

Choosing between payroll outsourcing and an in-house payroll process involves weighing several key factors, from cost to compliance.

The table below highlights the main differences in the payroll accounting process.

| Feature | In-House Payroll | Payroll Outsourcing |

|---|---|---|

| Cost | Higher overheads (salaries, software, training) | Lower, predictable payroll expenses |

| Expertise | Limited to your internal team’s knowledge | Access to a team of payroll specialists |

| Compliance | Responsibility falls entirely on your firm | Provider stays updated on tax laws and ensures compliance |

| Time | Time-consuming administrative work | Frees up your team to focus on core activities |

| Technology | Requires investment in and maintenance of payroll software | Leverages advanced, up-to-date payroll solutions |

Looking for a simpler way to manage payroll for your clients? Explore our payroll support built specifically for accountants in London.

What Are the Advantages of Payroll Outsourcing for Accountants?

Payroll outsourcing for accountants allows accountancy firms to manage growing payroll demands without increasing internal complexity, cost, or compliance risk. As payroll regulations tighten and client expectations rise, outsourcing provides a structured, scalable way to deliver accurate payroll services while protecting margins and service quality.

Below are the key advantages of payroll outsourcing for accountants, explained in detail.

1. Significant Time Savings for Accountancy Firms

Payroll processing involves frequent deadlines, manual checks, and constant updates. Payroll outsourcing for accountants removes these repetitive tasks from in-house teams, including calculations, submissions, corrections, and client queries.

This frees accountants to focus on advisory services, relationship management, and higher-value work that directly supports firm growth and client retention.

2. Reduced Operating Costs and Predictable Pricing

Maintaining an in-house payroll function requires staffing, training, payroll software, and regular system upgrades. Payroll outsourcing for accountants replaces these fixed and variable costs with predictable service fees.

Firms gain clearer cost control, avoid unexpected compliance expenses, and improve profitability while continuing to offer reliable payroll services to clients.

3. Improved Accuracy and Regulatory Compliance

Payroll errors can damage client trust and expose firms to penalties. Payroll outsourcing for accountants provides access to specialist processes, automated checks, and up-to-date legislative knowledge.

This significantly reduces the risk of incorrect calculations, missed filings, or non-compliance with HMRC requirements, helping protect both the accountant’s reputation and the client’s business.

4. Ability to Offer Expanded Payroll Services to Clients

With payroll outsourcing, accountants can offer a wider range of payroll services without building internal expertise. This includes managed payroll, CIS payroll, pension administration, bureau services, and digital payslips.

Expanding payroll offerings strengthens the firm’s service portfolio, creates recurring revenue, and positions the accountant as a full-service partner rather than a compliance-only provider.

5. Scalability Without Additional Internal Resources

Client payroll volumes often fluctuate due to growth, seasonal demand, or regulatory changes. Payroll outsourcing for accountants allows firms to scale payroll services smoothly without hiring new staff or investing in additional systems.

This ensures consistent service levels during peak periods while supporting long-term growth without operational strain.

6. Access to Specialist Payroll Expertise

Payroll legislation changes frequently and varies across industries. Payroll outsourcing for accountants provides direct access to dedicated payroll professionals who stay current with UK regulations.

This expertise supports complex payroll requirements, resolves client queries faster, and ensures confident handling of specialist sectors such as construction, care, and multi-director payrolls.

Ready to scale your accounting services without adding payroll stress? Discover trusted payroll solutions designed for London accountants.

What Payroll Tasks Are Typically Handled Through Payroll Outsourcing for Accountants?

Payroll outsourcing for accountants covers far more than processing monthly pay runs. It supports accounting firms by taking responsibility for data accuracy, compliance, reporting, and employee benefits, allowing accountants to serve clients efficiently without expanding internal payroll teams.

1. Employee Data Collection and Ongoing Management

With payroll outsourcing for accountants, employee records such as tax codes, bank details, starters, leavers, and salary changes are managed securely and updated in real time. This reduces admin work for accounting firms and helps prevent payment errors across multiple clients.

2. UK Payroll Compliance and Statutory Processing

Outsourced payroll providers stay up to date with UK tax laws and HMRC requirements. They handle PAYE calculations, statutory payments, deductions, and submissions accurately, helping accountants reduce compliance risk while meeting deadlines confidently for every client.

3. Payroll Reporting for Accounting Firms and Their Clients

Payroll outsourcing for accountants includes detailed payroll reports covering wages, deductions, taxes, and employer costs. These reports integrate smoothly into accounting workflows, supporting audits, forecasting, and client advisory services without additional internal effort.

4. Administration of Employee Benefits and Pensions

Outsourced payroll teams manage pension contributions, benefits deductions, and reconciliations with providers. This ensures employee benefits are processed correctly while accountants avoid the operational burden of ongoing benefits administration.

By outsourcing these payroll tasks, accounting firms reduce administrative pressure, improve accuracy, stay compliant, and scale their payroll offering without hiring or training additional staff.

How Do Accountants Help Companies Manage Payroll Efficiently?

Payroll accountants take care of critical payroll responsibilities so businesses can pay employees accurately, stay compliant, and reduce internal administrative pressure without disrupting daily operations.

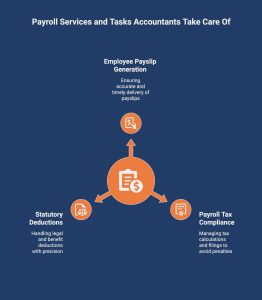

Here are the essential payroll services accountants provide, with the exact tasks handled under each service:

1. Employee Payslip Generation and Distribution

Payroll accountants ensure every employee receives a clear, accurate payslip each pay cycle. They manage calculations, verify records, and handle secure delivery, reducing confusion and payroll queries while maintaining transparency and trust across the workforce.

- Sending payslips directly to employees electronically.

- Providing access to a secure online portal where employees can view current and past payslips.

- Generating payroll reports for your records, summarising the payments made.

2. Payroll Tax Calculation and Compliance

Managing payroll taxes is complex and time-sensitive. Payroll accountants stay updated with regulations, calculate deductions accurately, and ensure filings are completed on time, protecting businesses from penalties and compliance risks.

- Accurately calculating all required payroll taxes.

- Preparing and filing necessary tax forms with government authorities on time.

- Resolving any tax-related queries or issues that may arise.

3. Managing Statutory Deductions and Pension Contributions

Accountants handle statutory deductions and pension contributions carefully to meet legal obligations and employee expectations. This ensures benefits are processed correctly and reflected clearly in payroll records every cycle.

- Calculating and processing deductions for student loans and other court-ordered payments.

- Managing contributions for employee benefits, such as private health insurance.

- Ensuring all payroll deductions are clearly itemised on employee payslips.

Working with a payroll accountant helps businesses reduce errors, stay compliant, save time, and ensure employees are paid accurately and confidently every payroll cycle.

What Is Payroll Software for Accountants and Why Does It Matter?

Payroll software for accountants is designed to simplify and automate payroll tasks, making it easier to manage pay, taxes, and compliance accurately across multiple clients. Here’s what strong payroll software typically offers:

- Automated payroll calculations: Handles wages, taxes, deductions, and net pay accurately, reducing manual errors and rework.

- Seamless integration with accounting platforms: Connects with tools like Xero and QuickBooks Online, creating efficient payroll systems for accountants and smoother reconciliation.

- HMRC compliance and UK-specific features: Supports RTI submissions, auto-enrolment pensions, statutory payments, and other UK payroll requirements.

- Cloud-based access and multi-client management: Enables online payroll for accountants, allowing accountants and accountants payroll companies to manage multiple client payrolls securely from one dashboard.

- Reporting and payment processing tools: Generates payslips, payroll reports, and processes payments quickly and reliably.

Ready to scale your accounting services without adding payroll stress? Discover trusted payroll solutions designed for London accountants.

Looking for Payroll Outsourcing That Works Seamlessly for Accountants?

Direct Payroll Services provides payroll for accountants who want to reduce day-to-day payroll pressure without losing control. We manage payroll processing, HMRC submissions, and routine payroll queries accurately and on time, while you remain the main point of contact for your clients.

Our payroll for accountants service fits smoothly into existing workflows, supporting weekly, fortnightly, and monthly payrolls in line with current UK regulations. Using secure systems and clear processes, we help ensure accuracy, compliance, and consistency across every pay run.

Speak with Direct Payroll Services today to explore outsourcing options built specifically for accountants.

Conclusion

Payroll outsourcing helps accountants reclaim time and reduce risk without losing control. With online payroll for accountants and support from trusted accountants payroll companies, firms strengthen their understanding payroll accounting while simplifying the accountant and payroll function through reliable payroll systems for accountants. The next step is to assess your current payroll workload and explore outsourcing options that fit your firm’s scale and client needs.

Frequently Asked Questions

Can accounting firms handle both payroll and HR services for businesses?

Yes, many accounting firms handle both payroll and HR services by combining compliance, employee administration, and reporting. This approach suits small businesses seeking one provider, though complex HR matters may still require specialist advisors for growing organisations nationwide.

What are the pros and cons of outsourcing payroll for UK companies?

Outsourcing payroll saves time, improves accuracy, and reduces compliance risk for UK companies. However, it adds service costs, reduces direct control, and requires trusting third parties with sensitive employee data and strict service level management expectations and oversight.

How do payroll agents support accountants in processing employee payments?

Payroll agents support accountants by calculating wages, managing deductions, submitting filings, and scheduling payments accurately. They reduce admin workload, handle queries, ensure deadlines are met, and help maintain consistent, compliant payroll processing across multiple clients efficiently securely reliably.

Which payroll software is most recommended for UK accountants?

UK accountants commonly recommend payroll software that supports HMRC compliance, automation, and integrations, such as Xero Payroll, Sage Payroll, or BrightPay. The best option depends on firm size, client volume, reporting needs, and budget flexibility, support, scalability, usability.

Are there cloud-based payroll solutions designed specifically for accountants?

Yes, several cloud-based payroll solutions are built for accountants, offering multi-client dashboards, automation, secure access, and integrations. These platforms allow remote management, real-time updates, and scalable payroll delivery without maintaining on-premise systems or infrastructure internally, manually, locally, or traditionally.

How do payroll agents support accountants in processing employee payments?

Payroll agents assist accountants by preparing payroll data, validating calculations, processing payments, and resolving discrepancies. Their support improves efficiency, reduces errors, meets statutory deadlines, and enables accountants to focus on advisory work and client relationships more strategically and effectively.

How much do accountants charge to run payroll?

Accountants typically charge payroll fees per employee or per pay run. Costs vary based on complexity, frequency, software used, and support required, ranging from modest monthly fees for small teams to higher rates for larger businesses, industries, nationwide.

What does it cost to outsource payroll?

The cost to outsource payroll depends on employee numbers, pay frequency, and service scope. Providers usually charge monthly per-employee fees, making outsourcing affordable for small businesses, while complex payrolls increase overall costs significantly, for larger organisations, sectors, nationally.