Key Highlights

- Flexible pay gives your employees more control over when they access their earnings, moving beyond traditional pay cycles.

- Offering flexible pay options like earned wage access helps you stand out in a competitive job market.

- These systems are a powerful tool for improving the employees’ financial well-being and reducing money-related stress.

- Earned wage access (EWA) allows staff to withdraw a portion of their income before the official payday.

- Successful implementation relies on choosing the right model and integrating it with your existing payroll systems.

- Flexible pay can improve employee retention, motivation, and overall job satisfaction.

Ever wondered why employees still feel financially stressed even with a steady income? Most of the time, it’s because they can’t access their earnings when real-life expenses show up.

Flexible pay changes that by giving people more control instead of locking them into a strict payday. It’s quickly becoming a standout benefit that helps businesses support their teams and improve retention.

Read this guide now to understand how flexible pay really works and why it matters to employees and employers alike.

What Is Flexible Pay and How Does It Work?

Financial stress is common among employees, especially when long gaps between paydays make everyday budgeting difficult. That’s why flexible pay is growing in popularity; it gives employees more control over their earnings and helps ease the strain created by traditional pay cycles.

At its simplest, flexible pay allows individuals to access a portion of the wages they’ve already earned, without waiting for the standard biweekly or monthly pay cheque.

Here’s how the model works in practice:

- Employees can access earned wages early: Instead of waiting for a fixed payday, employees can withdraw part of their accrued earnings, sometimes daily or on demand.

- Earned Wage Access (EWA) is the core mechanism: EWA enables employees to tap into money they have already earned. It is not a loan, and it avoids the risks of debt or credit checks.

- It integrates smoothly with existing payroll systems: Companies typically use their current payroll software, partner with a reliable payroll provider, or connect through financial apps, no major system overhaul required.

- Funds are advanced securely and reconciled automatically: When an employee requests early access, the amount is advanced and later deducted from their upcoming pay cheque, ensuring accuracy and compliance.

- Employees gain financial flexibility, and employers maintain efficiency: The model ensures staff only access funds they’ve already earned, while payroll operations remain streamlined and manageable.

What Are the Benefits of Flexible Pay for Employers?

Flexible pay has quickly become a valuable benefit in today’s talent market. It helps employers stand out, attract strong candidates, and create a more financially confident workforce. By giving employees greater control over when they access their earnings, you build trust, reduce stress, and support long-term retention.

Here are the key benefits of offering flexible pay:

- Stronger employer brand: Positions your organisation as modern, supportive, and employee-focused.

- Improved talent attraction: Makes job offers more appealing, especially to hourly and high-turnover workers.

- Higher employee engagement: Employees feel more in control of their finances, which boosts motivation and satisfaction.

- Better retention across departments: Financially secure employees are less likely to look for new roles.

- Lower hiring and training costs: Reduced turnover means fewer resources spent on constant recruitment.

- Less administrative burden: Minimises manual wage advances and creates a smoother payroll process.

What Are the Benefits of Flexible Pay for Employees?

Flexible pay can make a meaningful difference in your employees’ day-to-day lives. By giving them access to the money they have already earned, employers help reduce financial pressure, support smarter money management, and create a stronger sense of security at work.

Here are the key benefits for employees:

- Lower financial stress: Employees can access earned wages when unexpected expenses arise, reducing anxiety around cash flow.

- Avoidance of high-interest debt: Flexible pay helps staff stay away from payday loans and credit card debt when covering essential bills.

- Improved financial well-being: Many flexible pay platforms include budgeting tools that encourage better financial habits.

- Greater focus and productivity: When employees worry less about money, they can concentrate more on their work and perform at a higher level.

- Stronger sense of security and support: Feeling financially supported increases overall morale and contributes to long-term employee retention.

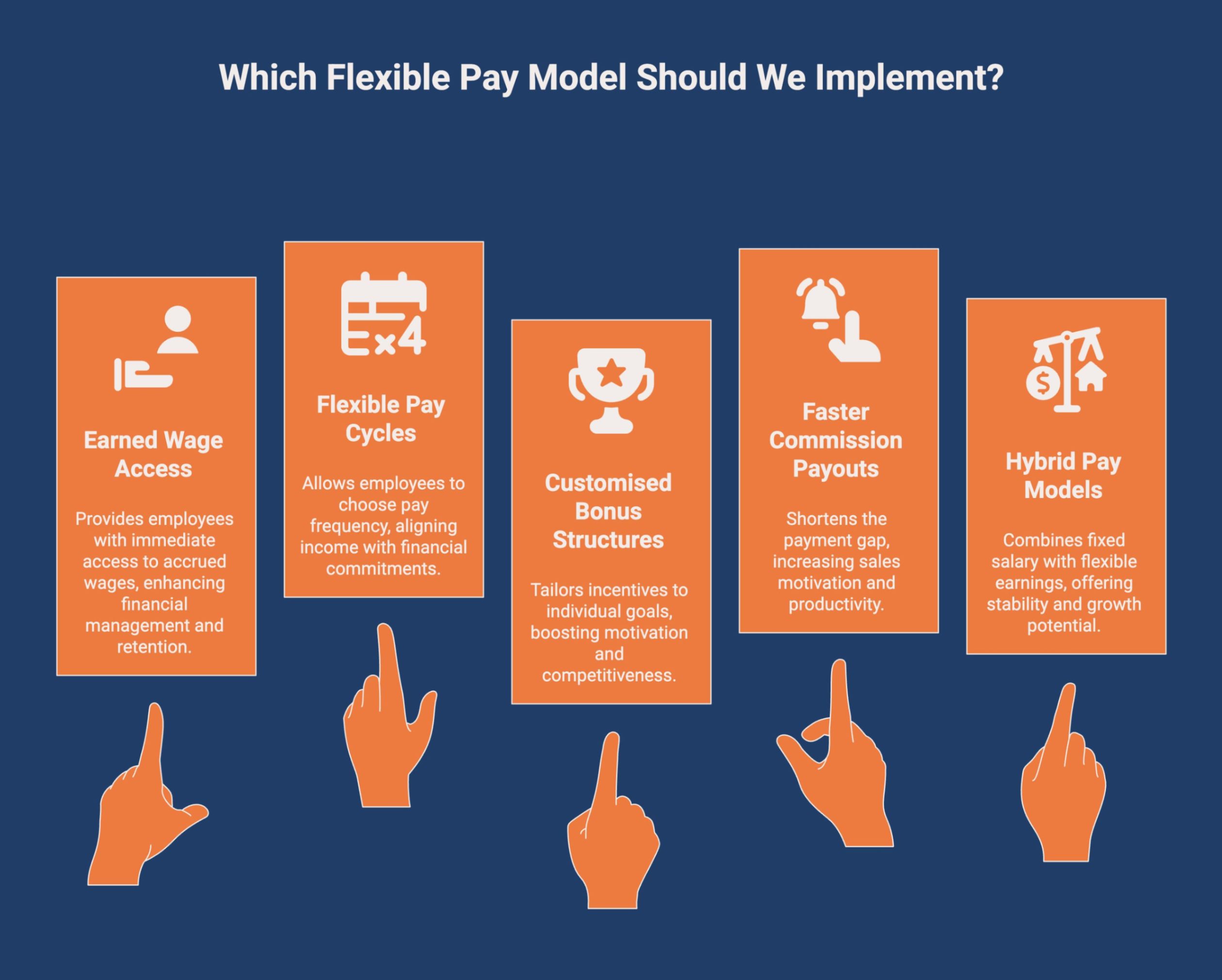

What Types of Flexible Pay Models Can Businesses Use?

As flexible pay becomes more common, businesses have several models to choose from. Each option supports different workforce needs, pay structures, and industry demands. Understanding how these models work makes it easier to choose the one that fits your organisation’s goals, payroll setup, and employee expectations.

Below are the most practical and widely used flexible pay models, along with how each one supports both employees and employers.

1. Earned Wage Access

Earned Wage Access allows employees to access a portion of their accrued wages before payday. It gives staff a reliable way to manage unexpected expenses without relying on debt. EWA is simple to implement through payroll providers or financial apps and is a strong incentive for attracting and retaining frontline and hourly workers.

2. Flexible Pay Cycles

Flexible pay cycles give employees the ability to choose how often they get paid, such as weekly, biweekly, or semi-monthly. This helps them align income with important financial commitments like rent or bill payments. To support multiple schedules, payroll systems must be capable of processing varied pay periods accurately and on time.

3. Customised Bonus Structures

Customised bonuses allow organisations to tailor incentives to individual goals, performance, or personal needs. These structures support financial well-being by giving employees more control over when and how they receive additional earnings. They also strengthen motivation and make your compensation package more competitive in high-demand job markets.

4. Faster Commission Payouts

Faster commission cycles shorten the gap between completing work and receiving payment. Instead of waiting monthly or quarterly, employees can receive commissions weekly or biweekly. This creates a clear link between performance and reward, increasing motivation, job satisfaction, and overall productivity.

5. Hybrid Pay Models

Hybrid compensation blends a fixed salary with flexible performance-based earnings. The fixed component provides financial stability, while bonuses or commissions are paid on more adaptable schedules. This model supports employees who value both security and the opportunity to earn more, making it a balanced and appealing approach for diverse teams.

What Should Businesses Consider Before Implementing Flexible Pay?

Flexible pay can be a powerful addition to your employee benefits, but it works best when the foundations are set up correctly. Before rolling it out, businesses need to look at how it impacts payroll, compliance, costs, and long-term financial habits. A thoughtful approach ensures the programme is sustainable, effective, and genuinely supportive for employees.

Below are the key factors every organisation should assess before getting started.

1. Managing Cash Flow and Payroll Operations

Smooth cash flow management is essential when offering flexible pay.

Your payroll team must be able to process early wage access requests without disrupting regular pay cycles. A well-integrated system reduces manual work, keeps operations efficient, and ensures employees receive accurate payouts every time.

When done well, this flexibility builds trust, supports employee wellbeing, and strengthens overall workforce stability.

2. Local Compliance and Regulation

Compliance is a critical part of implementing flexible pay. Labour laws, tax rules, and payroll regulations differ by region, so your model must meet all local requirements.

This includes confirming wages remain above minimum standards and ensuring the programme does not unintentionally fall under lending rules.

Seeking legal guidance can help you avoid penalties and launch a fully compliant solution from day one.

3. Provider and Integration Costs

Before choosing a flexible pay provider, it is important to understand the full cost structure.

Fees can vary based on features, usage, and integration needs. Some systems require setup costs, API integrations, or ongoing maintenance.

Evaluating your budget and comparing pricing models helps you select a provider that aligns with your goals and supports both your financial strategy and your employees’ well-being.

4. Risk of Employee Over-Reliance

While flexible pay reduces financial stress, there is a risk that some employees may rely on early wage access too frequently.

This can create challenges when payday arrives and their remaining balance is smaller than expected. To prevent this, flexible pay should be paired with financial wellness tools like budgeting support, savings goals, and educational resources.

Encouraging responsible usage helps employees build healthier, long-term financial habits.

How Does Flexible Pay Align With UK Payroll Compliance Requirements?

Flexible pay is fully legal in the UK, but it must operate within the same payroll rules that apply to traditional pay cycles. Employers are still responsible for accurate tax calculations, correct National Insurance deductions, and timely HMRC reporting. The core obligation does not change, even if employees access their wages earlier or more frequently.

To stay compliant, businesses need to understand how flexible pay interacts with HMRC systems, PAYE rules, and reporting timelines. Here are the key areas to review before rolling out any flexible pay model.

1. HMRC RTI Reporting Requirements

Flexible pay affects how often you need to report to HMRC through Real Time Information. Under RTI, every payment to an employee must be reported on or before the date it is made. This includes early wage access withdrawals.

If employees access earnings multiple times in a pay period, your payroll system may need to submit several Full Payment Submissions. Without the right software or provider, this can quickly become complex. Ensuring your system can automate RTI submissions is essential for staying compliant.

2. PAYE and Tax Considerations

Flexible pay does not change the total tax or National Insurance owed over the year. What changes is the timing of the deductions. Each early payment must be processed through PAYE so tax and NI can be deducted at the point of payment.

This means your payroll system must calculate PAYE accurately for every withdrawal, not just the standard payday. Consistent and correct deductions help spread an employee’s tax liability evenly and keep your organisation aligned with HMRC requirements.

What Technology and Tools Support Flexible Pay Implementation?

Modern payroll technology has made flexible pay easier and more accessible for businesses of all sizes. Companies can implement it at additional costs, through payroll software integrations, fintech partners, or financial well-being platforms that automate the entire process. The right tool reduces admin work, improves accuracy, and creates a seamless experience for both employers and employees.

Below are the essential technologies that support a smooth and compliant flexible pay programme.

- Payroll software integrations allow businesses to deliver flexible pay seamlessly by calculating earnings in real time, updating employee balances automatically, and processing early wage access without interrupting regular payroll cycles or increasing administrative workload.

- Security, data privacy, and reporting tools ensure the flexible pay programme remains protected and compliant by safeguarding sensitive payroll data with strong encryption, enforcing strict access controls, and providing detailed reporting that supports payroll reconciliation, transparency, and ongoing programme management.

How Can Businesses Get Started With Flexible Pay?

Introducing flexible pay works best with a clear and organised approach. Beyond choosing a provider, you need to ensure your payroll systems are ready, your teams are aligned, and your employees understand how to use the new benefit. Careful planning helps you avoid complications and creates a smooth experience for everyone involved.

Below are the key steps that help businesses launch flexible pay confidently and effectively.

1. Internal Audit of Payroll Systems

Before anything else, review your current payroll setup to make sure it can support flexible pay. An internal audit helps you check for inconsistencies, spot potential gaps, and confirm your system can calculate earnings accurately in real time.

This step protects against errors, strengthens compliance, and builds trust by ensuring employees are always paid correctly.

2. Engaging HR, Finance, and Legal Stakeholders

Successful implementation requires input from multiple teams. HR can guide communication and employee readiness, finance can assess cash flow implications, and legal can ensure your approach complies with employment laws and payroll regulations. When these departments collaborate early, you create a structured, reliable, and compliant flexible pay programme.

3. Running a Trial or Pilot Programme

Starting with a small pilot makes it easier to test the system and work through any challenges before a full rollout. A trial helps you observe how employees use flexible pay, identify technical or process issues, and gather honest feedback. These insights allow you to fine-tune your policies, improve your communication, and ensure a smooth launch across the organisation.

4. Employee Education and Communication

Clear communication is essential for helping employees use flexible pay responsibly. Provide simple, transparent resources that explain how the system works, how to access wages, and what to expect during the process. When employees feel informed and confident, the programme becomes more effective and truly supports their financial wellbeing.

How Can Direct Payroll Services Support Flexible Pay Implementation?

Introducing flexible pay can feel overwhelming, but Direct Payroll Services makes the transition smooth and stress-free. With our cloud-based payroll systems and HMRC-compliant processes, we help you build a reliable foundation for offering more flexible payment options to your team.

Our experts handle calculations, deductions, multi-cycle pay runs, and secure data management, ensuring your payroll stays accurate, consistent, and fully compliant. Instead of juggling multiple platforms or integrations, you get a streamlined, all-in-one payroll solution that supports modern payment models and reduces admin strain on your HR team.

It’s a smarter way to offer flexibility while keeping payroll efficient. Want to simplify flexible pay for your workforce? Contact Direct Payroll Services today for an instant quote.

Conclusion

By implementing flexible pay models like Earned Wage Access or customised bonus structures, companies can create a more adaptable and responsive workplace. However, it is crucial to consider factors such as cash flow management and compliance issues before making the transition.

As the landscape of work continues to evolve, integrating flexible pay can set your organisation apart and enhance the overall employee experience.

Frequently Asked Questions

Is flexible pay the same as earned wage access?

Not exactly. Flexible pay is a broad term for various non-traditional payment models. Earned wage access (EWA), or pay-on-demand, is a specific type of flexible pay that allows employees to get early wage access. Tools like MyView PayNow provide EWA as part of a wider financial wellbeing offering.

What are flexible pay solutions?

Flexible pay solutions let employees access part of their earned wages before payday. They improve financial well-being, reduce stress, support budgeting, and give workers greater control while helping employers enhance retention and modernise their payroll offerings.

How does pay flexibility benefit employees and businesses?

Pay flexibility helps employees manage unexpected expenses without debt, improves financial confidence, and reduces stress. For businesses, it boosts retention, engagement, productivity, and overall satisfaction by offering a modern, supportive benefit aligned with employees’ real financial needs.

What is flexible pay in salary?

Flexible pay in salary allows employees to withdraw earned wages whenever required, rather than waiting for a fixed payday. It provides financial stability, encourages responsible money management, and helps reduce short-term financial pressure during unexpected expenses.

What is flexible holiday pay, and how does it work?

Flexible holiday pay offers rolled-up or pay-as-you-go options, supporting flexible compensation and pay flexibility. In recent years, it’s helped part-time and gig workers manage irregular income, attract top talent, and provide better control when considering a new job or opportunities.