Key Highlights

- Managed payroll services handle every part of payroll, from calculations to compliance, saving businesses time and effort.

- Outsourcing payroll ensures accuracy, efficiency, and data protection for sensitive employee information.

- Businesses benefit from automation, cost savings, scalability, and expert support through professional providers.

- Managed payroll providers help maintain full compliance with evolving tax and payroll legislation.

- Small and mid-sized companies gain the most from outsourcing, especially during periods of growth or change.

- Choosing the right provider means checking experience, compliance standards, technology, and customer support.

- Managed payroll integrates smoothly with HR and accounting systems for streamlined operations.

- Reliable payroll management enhances employee experience, trust, and overall business performance.

- Direct Payroll Services delivers secure, compliant, and scalable payroll solutions trusted by businesses across the UK.

Processing payroll sounds straightforward until you’re knee-deep in calculations, chasing updated tax codes, and double-checking payslips before payday. For many businesses, what should be a routine task often turns into a monthly scramble that drains time and focus.

As your business grows, payroll complexity grows with it. More employees, new legislation, and tighter reporting rules mean even small mistakes can lead to compliance issues or unhappy staff. What starts as an administrative task can easily become an ongoing source of pressure.

That’s where managed payroll services come in. Instead of managing endless details in-house, you can rely on professionals who handle payroll accurately, securely, and on time. This blog will walk you through how managed payroll works, why it’s worth considering, and how to choose the right provider for your business. Let’s get started.

What Is Managed Payroll?

Managed payroll is a professional service where a trusted service provider handles your company’s entire payroll process, from salary calculations and deductions to tax compliance and reporting. Instead of relying on an internal payroll team, businesses partner with experienced payroll providers who use secure payroll software to manage employee data, maintain accurate records, and ensure all payments meet current payroll legislation.

Depending on how much control you want to retain, you can choose between a fully managed payroll service or a partially managed payroll setup. Here’s how they differ:

| Feature | Fully Managed Payroll | Partially Managed Payroll |

|---|---|---|

| Level of Control | The provider manages the entire payroll process from start to finish. | The business handles specific tasks while the provider supports selected areas. |

| Responsibility | All payroll functions, compliance, and reporting are handled externally. | The business retains some responsibility for data entry and approvals. |

| Ideal For | Companies wanting a completely hands-free payroll solution. | Businesses preferring to stay involved in certain payroll stages. |

| Time Commitment | Minimal: the provider manages everything. | Moderate: shared effort between provider and business. |

| Compliance Management | Fully handled by payroll experts, ensuring up-to-date adherence to legislation. | Shared: provider advises, but the business must ensure compliance. |

| Cost | Higher due to complete coverage and expert oversight. | Lower, as the workload is shared. |

| Scalability | Highly scalable for growing teams and multi-location businesses. | Suitable for smaller teams with predictable payroll needs. |

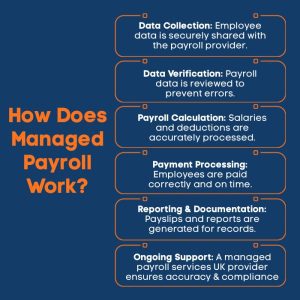

How Does Managed Payroll Work?

When a business chooses a managed payroll service, the process starts with securely sharing employee data such as hours worked, salary details, and tax codes with an experienced payroll provider. The payroll specialists then use advanced payroll software solutions to calculate salaries, process deductions, and ensure compliance with payroll laws and tax requirements.

Here’s how the typical workflow looks:

Step 1: Submit Payroll Data

The business securely shares all necessary employee information, including hours worked, salary details, and tax codes, with the service provider. This forms the foundation for accurate payroll processing.

Step 2: Verify Information

Payroll professionals carefully review and validate the submitted data to ensure accuracy. This step helps identify discrepancies early and prevents costly payroll errors later in the process.

Step 3: Calculate Pay and Deductions

The provider calculates gross and net pay, tax deductions, pension contributions, and statutory payments in line with UK payroll legislation, ensuring compliance and precision.

Step 4: Process Employee Payments

Once calculations are complete, employees receive their pay accurately and on schedule. This maintains trust, consistency, and a positive employee experience across every pay cycle.

Step 5: Generate Reports and Payslips

Detailed reports, audit trails, and electronic payslips are generated for both management and employees. These documents provide full visibility, help with compliance, and simplify record keeping.

A managed payroll services UK provider, such as Direct Payroll Services, ensures every step runs smoothly, from calculations to compliance. Whether you choose fully managed payroll services or a tailored setup, our team handles every detail with precision so your payroll remains accurate, efficient, and fully compliant with UK regulations.

What Does a Managed Payroll Solution Include?

A managed payroll solution goes beyond just processing payslips. It’s a complete service designed to take care of every step involved in paying your team accurately and compliantly. While offerings vary by provider, most managed payroll services include the following:

- Payroll Processing: Calculation of gross and net pay, tax deductions, pensions, and statutory contributions.

- Tax Management: Submission of PAYE, National Insurance, and other HMRC filings on time.

- Data Management: Secure handling of employee data, including new starters, leavers, and updates to personal information.

- Payslip Generation: Issuing digital or paper payslips to employees, often with 24/7 access via a secure portal.

- Compliance Monitoring: Ongoing checks to ensure your payroll meets the latest legislation and reporting standards.

- Reporting and Analytics: Detailed payroll reports on costs, overtime, and summaries.

- Year-End Processing: Handling of P60s, P11Ds, and any statutory year-end submissions.

- Expert Support: Access to payroll professionals for advice, troubleshooting, and compliance guidance.

Together, these services create a seamless payroll experience, giving you both accuracy and peace of mind without the administrative burden.

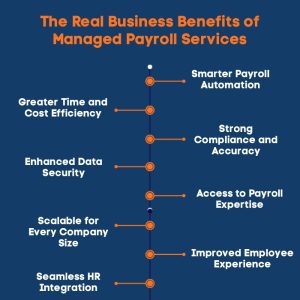

Why More Businesses Are Turning to Managed Payroll Services?

Running payroll in-house can quickly become complex, time-consuming, and prone to costly mistakes. Partnering with a trusted provider for managed payroll services helps businesses simplify the payroll process, improve compliance, and protect sensitive data, all while freeing up valuable time for core business activities.

Here are some of the most meaningful advantages you can expect:

1. Smarter Payroll Automation

A managed payroll service streamlines payroll processes through modern software, reducing manual effort and the risk of payroll errors while improving overall efficiency.

2. Greater Time and Cost Efficiency

Outsourcing to professional payroll management services saves administrative hours and reduces expenses related to training, payroll software, and staff management, allowing teams to focus on growth.

3. Strong Compliance and Accuracy

Payroll specialists stay updated with changing payroll legislation and tax laws, ensuring every payment, report, and submission is accurate and fully compliant.

4. Enhanced Data Security

With robust data protection protocols, encrypted systems, and disaster recovery plans, your sensitive employee data remains secure and confidential.

5. Access to Payroll Expertise

Businesses gain direct access to experienced payroll professionals who offer expert support, guidance, and insight into evolving payroll requirements.

6. Scalable for Every Company Size

Managed payroll services can easily adapt to growing teams or shifting payroll needs without disrupting the pay cycle or adding administrative pressure.

7. Improved Employee Experience

Consistent, accurate payroll builds trust and satisfaction among employees, creating a smoother and more positive workplace experience.

8. Seamless HR Integration

Modern systems connect with existing HR software to synchronise employee records and enhance decision-making in talent management and reporting.

For many UK businesses, investing in managed payroll services or fully managed payroll services offers a smoother way to manage their payroll functions while improving accuracy and data protection.

Whether you’re a small business or scaling up, outsourcing to a fully managed payroll provider delivers peace of mind, saves significant time, and helps maintain compliance with the latest legislation.

Contact Direct Payroll Services today!

How Much Do Managed Payroll Services Cost?

The cost of managed payroll services varies depending on your company’s size, pay frequency, and the level of support you need. A small business with a few employees will naturally pay less than a large organisation running multiple pay cycles across different locations.

Most payroll providers use one of the following pricing models:

- Per Employee, Per Month (PEPM): A flat monthly fee for each employee, covering standard payroll processing and reporting.

- Pay Period Pricing: Charges are based on each pay run, whether weekly, fortnightly, or monthly.

- Transactional Pricing: Costs depend on the number of payroll transactions, such as payments, deductions, and tax submissions.

- Custom Pricing: A tailored plan designed around your business’s specific needs, complexity, and compliance requirements.

Several factors can influence how much you pay for managed payroll services:

| Factor | How It Affects Cost |

|---|---|

| Complexity of Payroll | Payrolls with varied pay structures, bonuses, or allowances require more processing time and cost more. |

| Number of Employees | A higher headcount increases data processing, reporting, and payslip generation costs. |

| Payroll Frequency | Running weekly or bi-weekly payrolls typically costs more than monthly schedules. |

| Level of Service Required | Added features like HR integration, benefits management, or time tracking can raise the overall cost. |

| Regulatory Compliance | Multi-location businesses or those with complex tax obligations may incur extra costs to stay compliant. |

While prices vary, the value of managed payroll lies in accuracy, compliance, and the time you reclaim to focus on your business.

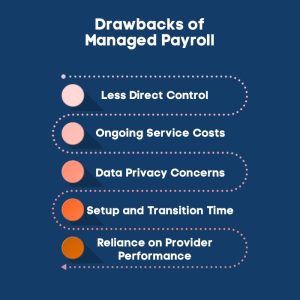

Are There Any Drawbacks to Managed Payroll?

While managed payroll services can streamline your operations, it’s important to understand a few potential challenges before outsourcing your payroll.

1. Reduced Direct Control

When payroll is handled externally, you rely on your provider’s systems, schedules, and processes. This can mean less hands-on oversight of day-to-day payroll activities.

2. Ongoing Costs

Managed payroll involves a recurring service fee. While it saves time and improves accuracy, businesses must budget for the ongoing expense as part of operational costs.

3. Data Sharing Concerns

Some businesses prefer to keep sensitive employee data in-house. Even with encryption and data protection measures, sharing information externally may require additional trust and security checks.

4. Transition Challenges

Switching from in-house to outsourced payroll requires careful data transfer and testing. The onboarding process may take time before full accuracy and rhythm are achieved.

5. Dependence on Provider Performance

Outsourced payroll depends on your provider’s reliability. Delays, system issues, or communication gaps could affect payroll timelines and staff satisfaction.

While these considerations exist, many businesses find that with the right provider, the benefits of managed payroll far outweigh the drawbacks.

Is It Time to Switch to Managed Payroll? Here’s How to Know

Not every business needs to manage payroll internally. For many, partnering with a trusted provider offering managed payroll services can save time, reduce risk, and improve accuracy. If any of the situations below sound familiar, it might be time to make the switch.

1. Small and Mid-Sized Businesses

Companies without a dedicated payroll department often benefit most from outsourcing. It lightens administrative workloads and ensures every pay cycle runs smoothly.

2. Growing Organisations

When a business expands, payroll requirements become more complex. Payroll management services help you scale effortlessly without hiring extra staff or overloading existing teams.

3. Businesses Focused on Compliance

If keeping up with changing payroll legislation and tax laws is becoming difficult, outsourcing ensures your company stays compliant and avoids penalties.

4. Data-Driven Companies

Businesses managing sensitive employee data can rely on managed payroll providers to maintain high standards of data protection and system security.

5. Companies Using Multiple Systems

If HR, accounting, and payroll tools don’t integrate well, managed payroll providers can connect them seamlessly for smoother payroll processes.

6. Businesses Facing Frequent Payroll Errors

Repeated mistakes or missed deadlines are signs that it’s time for expert help. Managed payroll professionals bring precision and consistency to every pay run.

7. Business Owners Seeking Expert Guidance

Outsourcing gives you access to payroll specialists who provide expert support, strategic advice, and peace of mind throughout the entire payroll process.

How to Find the Best Managed Payroll Provider for Your Business?

Choosing the right provider for managed payroll services can make all the difference between smooth, compliant payroll and unnecessary stress. The goal is to find a partner who understands your business, values data protection, and delivers accuracy every time.

Here’s what to look for when selecting your provider:

1. Proven Experience and Reputation

Select managed payroll providers with a strong track record in your industry. Experienced payroll experts understand complex regulations and can handle everything from small business setups to large-scale payroll operations.

2. Compliance and Security Standards

Ensure your provider follows strict payroll management services protocols, including ISO 27001 certification, GDPR compliance, secure encryption, and regular updates to meet evolving data protection and legal standards. Protecting sensitive employee data should always be a top priority.

3. Technology and Integration Capabilities

A reliable provider uses modern payroll software that integrates smoothly with HR and accounting systems, keeping your payroll processes consistent and efficient.

4. Transparent Pricing Structure

Look for clear, straightforward pricing with no hidden fees. The right provider should offer flexible plans that match your company’s size and budget.

5. Quality of Customer Support

Strong service is about more than software. Choose a provider that offers responsive expert support and understands your unique payroll requirements.

6. Scalability and Flexibility

As your workforce grows, your payroll needs will change. A good provider offers scalable solutions that can evolve with your business without disruptions.

7. Disaster Recovery and Reliability

Confirm that your provider has disaster recovery systems in place to protect your data and maintain payroll continuity during technical issues.

Make Payroll Effortless with Direct Payroll Services

Payroll shouldn’t feel like a monthly headache. Late updates, complex tax rules, and constant admin can drain your time and energy.

At Direct Payroll Services, we take that pressure off your plate. Using cloud-based technology and expert support, we handle payroll accurately, securely, and fully compliant with UK legislation. From small business payroll to CIS and directors’ payroll, our services are built around your needs.

Trusted by over 250 UK businesses, we deliver reliability, real-time reporting, and peace of mind every pay cycle — so you can focus on what truly matters: growing your business.

Get in touch with us today to discover how our expert team can manage your payroll with accuracy, compliance, and complete peace of mind.

Final Thoughts

Managing payroll isn’t just about getting payslips right; it’s about building trust, accuracy, and consistency into how your business operates. When handled efficiently, payroll becomes an invisible engine that supports smooth operations, satisfied employees, and stronger compliance.

As your business evolves, so do your payroll needs. Choosing the right approach, whether keeping it in-house or partnering with experts, is ultimately about creating space for what truly drives success: your people, your time, and your ability to grow with confidence.

Frequently Asked Questions

What is payroll management?

Payroll management involves handling employee salaries, deductions, tax calculations, and statutory compliance. It ensures employees are paid accurately and on time while keeping records aligned with legal and financial reporting standards for the business.

How to manage payroll for small businesses?

Small businesses can manage payroll efficiently by using reliable payroll software or outsourcing to experts. This approach saves time, reduces errors, ensures compliance with tax laws, and keeps employee data secure and well-organised.

Is payroll outsourcing the same as managed payroll?

Not exactly. Payroll outsourcing means hiring an external company to handle payroll, while managed payroll offers a more tailored service that combines technology, compliance support, and expert oversight to manage payroll processes end to end.

How does managed payroll work with PAYE for UK employers?

Managed payroll providers handle PAYE by calculating income tax, National Insurance, and other deductions automatically. They ensure accurate submissions to HMRC and timely payments, keeping employers compliant with all UK payroll and tax regulations.

What are the main advantages of payroll management systems?

Payroll management systems automate salary processing, improve accuracy, ensure compliance with legislation, and protect employee data. They also save time, reduce administrative effort, and provide better reporting for strategic financial planning and decision-making.

How to manage payroll security effectively?

Payroll security can be maintained through encryption, restricted access, and secure payroll software. Regular password updates, compliance with data protection laws, and staff training on privacy and security best practices further strengthen payroll data safety.

How much does fully managed payroll cost?

Costs for fully managed payroll vary by company size and service level. On average, UK businesses can expect to pay between £3 and £10 per employee per month, depending on complexity, add-on services, and provider expertise.

What is HR payroll management?

HR payroll management integrates employee administration with payroll processing. It combines HR tasks like attendance tracking and leave management with accurate payroll calculation, helping businesses maintain efficiency, compliance, and consistency across their workforce operations.